The payments version of the rumor mill has been going full tilt about whether Square’s running out of cash, whether it’s up for sale, and how much it’s really worth. Well, MPD CEO Karen Webster has a point of view on this whole topic that takes a slightly different tact. She suggests that the value of Square just might not be where everyone else is looking. Guess you’ll have to read more to see if you agree.

Jack Dorsey was quite literally the face that launched millions of micro-merchants and an entirely new segment of payments in 2009. His Square device, initially branded Squirrel, was an ingenious way to turn a mobile phone into a cheap, wireless point of sale device. It has inspired hundreds of copycats around the world and given birth to a new payments vocabulary word – mPOS. PYMNTS tracks the activities of some 151 players in the mPOS space as part of our mPOS Tracker and the space is now quite active on a worldwide basis.

But Square’s real innovation, as we all know, was the business model that essentially gave these high risk merchants something they never had before – a merchant account and, therefore, card acceptance. Before Dorsey and Square, it was either too expensive or impossible. Square brought merchant processing and card acceptance into the micro merchant mainstream. Now, taxi drivers and fitness instructors and flea market sellers and math tutors and dog walkers and anyone else who could only be paid by cash or check can now accommodate their customer’s wishes to use the plastic cards that are in their wallets.

Since the very beginning, Square and Dorsey were a magnet for criticism from many in the traditional payments industry, first for not being “from payments,” to producing a device that was said to be bait for card skimmers and fraud, to serving what most characterized as the dregs of the merchant community to now to being on the ropes financially.

So today, the big question on everyone’s mind now is – what does Square really have and how much is Square really worth? .

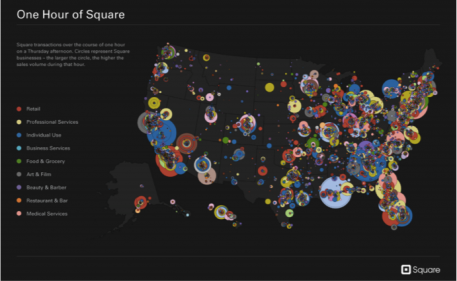

It’s hard to know how many merchants Square really has or how active any of them are. Data on Square is hard to come by and also buried in bits and pieces everywhere on the web. In digging around, I found this graphic of “an hour in the life of Square” from 2012 which I think might have been designed to counter the claims that Square was only used by farmers’ market sellers and the craft show trade and only in select parts of the country. I have no idea if it’s right but there it is.

It’s hard to know how many merchants Square really has or how active any of them are. Data on Square is hard to come by and also buried in bits and pieces everywhere on the web. In digging around, I found this graphic of “an hour in the life of Square” from 2012 which I think might have been designed to counter the claims that Square was only used by farmers’ market sellers and the craft show trade and only in select parts of the country. I have no idea if it’s right but there it is.

Dorsey, in an interview when Square launched in Canada last year, said that Square’s average transaction size was $70.00. That seemed a bit hard to, no pun intended, process, given that in the next sentence, he mentioned that many of Square’s customers in the US were food trucks which he went on to say probably wouldn’t be the most popular merchant category in Canada given the colder temps (where he said the average transaction was $120). But it does make it a bit challenging to try to play with numbers and guesstimate the average number of merchants and merchant volumes. If most of Square’s customers are door to door fundraisers, and artisans at flea markets then that $70 average transaction number could make sense. But the annual volume and or longevity of those merchants, on the other hand, could make for some very lumpy financials.

And that is sort of at the core of the recent spate of criticism about Square. There were reports a couple of weeks back that Square lost $100M last year and is burning thru its $340M cash reserves almost as quickly as Kim Kardashian’s takes selfies and posts them on Instagram. This set off a wave of well documented and now endless speculation about the economics of Square’s business and its overall viability and the rumors of Square being in desperate enough straights to sell itself.

Here are a few new thoughts about Square and what it’s really worth.

