Welcome to the first Monday of 2019.

According to the Chinese calendar, 2019 is the “Year of the Pig” – which may not, at first blush, inspire much excitement for the 358 days ahead of us. It’s almost as bad as saying it’s the “Year of The Sloth” – since, let’s face it, pigs are not typically prized for their wisdom, energy, vision or leadership qualities across the animal kingdom.

Chinese tradition, however, takes a different view.

Pigs are considered practical, yet fun-loving and blessed with good fortune – as measured by their very generous girths. So, if Chinese tradition can be believed, the year ahead will be one of pragmatic good fortune, delivered with a side of good humor.

Animal metaphors aside, 2019 is a year that should inspire excitement, along with great anticipation, across the expansive payments and commerce ecosystem: It’s the bridge year between the decades of the ‘10s and the ‘20s.

That makes it the most important year of the last decade.

This is the year that everyone takes a critical look at the innovations they’ve pursued over the last decade to decide what’s worth taking forward into the decade of the ‘20s and what’s best left behind in the decade whose door will close 358 days from today.

Naturally, I have a few thoughts.

Leave Mobile Payments, Embrace Ambient Commerce

I’m glad I got your attention.

And, yes, this likely sounds blasphemous from someone who’s been beating the mobile payments drum since 2005, well before the iPhone and the App Store changed how consumers, retailers and payments players all use mobile devices.

That just makes the point much stronger.

Consider this.

Icons and apps as an interface – first to the internet and, later, to commerce via digital payments – have been around since 1980. That was the year Apple introduced the first Mac, the Lisa, and a new shortcut for accessing work on the desktop.

Thirty-nine years ago, they weren’t called icons, nor did they have the functionality of apps as we use them today, but their purpose was the same – little “document windows” on the desktop screen that functioned as shortcuts to working documents.

Those document windows gave birth to the icons that today serve as the predominant shortcuts to apps on mobile screens, which have blurred the lines between the digital and physical worlds for going on four decades now.

We have seen the power of those icons on those devices over the last decade: 52 percent of all internet traffic in 2018 came via a mobile device. That’s up from 50 percent in 2017 and 43 percent in 2016.

Commerce via those mobile devices has ridden those connected device coattails, except at the physical point of sale, where adoption has been a long, four-year slog that has never amounted to much.

In 2018, it was estimated that roughly 45 percent of all digital purchases, and 40 percent of all commerce, was done via the mobile device. That’s up from 35 percent in 2017.

Mobile handsets have made commerce possible anywhere a consumer, handset in hand, wants to buy something.

Soon, that may seem so last decade, as commerce will be all around us.

In fact, it already is.

Software platforms are taking commerce to new worlds, independent of any single device to provide that point of entry.

Devices with chips can flag problems and alert consumers or businesses of the need to replace a part or call a repair technician.

Washing machines can calculate the number of loads and estimate when laundry detergent needs to be ordered – and auto-order it.

Refrigerators can reorder food when sensors detect that quantities are low. Wearables – watches, shoes and clothing – can alert users to the need to replace them while providing tips on diet and exercise.

Cars, today, have the capability to meter usage for insurance premium billing, and to order (and pay for) food and fuel from in-vehicle systems.

Payments are and will be embedded in each of these experiences, enabled by an intermediary that will authenticate the user or the user’s device and enable secure, private and interoperable commerce experiences.

We won’t be talking about mobile payments at the end of the next decade, because consumers won’t need mobile phones to enable those connected, very contextual commerce experiences.

That suggests those who today are dominant in enabling mobile payments via those devices may soon find themselves at risk.

Voice will be a huge catalyst for this ambient commerce shift. As an enabler to commerce, its adoption rate is staggering across all ages and demographics. That’s because voice is the most ubiquitous commerce access device in the world.

The How We Will Pay study, done in collaboration with Visa and published last fall, made this point quite vividly. Twenty-eight percent of all consumers owned a voice-activated speaker – and that was before this holiday season, when Amazon and Google reported millions more.

