Benjamin Franklin is best remembered as a signer of the Declaration of Independence in 1776 and a prolific inventor who created the lightning rod after flying a kite with a key on it in a thunderstorm. A little known fact, perhaps, is that Franklin is credited with inventing two things that almost every person has used — or will — at some point in their lifetime: swimming fins and bifocals.

Mr. B Franklin was also a prolific writer, whose many musings were captured in Poor Richard’s Almanac. Published under his nom de plume, Richard Saunders, between 1732 and 1758, the almanac was an annual collection of poems, puzzles, prognostications and words to live by.

Many of Franklin’s published aphorisms have survived the test of time and remain quite familiar.

A penny saved is a penny earned.

Honesty is the best policy.

In this world, the only things certain are death and taxes.

And one that should be every innovator’s anthem:

“Well done is better than well said.” — Benjamin Franklin

It’s a thought that was triggered recently after reading and reflecting on recent developments across three innovations heralded as FinTech’s poster children — disruptors out to change the world and eat the proverbial lunches of incumbents they say are too big and too unmotivated to change.

Blockchain. Marketplace lending. Digital banks.

Three things that today seem more like talk than truly transformative innovations.

Take the blockchain.

An alien landing on Earth and reading the popular tech press would be thoroughly convinced that blockchain is the biggest thing to have happened here since the invention of indoor plumbing.

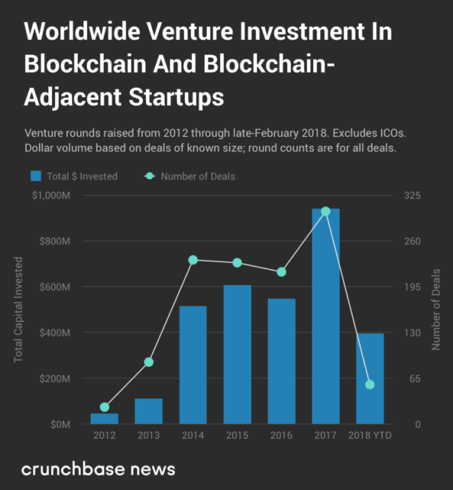

Consider the money being poured into it.

According to a Crunchbase article published in February of 2018, investments in blockchain and blockchain-related startups (excluding initial coin offerings, or ICOs) were already 40 percent of what they were in 2017. And in 2017, those investments were off-the-charts nuts.

Then, there are the claims being made by innovators about its potential.

The blockchain has been hailed as the most significant invention since electricity and the fix for the world’s biggest problems and pain points. It’s positioned as the way to send money to people anywhere in the world in an instant and for free. It’s said to be the answer to the world’s food safety and digital identity problems. The blockchain can even end world poverty and transform society by making it safer for total strangers to lend each other money — without any third-party intermediary — and without any risk.

In short, there seems to be, literally, nothing the blockchain cannot do.

The hype cycle on blockchain and blockchain tech has become so frothy that companies have even changed their names to include it. Today, corporate public relations and communication teams go to great lengths to find any angle to connect what they’re doing to the blockchain so that they, too, can ride its publicity draft.

However, the reality behind the hype tells a different story.

In January, the International Data Corporation (IDC) reported worldwide spending on blockchain solutions would increase to $2.1 billion in 2018 from $945 million in 2017 and will grow more than 80 percent year over year to reach $9.7 billion by 2021. Most of that spend will be concentrated in the U.S., with supporting use cases mostly related to financial services and cross-border settlement, for a grand total of $242 million in 2018.

To put that into context, the IDC projected worldwide growth and spending on mobility solutions at 15 percent a year from a 2018 base of $1.6 trillion; on security-related hardware, software and services at 10 percent a year from a 2018 base of $91.4 billion growing to $120.7 billion in 2021 and on the Internet of Things at 14 percent a year from $772.5 billion in 2018 growing to $1.1 trillion in 2021.

Then, there’s IBM and its most recent earnings report.

IBM has made its blockchain ambitions clear: It wants to be the first mover, using its “Blockchain as a Service” initiative as a way to capture and keep that lead.

In its earnings call two weeks ago, IBM even used those words — a first mover in blockchain — citing the 50 blockchain networks that are now up and running using their platform. IBM’s management team described its blockchain developer toolkit as another way to make it easier for innovators to “stand up” blockchain networks. Some 750 such networks, they said, were provisioned in the first two weeks of that launch.

After reporting those earnings and making those claims, IBM’s stock lost 6 percent of its value.

Many were surprised, since IBM posted an increase in revenue for the second straight quarter — after five consecutive years of losses.

Analysts said disappointing performance in its strategic imperatives group was to blame.