First, does anyone else find it even a little tiny bit ironic that the same people who are criticizing Square for losing money and questioning its value – a firm that is actually producing products and generating revenue – thought that it was okay for What’sApp – a company that hasn’t generated a penny of revenue ever – to be acquired for $19 billion? And how many years did it take for Amazon to eke out any profit at all? Listen, I’m not pushing back against those who say that the merchant base that Square initially targeted – the micro merchant – is a tough market to serve and to serve profitably, but maybe we need a little perspective here. I was once told by a VC at a meeting I attended with an early stage venture that one of the worst things that a venture can do is actually have revenue since that puts a stake in the ground around what it could be worth in the future. This investor said that it was much better not to have any revenue so that the vision alone could drive the valuation. So, maybe Square should have taken that advice and not generated any revenue over the last 5 years. They could have then at least, when asked about revenue, used the classic venture fall back line – we’re acquiring customers now, we’ll figure out how to generate revenue later.

Ok, enough of my sass but hopefully you get the point. It’s absolutely the case that it’s extraordinarily hard to make money serving the category of merchant that Square initially targeted. There was a very good reason why traditional acquirers didn’t have an interest in serving them and/or priced the product at such a high rate so that if they failed they weren’t left holding the bag. It’s also why you see the only real success stories in the mPOS space in three distinct areas: (1) where mPOS is used in the services sector – plumbers, electricians and mobile service personnel who have a steady and ongoing customer base and higher ticket revenue stream; (2) where mPOS devices have morphed well beyond mobile phones into integrated tablets designed to serve small and medium “main street” merchants and; (3) with companies that operate as a platform and make a variety of hardware and software services available to SMBs in addition to card processing. Revenue, then, is a function of a more stable merchant – one that may also be interested in paying for other services like integration with accounting and inventory and customer management databases and marketing services and data analytics that are made available as part of the platform. It’s also why you see the traditional device manufacturers getting into the mix now and even adapting tablet solutions to Tier One merchants for use as complements to fixed terminals and fixed station checkout.

And, that’s what Square has done too. Square Register/Stand was designed to move it upstream to the category of merchant that was more stable, could deliver more volume and buy more services from the Square platform. Square recently implemented Square Register at Whole Foods so that consumers can pay for some items in certain places in the store without having to stand in the usual checkout lines.

But if Square is, indeed, struggling, and it vigorously denies reports that it is, it might be because it hasn’t been able to ignite its original strategy.

My colleague, David Evans, interviewed Jack Dorsey in 2009 right after Square launched (and right after PYMNTS launched, too). He was pretty specific about Square’s ambition as a company and it wasn’t to be an aggregator for microbusinesses. In that interview, Dorsey described his vision for attracting Main Street merchants and using customer receipts as the prompt for consumers to be driven to other Square-accepting merchants on Main Street” and who would be given an incentive to do so. Dorsey reprised that theme this year at NRF. Square, from day one, wanted to be a small business merchant/consumer commerce network.

Except that’s the hardest problem to solve in payments, especially when your starting point is, well, zero: no merchants and no consumers.

So off Square went to sign up merchants – the little guys to start. At the beginning, Square had no chicken and egg issue to crack, it had consumers with plastic cards already – Square was simply giving merchants a tool to accept the cards that consumers already had. And it got lots of small guys on board.

Card Case (now Pay With Square) launched in 2011. It was Square’s first attempt to get consumers on board with a Square-branded digital payments application. Pay With Square allows consumers to pay “with their face” leveraging the then iOS 5′s geo-fencing capabilities that automatically checked in consumers within 100 meters of a Square merchant . It was cool and got great reviews. Its wallet problem though was merchant acceptance. Square began to experience the pain of the chicken and egg game in payments.

Without a dedicated sales force or channel to sign up merchants, Square responded mostly to inbound marketing requests. That meant that it got calls, and sent devices, to any merchant just about anywhere. There was just one problem with that strategy. Without a critical mass of merchants in any geography that could accept Pay With Square, there wasn’t any real incentive for consumers to download a Pay With Square wallet. And besides, consumers associated Square with that cool dongle thing that they could use their plastic card to pay – so why bother. So, without lots of consumers with Pay With Square wallets running around, Square Register merchants were interested in only one thing from Square – cheap processing fees – which as we all know, doesn’t really drive enough revenue to pay the bills.

