Deep Dive: Bridge Millennials And The C-Store Experience

Bridge Millennials buy gas more frequently than other consumers and are more likely to abandon a business following an unpleasant or friction-filled shopping experience. The following Deep Dive explores the mobile app features that this highly influential group of consumers value most during a convenience store run.

Convenience store operators would be wise to pay close attention to the purchasing habits of a certain subset of consumer: the Bridge Millennial — the first generation of connected consumers with spending power.

Bridge Millennials (BMs), who are between 30 and 40 years old, earn more money than their peers, taking in an average salary of $65,600 annually, and have a predilection for using mobile devices to shop seamlessly between online and offline channels. These consumers are more likely to abandon a business following an unpleasant or friction-filled shopping experience, putting pressure on gas stations and convenience stores (c-stores) to deliver an experience that meets the expectations of this highly influential consumer base.

Of the 10,049 consumers we surveyed, Bridge Millennials represented just 22 percent, but their purchasing power should not be overlooked.

When it comes to making purchases at gas stations and c-stores, BMs buy gas at a higher rate than other consumers and are more likely to buy other items when visiting a c-store. As shown in Figure 1, 64 percent of BMs buy gas on a weekly basis, outpacing average consumers (58 percent).

But what motivates consumers, BMs included, to use mobile apps for gas-related purchases? As it turns out, saving time and money and being able to quickly locate and navigate to gas stations are among consumers’ top priorities when it comes to gas apps. BMs, however, consider these features to be a higher priority than other consumers. As shown in Figure 2, the most common gas app use cases for BMs include finding the best gas prices (39 percent), finding a nearby gas station (31 percent) and navigating to the gas station (21 percent), while general consumers ranked these features lower.

But what motivates consumers, BMs included, to use mobile apps for gas-related purchases? As it turns out, saving time and money and being able to quickly locate and navigate to gas stations are among consumers’ top priorities when it comes to gas apps. BMs, however, consider these features to be a higher priority than other consumers. As shown in Figure 2, the most common gas app use cases for BMs include finding the best gas prices (39 percent), finding a nearby gas station (31 percent) and navigating to the gas station (21 percent), while general consumers ranked these features lower.

That said, when it comes to making gas payments with apps, only 6 percent of BMs do so — slightly more than the average consumer (4 percent).

Though few BMs use mobile apps to pay for gas, PYMNTS found that providing a more seamless mobile app experience could help drive those that do from the pumps and into c-stores.