Strategic imperatives include the blockchain services IBM has invested heavily in and counts as one of its important strategic cornerstones. That group, collectively, grew 17 percent and contributed 49 percent of revenue at the end of Q4 2017. The first quarter of 2018 saw that shrink to 15 percent growth and 47 percent revenue.

This all comes on top of Warren Buffet dumping nearly all of his IBM holdings at the end of last year. In 2011, Buffett made a $10 billion investment in the company in support of then-new CEO Ginni Rometty’s turnaround plans. Buffet told CNBC in May 2017 that he doesn’t value IBM the way he once did.

Blockchain, of course, isn’t only to blame. The issues at IBM run far deeper.

But its positioning of the blockchain as one of its critical strategic pillars emphasizes a bigger and more important point: The hype is only as good as the numbers it can deliver.

And we are in the very, very, very early stages of finding and determining blockchain tech’s true potential.

Now, it’s true that some companies — including some very big names across many important sectors of the economy — are taking measured steps and experimenting with blockchain tech — aka distributed ledger technology (DLT) — in the support of use cases that address tough problems.

But they’re spending small (emphasis on small) amounts of money to do that. They’re also using software and cryptographic techniques and permissioned-based networks to digitize and move assets around the world faster and in a secure, compliant manner.

And to learn.

Anyone in a regulated industry — and that’s just about all of them — are also plenty dubious about using cryptocurrencies as the processing rails for supporting those pilots and incorporating them into their longer-term plans should their pilots show promise.

Today, the hype machine, which is the fuel of the investments in blockchain and crypto, rooted in a world run by algo-driven, permissionless networks, appears to be little more than a bunch of academic white papers and blog posts that sound great in the echo chambers.

All you need for proof is to just follow the smart money.

LendingClub was hit with a lawsuit by the Federal Trade Commission (FTC) last week over claims of “deceptive” practices.

The FTC complaint alleges that LendingClub’s advertisements of “no hidden fees” is in conflict with reports from consumers who received loan proceeds minus those hidden fees that were, well, hidden in the fine print. The suit also alleges that some consumers were double-charged and continued to be billed after their loans were paid off.

Following that news, LendingClub’s stock price took a nosedive. Yesterday, it was trading at an all-time low of $2.70.

Even before this latest blow to the company’s stock price, the bloom was starting to fade from the marketplace lending rose. Investors have remained skeptical that the marketplace business model touted in 2006 is sustainable.

LendingClub’s Q4 2017 results, under new management, showed four straight years of losses, sales that missed forecasted targets and continued losses in 2018, seemed to prove investors had every reason to be skeptical. Additionally, LendingClub’s stock has lost 88 percent of its value since its 2014 IPO.

LendingClub is considered one of the pioneers in marketplace lending — a supposedly disruptive model that wasn’t about lending money and making money the good, old-fashioned way, but about creating a tech-driven front and back end to originate loans and then making money when those loans are sold, offered to investors, traded and then serviced. LendingClub makes unsecured personal loans to consumers, mostly to consolidate and pay off credit card debt and more recently to refinance auto loans.

In an interview in 2013, Founder and then-CEO Renaud Laplanche boasted that incumbent banks like Chase were “like Blockbuster Video” in a world in which tech and new lending models like LendingClub’s would bury them. All-digital, all-tech lending platforms that could deliver better user experiences and faster credit decisioning would become the new normal and take share from banks who were too big and cost-laden to keep — or catch — up.

Three years later, in May of 2016, Laplanche was ousted from the firm he started after the Board concluded that he violated business practices after failing to disclose investment conflicts that some say were driven by growing pressure to meet sales targets and prove the efficacy of its teetering alt-lending model. A month later, a new management team was put in place to rebuild the business.

It’s now hard to see how even a new management team can rebuild LendingClub — unless it blows up the marketplace lending model it was founded to popularize.

Without any skin in the game, like balance sheet lenders have, there’s not much to prevent making loans to people who may not be able to pay them back. Fast-as-lightning credit approvals come with an unintended sidekick: loan stacking — either by fraudsters looking to score big or desperate borrowers with nothing to lose by stacking up loans for unsecured credit lines that they’ll never have to repay.

Either way, it’s a recipe for losses and lost investor confidence.

Tightening up their risk models to serve a more Prime-like customer means LendingClub would look like every other digital lending platform competing for the most creditworthy of customers: competitors with healthy balance sheets, a lower cost of capital and a broader digital consumer platform to offer consumers.

Take Goldman Sachs and Marcus.

Marcus is a digital consumer platform that includes lending and deposit-taking. Launched in October of 2016, Marcus is Goldman’s $2 billion annual hedge on threats to its core commercial banking and trading businesses. Goldman Sachs reported on its Q1 earnings call that Marcus, since it launched, has originated $3 billion of new loans and taken in $9 billion of new retail deposits.