Perhaps more stunning was how many of those device owners used them to make a purchase – more than a quarter of them across all age groups. For bridge millennials, those consumers between the ages of 30 and 40 who are the first generation of connected consumers with spending power, those percentages are even higher: 31 percent own a voice-activated device, 55 percent of whom used it to make a commerce purchase in the week we asked them to report on their purchasing experiences.

This is, of course, a mere four years after voice-activated devices were officially introduced by Amazon and Alexa through the Echo device. It has taken only four years for more than 25 percent of the population to own and use a voice-activated device, half the time it took for 25 percent of the U.S. population to adopt broadband. It’s taken just two years for 10 percent of the population to use them to make a purchase.

It’s a stunning development – and those who shun voice and voice assistants as an important commerce enabler won’t need until the end of the next decade to find the door shut on themselves.

In other words, pay no attention to the notion that voice assistants are these clunky, friction-filled technologies that have reached their peak. Sure, it may take a few years for the interoperability to get sorted out – but the last time I counted, a decade does have 10 years in it. In the payments and commerce world, that’s not much time at all.

Naturally, maintaining the privacy and security of transactions initiated via voice is critical for consumers to continue to ride this wave of innovation: Those concerns were expressed by more than three-quarters of the 2,758 consumers we studied.

But those concerns haven’t stopped consumers from using voice to access these new experiences, because they trust the primary enabler of those voice-enabled purchasing experiences – today that’s Amazon – as well as the underlying payment methods they use to make those purchases, which are network-branded credit and debit cards.

If you believe that commerce will shift from the mobile phone to any device that a consumer interacts with as she moves from the home to the car to the office to the store to the movies to the restaurant and then back home again, then 2019, for many players, will be the year in which they must decide how to leverage their mobile and digital assets to exist in this new, ambient commerce world.

They’ll have to.

Amazon announced on Friday that Alexa is now in 100 million devices: that’s 100 million voice-enabled, connected point-of-sale endpoints, in addition to the millions of mobile phones that now have the Alexa app downloaded. Consumers associate Amazon with commerce, Alexa as their virtual assistant. Amazon Pay, if they even think about it at all, is how they pay for what Alexa helps them buy.

Google, with Google Assistant, recognizes this shift, too, and is making its own moves in the space with branded devices and integrations with consumer product brands. But it has a lot of work to do to catch up with Amazon and Alexa, whose reputation has been built over the years on commerce and purchasing, not on search and information.

This shift from mobile payments to ambient commerce means that the decade of the ‘20s won’t be dependent on devices, but will be driven by an intermediary – an intermediary that can connect the consumer to any device and any commerce experience that is relevant for them at any moment in time. And that will muddy even further the brand waters of bank, payments and retail brands that feel invisible today in a mobile payment, mobile phone-driven world.

In an age in which convenience trumps price and even product selection in some cases, it’s the consumer who’s pulling brands in the direction of this ambient commerce world. The consumers we studied in the How We Will Pay survey want the ability to buy things while doing other things: cooking, cleaning, watching the kids, watching TV, commuting, working, traveling. Mobile devices and the payments so closely aligned with those experiences today will give way to a commerce and payments experience that is just there, waiting for a consumer’s command, something that looks and functions quite differently than what we know and use today.

And who knows? Perhaps icons on mobile devices will revert to what they were some 40 years ago: pointers to what we are doing or have done, not enablers of what we want to do.

Leave POS, Take Remote Payments

“I’m going to the store” means something very different today than it did a decade ago.

Then, it meant that a consumer was out to discover what to buy, and then buy it, at that store. Today, it means that a consumer, if she goes to the store at all, walks in already knowing what to buy – and most likely only because she can snag a deal.

And, increasingly, she is paying for those purchases in advance.

For many time-starved, convenience-driven consumers, going to the store creates friction. Part of that friction is checking out.