Building A Better Bridge Millennial Gas App

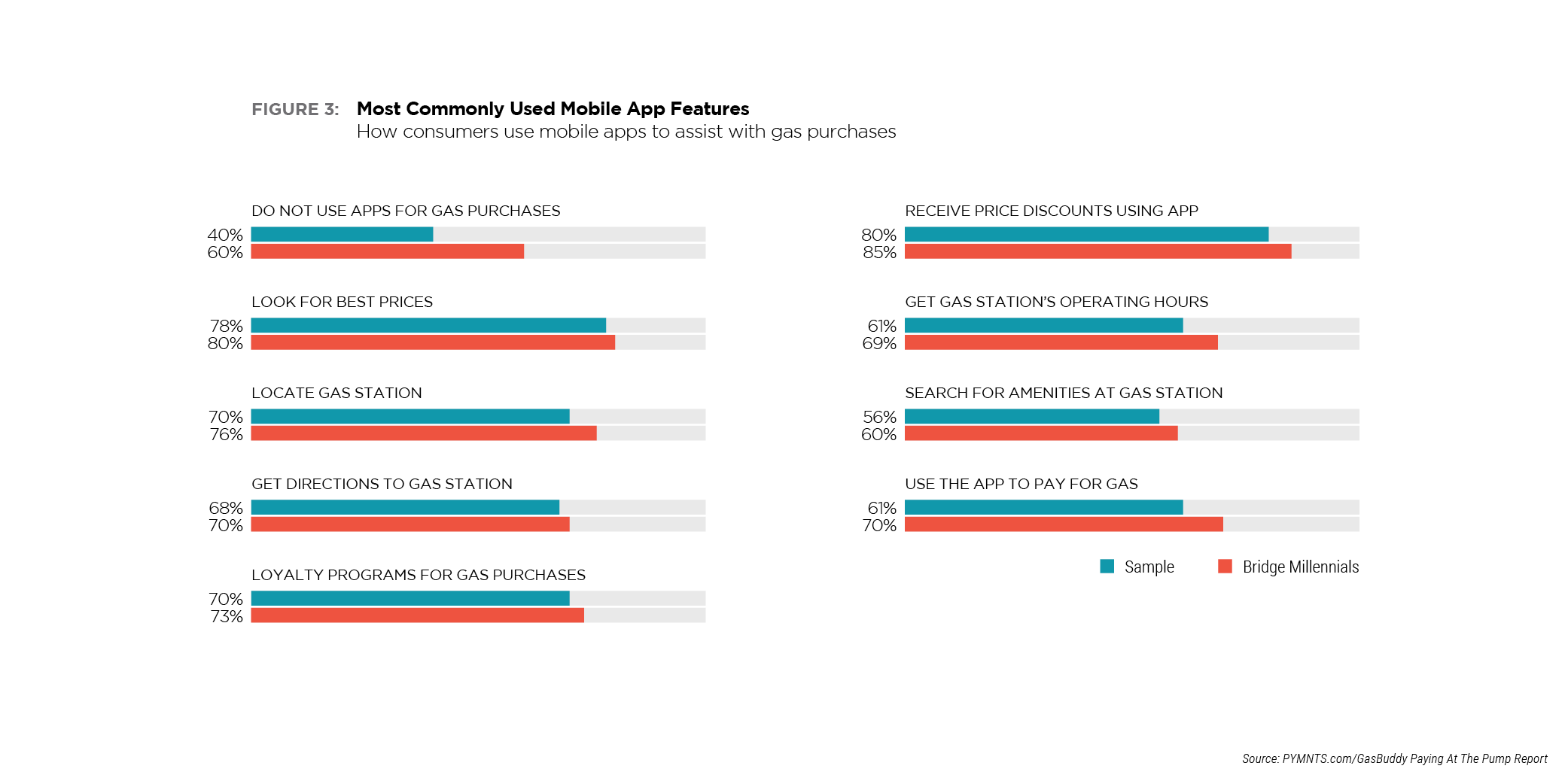

So what do BMs want from a gas app? Ultimately, it all comes down to saving money. Receiving discounts was ranked as the most important feature of gas apps by 85 percent of BMs, followed by the ability to find the best gas prices, at 80 percent.

While fewer BMs use mobile apps to make payments at the pump, having the ability to do so is among their top concerns. In fact, paying for gas using an app is one of the most commonly used features, cited by 70 percent of BMs who pay for gas with apps. That number was 61 percent among the rest of the sample.

Not surprisingly, cost-saving opportunities have universal appeal among the different consumer groups. Similar levels of both BMs and average consumers — 56 percent and 58 percent, respectively — indicate that saving money is the top reason for using a gas app.

Not surprisingly, cost-saving opportunities have universal appeal among the different consumer groups. Similar levels of both BMs and average consumers — 56 percent and 58 percent, respectively — indicate that saving money is the top reason for using a gas app.

Saving money aside, BMs place a higher priority on speed and convenience when compared to the rest of the sample. Nearly half of BMs (46 percent) said they were motivated to use mobile apps for gas purchases because of the convenience they offer — and 42 percent of general consumers said the same. Meanwhile, 32 percent of BMs said they were driven to use mobile apps to access faster purchasing capabilities, compared to 27 percent of the rest of the sample.