During that call, Goldman Sachs’ management said they’re in no big hurry to grow Marcus by opening the credit spigot too fast or too wide. They said they have decided not to approve “large numbers” of credit applications, opting instead to slowly grow deposits and high-quality loans by offering no-fee, fixed-rate loans, CDs and interest on checking accounts through the acquisition of Clarity Money, a personal financial management tool. Marcus is reinventing the lending model not by clever card tricks, but by creating a trusted, digital retail financial services platform to help consumers find and use credit responsibly and save.

They have a big incentive on their books to make sure that happens.

JPMorgan Chase and OnDeck have made the same point on the small business (SMB) lending side with the announcement in 2015 of their OnDeck partnership.

The partnership does what Chase CEO Jaime Dimon said at the time is something Chase didn’t want to do and could not do — lend small amounts of money to SMBs. Mashing up OnDeck’s quick credit-decisioning tech with Chase’s risk and underwriting models and capital pools gave Chase a way to expand its community of SMB borrowers without expanding its bad debt.

Marketplace lending models were about using tech to lend money while sidestepping the regulatory burdens of being a bank. Tech and a great user experience alone didn’t turn out to be a great way to sidestep the merits of using good, old-fashioned credit, risk and lending models to do it.

If the blockchain is all about replacing the global financial system and marketplace lending is all about replacing traditional lenders, digital banks in the developed world are about upending the traditional banking ecosystem.

There are literally hundreds of digital banks — all targeted at people who reportedly don’t like banks for one reason or another.

Most, though, aren’t really banks in the true sense of the word at all.

They’re prepaid accounts that run on network-branded rails that come with a network-branded plastic card that its customers can use just like they would a debit card to make purchases.

These digital banks offer a lot of free services — including overseas cash withdrawals — without any additional fees. Some digital banks encourage savings via the Federal Deposit Insurance Corporation bank behind them. All tout an easy user experience via a mobile app that helps users track and monitor spend.

The business model of these digital banks is based on the fees they collect on those transactions. But that’s not enough to support and service these accounts. Monzo bank, one of the larger U.K.-based digital banks, reported 450,000 users at the end of December 2017, losing $67 on average per customer account.

To make up for those losses, some of these challenger banks are selling access to their customer bases for a fee — a distribution channel of sorts for other financial and related services. That makes challenger banks less like banks and more like ad platforms wrapped around the delivery of a prepaid card product. Supporters say that’s not a bad thing, since investors tend to value ad platforms like Google over regulated banks.

Which begs the question: Who are these digital banks serving — investors or consumers?

In the developed world, delivering banking services must be more than acting as a prepaid program manager.

It’s about meeting the financial needs of people — adding value and delivering trust.

And doing it using mobile and digital means.

But digital banks don’t have a lock on delivering digital banking services.

Being digital is de rigueur for banks today, and some analysts project that the more than 2 billion mobile banking users that will exist worldwide by the end of this year is a powerful proof point.

There are, of course, people in developed markets for whom traditional banking services are not viable, but that number is small — at about 16 million — and includes a population for whom a variety of powerful digital alternatives are in place to serve those specific needs: think PayPal, MoneyGram, Walmart and some of the other global players like Finablr that are emerging to fill those gaps. Those players have scale and a variety of services that go well beyond a prepaid account and a mobile app. They also have something more: the consumer’s trust.

In developing worlds, of course, the situation is quite different. Mobile is how banking and financial services are done — again, by players with scale (think Ant Financial), services and an objective to help consumers achieve a much-needed path to financial inclusion and a more convenient ecosystem in which to provide digital financial services.

Today, digital-only banks are licking their chops as open banking directives will soon level the competitive playing field and give them easy access to incumbent bank customers. But, as we’ve seen, simply being digital isn’t enough of a value proposition for consumers to care. Consumers want a bank that’s digital, but not necessarily a digital-only bank. Ben Franklin was famous for another aphorism that I find particularly relevant to this discussion: Time is money.

In a dynamic space like banking, lending, payments and financial services more broadly, time is a valuable currency.

Take too long to get something off the ground, and chances are that a newer tech will leapfrog it.

Take too long to prove value, and chances are that consumers will lose interest and bail.

Take too long to prove you have a viable business model once the VC’s checkbook runs dry, chances are that partners and investors will lose interest and bail, too.

Take too long to scale, and chances are that you’ll be outmaneuvered — quite possibly by the very players you set out to clobber.

Spend too long living in the hype cycle, and chances are that you’ll end up wondering how and why it all happened.