The POS has been under attack for the better part of the last decade, as the acquiring ecosystem has tried to navigate the shift away from terminals that simply enabled payments acceptance and toward integrated POS systems that offered retailers more business value.

All of that said, much of the last several years has also been characterized by efforts on the part of those retailers to upgrade existing POS systems to enable chip and contactless card transactions in response to the network’s liability shift. Today, some 59 percent of POS terminals in the U.S. are now EMV-compliant. According to Visa, more than half of all transactions done in a physical store are done at a terminal capable of taking a contactless payment.

All of that work was happening at the same time that more consumers were using order-ahead to avoid walking up to a cash register to check out at all.

And at a time when consumers are walking into physical stores less often, even to shop for the products that were once only possible to buy in the store, like groceries, prescriptions and clothes.

We studied 4,900 commuters in the fall to better understand how mobile devices and apps are influencing how people shop, and therefore, how they are using stores to check out. Of those customers, 8.9 percent used a mobile device to buy groceries, 24.6 percent used one to pay in QSRs and 30.5 percent used a mobile device to pay for clothes.

Last month, we studied consumer shopping and buying behavior while commuting to and from work. Of the 5,349 commuters we studied, 15 percent of them told us that they ordered ahead to pay for groceries, picking up their purchases curbside. In fact, 73 percent of commuters said they used mobile or voice-activated devices built into their cars to connect to the internet while on those trips. Eighty-five percent made purchases of food, gas, parking or other retail totaling some $230 billion during those round-trip commutes.

Today, with their mobile devices, and in an increasingly voice-activated, ambient commerce world, consumers are in control of how they want to buy and pay for things.

Checkout lines will soon become passé, and checkout will become a non-event.

Paying for things will happen online for pickup in the store later. It’s an experience that retailers are embracing and investing heavily in. Every dollar invested in what is being called “curbside commerce” is a dollar invested in outsourcing delivery to the consumer rather than to a third party, which improves retailers’ margins while keeping consumers sticky.

Checkout will happen as the consumer is shopping via smart shelves and apps on devices that consumers carry or wear – mobile phones, watches and who knows what else – that have already checked her in and authenticated her at the same time.

See Amazon Go.

Checkout at a terminal might not even require any device, but instead will use an alias like the shopper’s mobile phone number to link to an intermediary that can authenticate the consumer at a POS and send the transaction for authorization. It’s an idea that PayPal tried a decade ago, but today Amazon seems poised to enable at any place that accepts Amazon Pay – like Whole Foods. Already today, an Amazon Prime member can activate Prime member rewards by using the mobile number linked to the Prime account.

The implications for retailers and payments players over the next decade will be profound. Aside from the obvious process shifts for retailers, there will be a shift in how stores are staffed and consumers are serviced.

Consumers won’t need, or frankly want, salespeople in the store to push products or check them out when they’ve made a selection. Instead, they’ll want to tap services personnel who act more like personal assistants or knowledgeable product specialists to answer their questions, advise them on specials and deals, and offer payment options and other incentives to establish preference – all in an effort to build a trusted relationship with that customer.

Increasingly, this will take the form of virtual assistants, who, with the aid of AI, will be well-suited to offer personalized recommendations and handle payment and checkout like any good personal assistant would do. Stores, used more and more to fulfill purchase requests, will need to stock up on services and support personnel who can make that experience seamless and efficient.

Consumers, not stores, will decide how they want to check out and where – and will do so increasingly via devices and environments that maximize the use of their time and enable payments via the way they want to pay.

Leave Chaos, Take Attention

Growing up, I knew I was in big trouble when my father used my first and middle name in a sentence.

And when he did, it sure got my attention. C’mon, admit it, it was probably the same for you.

It’s been said that the sweetest sound any person can hear is the sound of their own name. (Except when it is immediately followed by their middle name, as explained above.) It suggests a familiarity, an intimacy and a respect for the other person – and a knowledge about who they are, their preferences and, often, even those preferences in a relevant context.