BMs may be more likely to use mobile apps to assist with their gas purchases, but when it comes to paying for gas, they’re fairly old school. As shown in Figure 5, the most common methods of paying for gas among BMs are debit cards (13.6 percent), credit cards (11.1 percent) and cash (10.8 percent).

BMs may be more likely to use mobile apps to assist with their gas purchases, but when it comes to paying for gas, they’re fairly old school. As shown in Figure 5, the most common methods of paying for gas among BMs are debit cards (13.6 percent), credit cards (11.1 percent) and cash (10.8 percent).

While mobile apps are a common part of the gas buying experience for BMs, using them to make payments is less of a priority for this group. Gas stations and c-stores should take note that, although BMs are less likely to use mobile apps to make payments at the gas pump, they still consider it to be an important feature.

Gas station and c-store owners who want to lure more Bridge Millennials into their stores should recognize that, while these consumers do not use mobile apps to pay for gas very often, their drive to find discounts and enjoy a speedier payment process could increase their mobile app usage. Businesses that can deliver the features that matter most to BM consumers will likely stand apart from the crowd.

For C-Stores, An Opportunity To Woo Bridge Millennials

Not only do BMs visit gas stations at a greater rate than most consumers, they are also more likely to make additional purchases at the c-store. This presents an opportunity for gas station and c-store owners to encourage BMs to extend their purchases beyond the pump.

Figure 6 indicates how rich the opportunity is for c-store owners to maximize a gas sale. Nearly one-fifth (19 percent) of BMs reported that they “always” purchase additional goods when they buy gas, and almost as many (18 percent) said they do so “most of the time.” Thirty percent “sometimes” make additional purchases and 18 percent “rarely” do.

The opportunity to lure Bridge Millennials from the gas pump into the c-store increases if the gas is purchased with a mobile app. More than half (52 percent) of BMs who buy gas with apps say they buy additional goods on most of their trips to the gas station.

The opportunity to lure Bridge Millennials from the gas pump into the c-store increases if the gas is purchased with a mobile app. More than half (52 percent) of BMs who buy gas with apps say they buy additional goods on most of their trips to the gas station.

For c-store owners, there are three important takeaways from this information. First, Bridge Millennials buy more gas than most consumers. Second, a significant share buy additional items during their trips to gas stations. Finally, the likelihood that Bridge Millennials will visit c-stores after making gas purchases increases if they use mobile apps to buy their gas.

How To Win (Or Lose) Bridge Millennials

For c-stores to win over Bridge Millennials’ business, they must first understand the mobile app features that encourage greater app usage — as well as what features discourage use.

BMs are more likely to use mobile apps if they deliver services and benefits that they value, the most important of which are convenience and loyalty rewards: 62 percent of BMs identified convenience as a factor that could motivate them to use mobile apps at gas stations, while 60 percent cited availability of reward and loyalty credits.

Saving money is also among the top priorities of the BM consumer, although to a lesser extent. More than half (56 percent) of BMs said that price discounts would encourage greater mobile app use at gas stations — a rate similar to that of general consumers.

BMs may be encouraged to use mobile apps if they deliver convenience, rewards and discounts, but there are also several factors that could have the opposite effect.

The security of their personal information is the top concern among BMs and threatens mobile app adoption among this group. Half of surveyed BMs said data theft risks would discourage them from using mobile gas apps, and more than one-third of BMs (36 percent) expressed concerns about the risk of money theft. It’s worth noting that overall, consumers are slightly more likely to be discouraged because of these concerns.

In terms of payments, BMs are more likely to be discouraged by a poor payment experience than other consumers. Eighteen percent of BMs said they would be discouraged from using a mobile app if it took long to make a payment, while only 13 percent of the rest of the sample said the same.

When developing a strategy to encourage greater usage of mobile apps at their businesses, gas stations and c-stores would benefit from looking at how BMs and the broader consumer base are already using mobile apps to make purchases.