Accelerating Innovation To Create Convenience

Finding solutions that work is great. But solutions that work everywhere for anyone who wants to use them is even better. Which is a tall order, particularly when it comes to things like building better ATM self-service technology, where the pace of innovation is oftentimes uneven. Or when introducing mobile upgrades and customers aren’t on the same page. Still, some are doing it right — and doing it quickly. Top-performing financial institutions can roll out new innovations a full 2.5 months faster than their medium-performing counterparts. As we learned from commercial real estate innovator Knotel this week, it’s not about the right solution; it’s about the right solution for the right user.

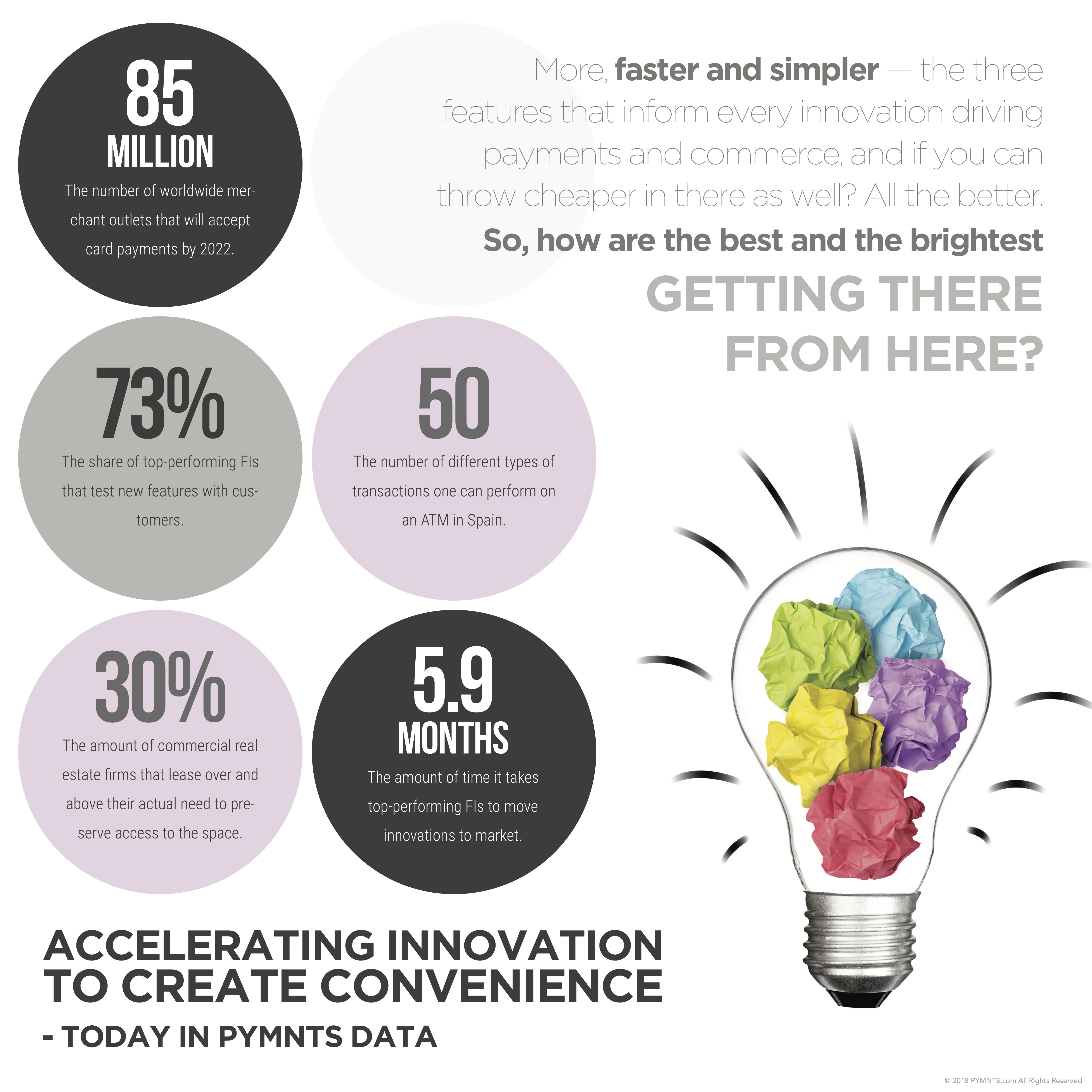

85 million: The number of worldwide merchant outlets that will accept card payments by 2022.

85 million: The number of worldwide merchant outlets that will accept card payments by 2022.

73 percent: The share of top-performing financial institutions (FIs) that test new features with customers.

50: The number of different types of transactions a consumer can perform on an ATM in Spain.

30 percent: The amount of commercial real estate firms that lease over and above their actual need to preserve access to the space.

5.9 months: The amount of time it takes top-performing FIs to move innovations to market.