Using a person’s name as a proxy for making that personalized connection gets their attention and builds trust in a way that a more general greeting – “hey, you over there in the navy sweater” – could never do.

To reach a consumer or a business today, you need to get their attention. That means using their name, but also using insights that can link their name to a personalized interaction.

Getting there isn’t so easy, though: It requires sifting through the 2.5 quintillion bytes of data created each and every day across all of the physical and digital touchpoints consumers encounter to find those relevant nuggets of knowledge.

But it’s worth the work.

A Salesforce study conducted in 2017 reported a 26 percent sales lift in AI-enabled interactions that used the person’s name, business context and purchase history to create a more personalized experience – even though those personalization efforts drove only 7 percent of all visits. The moral of the story is that it’s far better for the bottom line to know and convert a small number of highly qualified leads than to waste time sorting through a huge batch of tire kickers to find one buyer.

The ability to create those personalized experiences, however, remains elusive. A study of marketing professionals in 2018 suggested that although 88 percent of marketers say their customers expect a personalized experience, only 12 percent of those marketers report being very satisfied with their ability to deliver it.

That’s not surprising.

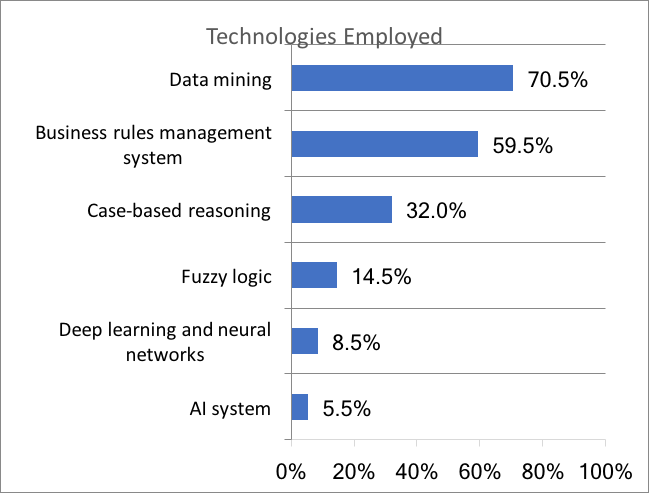

The same holds true for executives we studied across the FI ecosystem last year, in collaboration with Brighterion, and surprisingly in a sector that has made huge investments in tech. Fewer than 5 percent of all FIs reported using AI – true AI – to personalize offerings to their consumers, manage fraud or even allocate resources to collecting debt from consumers with the capacity to repay.

Most FIs, as with most players across payments and retail, still use supervised machine learning and rules-driven models to surface recommendations and influence actions. But those static tools do little to drive a relevant action at an appropriate point in time, whether the goal is to stop fraud or to offer a line of credit to a worthy consumer or SMB at some point in their digital journey.

Unsupervised AI tech is a powerful tool that can, finally, help innovators across payments and commerce to navigate the chaos of unstructured data to gain intelligence right down to the individual level, predicting with a high degree of confidence how that one person might respond to an offer or how that one fraudster should be stopped.

The next decade will be about using AI in this way to unlock the power of one and ignite an era of dynamic personalization that maximizes customer satisfaction and enterprise profits – leaving behind the AI impersonations that rely on a person’s name, and little else, to attempt those connections.

Leave Big Bang, Take Incremental Improvements

I must admit, I am fascinated by Elon Musk’s Hyperloop. The notion that a pneumatic tube, barreling at 700 mph through an underground tunnel, could turn a six-hour drive between Los Angeles and San Francisco into a 35-minute ride seems awesome to me. It is a $6 billion creative engineering marvel that, it’s said, could take its first passengers in three years.

From LA to San Francisco.

The Ted Williams Tunnel in Boston, by contrast, gets me far less excited, even though I use it a lot. Part of the infamous Big Dig project, it is a 7.5-mile-long tunnel that cost $1.3 billion to build in the mid-1990s. Roughly 55,000 vehicles use it to get in and out of Boston every day.

The Hyperloop is “big bang.”

It’s incredibly innovative. It’s fun to talk about. It could be transformative.

It also requires that we change everything about transportation as we know it – and on a grand scale, and over many, many decades – in order for it to be useful and practical. That’s assuming, of course, that enough consumers can overcome the fear of being strapped into a pneumatic tube that travels underground for 35 minutes at 700 miles per hour.

The Williams Tunnel is incremental improvement.

Stories of organized crime and officials on the take notwithstanding, there’s nothing that salacious or exciting about the Williams Tunnel. It was built using existing materials and tunnel engineers – state-of-the-art materials and engineers, of course, but all stuff that was available at the time. It accommodates the cars and trucks that people drive today.

When the tunnel opened, it alleviated the congestion in and out of Boston, once done via tiny, two-lane tunnels built in 1934 and 1961, and the stress level of commuters tremendously. It used to take somewhere between 30 minutes and 90 hours, with no way of knowing, to go from Cambridge to the airport. Now it’s a reliable 10- to 15-minute trip. There is a huge gain from an incremental improvement – even better if you have a senator, like we had in Massachusetts, Senator Kennedy, who can get people in other states to pay for it.

It’s a relevant analogy for the innovations of payments and commerce today – and what we should think hard about leaving behind at the end of this year.

People, of course, love the hype of the big bang.

The lure of crypto as an alternative to fiat currency is intoxicating – “it’s just like the internet of money,” its advocates still profess – even in the face of the massive crypto bust that was one of the biggest stories of 2018.

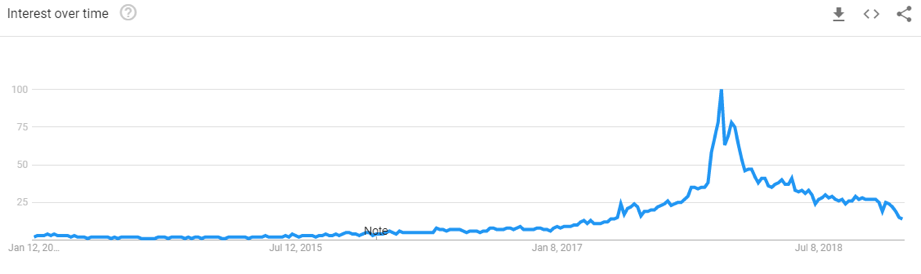

The hype machine has turned instead to “the blockchain,” as if it is a thing. It isn’t – as known by you longtime readers of my writings, and now maybe even by those who used to search on Google to get more scoop on it. Its interest, as measured by searches, appears to be going in a different direction than the PR hype machine might suggest.

Ironically, the proof may be in the press release.

Of the 200 press releases last year that announced blockchain innovations and project launches, only 10 were ever followed up by subsequent press releases announcing the wonderful outcomes of those launches.

Many of the largest players who tried it, at the suggestion of their boards, have privately said that not much of anything, aside from the initial PR hype, has come from it.

It sure hasn’t done much for IBM, which staked the farm on blockchain tech as the driver of revenue going forward.

But that has not stopped advocates from stating that blockchain and blockchain tech are the most important development of all time in moving money from point to point around the world. In fact, it occupies many 2019 predictions lists.

What we’re seeing at the start of the new year is that in many cases, the louder the noise and the greater the number of press releases, the less likely the emperor really has any clothes.

There’s a reason for that: Building on top of legacy systems delivers results faster.

Apple didn’t need to build its own mobile network to innovate with the iPhone; it could rely on cellular carriers around the world. Amazon didn’t need to create another internet to ignite digital commerce. PayPal didn’t have to build a new financial services ecosystem to enable payments transactions on eBay.

That’s the lesson for payments and financial services sectors: You don’t have to ditch everything that exists to extract new value from it. In fact, it’s quite the opposite: Big-bang innovations are too much work, come at too great a cost, pose too great a risk and require too much rework from a compliance, regulatory and interoperability standpoint to make the ROI one that management and the board can comfortably swallow.

So, while big-bang innovators continue to beat their press release drums about how good things might be one day, incremental improvements that build on existing systems continue to move the needle.

Look no further than Visa’s plan to acquire Earthport, Temasek’s $100M investment in Flywire, SWIFT with gpi to enable real-time and cross-border money movement, Ingo and its on-demand disbursement network, PayPal’s and Hyperwallet’s ability to push funds to sellers on demand, Mobeewave and its ability to turn any handset with an NFC chip into a POS device and the many, many others whose innovations leverage what’s right in front of them to move payments and commerce leaps and bounds forward.

In 2019, read big bang stuff for fun, but embrace – and fund – innovations that leverage what already operates at scale to deliver a more valuable experience for your customers.

Leave Free-for-All, Take Governance

Governance is a word that became very popular last year – and for all of the wrong reasons.

Instead of talking about how good governance has been crucial to the operations of strong platforms for millennia, we’ve been barraged with how one of them has traded good governance for an “anything goes” attitude.

Governance, of course, is a fancy word for rules. Without them, and the strict enforcement of them, platforms will simply self-destruct.

Facebook is the poster child for governance gone wrong, with a policy for letting everyone – almost without exception – do, say, or show whatever they want on the social network. Zuckerberg and team are learning just how costly that lack of governance has been for their brand and their shareholders.

And, unfortunately, it could be quite costly for everyone that the regulators have clumped together as “Big Tech” – who, they believe, all play fast and loose with their consumers’ data just as Facebook has.

Facebook’s reluctance to rein in bad behaviors over the years started with bullying and live shootings, and hit a high note last year with fake news, Russian meddling and the Cambridge Analytica breach. The company ended 2018 amid reports of suffering hacks and granting favored access to users’ data without their permission.

Facebook has lost $154 billion in market value over the last year, much of that coming in the last six months of the year.

All of this comes at the same time that regulators are getting very tough about making and enforcing rules they think are missing in regard to the collection and use of consumer data on their platforms.

The GDPR in the EU is no joke, with strict rules and even stricter penalties that could hobble even the largest of companies. These regulators will waste little time in making examples of those who don’t play by their rules, with Facebook, understandably, at the top of their hit parade.

Stateside, regulators and lawmakers seem united in their efforts to protect the safety and soundness of the platforms that gather and use consumer data. The risk, however, is that regulators and lawmakers who are unfamiliar with how platforms work could be the ones making rules about how they think they should.

That means it’s time for platforms to get serious about governance and to not use free-for-all, let-a-thousand-flowers-bloom behavior to rule how their platforms operate.

Uber did it with their new CEO, who took a no-tolerance policy to “bro culture” that drove platform actions and behaviors. Card networks do it with operating rules that keep bad actors from using their networks to do bad things. Apple does it by keeping apps out of the App Store that don’t meet their standards. PayPal and others have done it by closing accounts of those engaged in hate speech.

It’s not always easy to do, and it requires constant vigilance. And regulators today impose rules and frameworks to protect the integrity and soundness of our financial systems, as they should. But unless we also want lawmakers and regulators to impose their views of how platforms should govern themselves, 2019 is the year that we should make platform governance a key priority, and leave laissez-faire far, far behind.

Leave Friction, Take Certainty

Nearly 5,000 words later, perhaps the most important predictor of success in the decade that we will face in 358 days is to leave friction behind – and to innovate in a way that creates certainty for the end users of that innovation.

It sounds like such a simple thing, yet a lack of certainty has deviled many an otherwise incredibly slick payments and commerce breakthrough – and the presence of it has ignited many more.

Who would have ever thought that picking up a car via a high-tech vending machine could even be a thing, until Carvana’s founder decided that consumers would gladly trade off dealing with a car salesman to walk up to a vending machine to pick up a new car they bought online.

Who would have ever thought that consumers would trust that taking a picture of a check via an app would deposit it immediately into their bank account without a trip to the bank, until mobile banking and instant money networks put that capability into the hands of consumers – and they saw it work.

Who would have ever thought that today, in the age of digital payments and high tech, that 52 percent of all businesses still use paper checks to pay their suppliers, until businesses found that moving to digital was too much work and created too much uncertainty over the ROI.

Who would have ever thought the physical store that was once critical to how consumers bought things would be less relevant, until consumers started using mobile devices, Amazon and, now, voice-activated assistants for a better and more convenient experience.

Finally, Take Nothing for Granted

Ten years is a long time – but, in many ways, it is no time at all.

Just ask BlackBerry. Soon after it launched in 1999, it became the king of personal digital assistants – and once it had voice, it became king of the smartphones. It took a decade to hit its peak: In 2010, by its own reporting, BlackBerry was used by roughly 37 percent of the smartphone population. Just three years later, its market share was sub-2 percent.

It was the iPhone that turned “crackberry” addicts into iPhone lovers.

Over the last decade that the iPhone has been in existence, more than a billion units have been sold, and Apple was the first company to achieve a trillion-dollar market cap. Apple, with its iPhone, appeared unstoppable.

The last four years, however, has seen cracks in that armor for anyone who has been looking, along with longtime PYMNTS readers. Over that time, there was a lot of smoke and mirrors from Apple’s CEO about how awesome things were, with a refusal to offer much specific data beyond how many iPhones were sold.

Until that didn’t start to sound so awesome.

Last year, Apple decided that it would no longer report the number of units sold. Its last earnings report offered even more vagaries about Services revenue, even as Services was touted as the driver of future company revenue.

Then, just last week, Tim Cook revised guidance in advance of upcoming earnings about iPhone sales, citing the U.S.-China trade wars as a driving factor. The stock took a huge hit, with its market cap dipping below $700 million on the news.

But the trade war isn’t to blame. iPhone sales have suffered in China for a long time, as Chinese consumers buy high-end handsets that are cheaper but have just as much functionality, as well as a rich Android apps ecosystem.

This comes while big players in Apple’s app ecosystem are pushing new users to sign up for their services outside of the App Store. Both Netflix and Spotify have been testing signups outside of the App Store since August. Netflix made the announcement in late December that all new users would be directed to sign up on the Netflix website. Analysts say the Netflix move will cost Apple some $257 million in revenue. I think the more important point is that Netflix just poured cold water on any of Apple’s plans to try to impose fees on more apps or increase its fees on existing ones.

Now, it appears that in a world in which mobile plus payments gives way to ambient commerce, Apple – and its blockbuster iPhone – is at risk of losing ground. That’s despite being first to market with a voice assistant called Siri and a mobile payments platform called Apple Pay, both of which have failed to cross the commerce chasm in any meaningful way.

You could make the same case for Facebook, which rose to dominance after Myspace imploded, caused by — how ‘bout that for déjà vu all over again — a lack of governance to keep bad actors off its platform. It took eight years for Myspace to go from king of the social network to social network albatross, which then-owner Rupert Murdoch unloaded for $35 million in 2011.

As Facebook goes into its 15th year, one must wonder whether, over the next decade, the cornerstone of its social network empire will face its own unraveling, brought upon by its inability to do exactly what it said it would do when it was founded in 2004: serve as a safe and trusted place for the world to connect.

So, as you prepare for the journey that is 2019 – perhaps one of the most important journeys of the entire next decade – perhaps taking nothing for granted will be the most important takeaway over the next 358 days.

The CEO of Intel was once quoted as saying “today is so yesterday.” Before you know it, today will be the last decade.