Square’s deal with Starbucks, I suspect, was an effort to get more consumers on board. I wrote about what those possibilities might have looked like when that deal was announced. Except it really didn’t. Starbucks got a sweet processing deal out of it, but, when customers were presented with the choice of Pay with Square wallet and Starbucks app (that comes with rewards) if they picked a digtal wallet, they picked the Starbucks app – no real other places to use Pay With Square so why bother since the Starbucks app offered more at Starbucks.

Now enter Square Merchant and Square Cash – two other efforts to fill out the consumer side of the Square platform.

Square Merchant has said that it has about 500,000 merchants on its platform – most of them accept Square in their physical stores, thus giving their offline channel an online presence and some interesting embedded promotional options with Twitter. I surmise that anyone who has ever paid a Square merchant got an email announcing Square Market – I did. Details on volume aren’t available publicly but an interview with the head of Square Market in the Fall of 2013 said that half of all payments made to Market sellers have been from consumers who haven’t ever “paid with Square” before. I don’t know if that is half of 10, 100, 100,000 or a million consumers, so it’s hard to know how impactful that “half” really is overall.

Square Cash launched last year and has gotten great reviews. I’ve not used it but those I know who have rave about its simplicity. Its popularity is rooted in not having to be part of a “network” to actually send or receive money – all that is required is to register a debit card with Square and to send an email to the person who is getting the money. Could those customers represent a pool of consumers who could ultimately populate a Pay With Square wallet (accounts that are attached to cheap debit cards)? Possibly, but then Square is back to the age old problem of where those potential customers could use their digital wallets to shop and, therefore, the incentive to download it.

Today, Square has a chicken and egg issue, big time.

Critics say that Dorsey was crazy to even get into the payments business and that Square is worth little to nothing given what most in the business characterize as a crappy sub-species merchant base and an anemic platform to offer value added services to merchants. Most believe that makes Square worth something else that begins with a “b” – and that’s bupkus.

It’s true that the barriers to entry now for the innovation that Square introduced five years ago – devices that enable card acceptance – are very low, and that as the pioneer in this space, Square has shown the payments and commerce ecosystem the perils and potential of the mobile point of sale space. Square has inspired lots of competition, including from the traditional device manufacturers who are now devising their own strategies to offer units that look more like integrated tablets that enable two way communication with consumers carrying mobile devices and less like closed purpose built devices that have historically been too hard and expensive to adapt to new innovations.

But maybe those who say Square is worth bupkus are looking at the wrong side of its platform.

Maybe the value isn’t so much in Square’s merchant base which is small and fragmented and needs enormous scale and geographic concentration and acceptance to drive any meaningful revenue. Maybe the real value is in Square’s digital consumer base, those consumers – however many of them there are – who have sent money via Square Cash and/or shopped on Square Market and/or signed a digital receipt from a Square merchant. If you do the math of the What’sApp acquisition, at 500 million consumers on that platform, the market valued each kid sending a text message at $38. How much should the market value a Gen X-er or a Boomer actually engaged in an activity where money changes hands – and where the potential exists to convert them into a digital wallet customer – which is something that, save very few, just about everyone that wants a digital wallet lacks today? Is that $38? $50? $100? $500?

So, maybe Jack Dorsey and Square are crazy, as in crazy like a fox. Maybe the real value lies in the consumers Square has been accumulating not in a Pay With Square digital wallet but digitally nonetheless – as accounts that have registered debit cards with them and/or as accounts that are established to shop at Square Market and/or as email signatures on digital receipts signed by consumers at Square merchants. Those might be attractive assets for someone else with the merchants and merchant acceptance that those consumers would value, and who would be interested in using a digital wallet with, consumers who could then be used to attract more merchant acceptance for that digital wallet.

In this wild and very unpredictable world of mobile and payments and innovation and commerce, I think we’ve all seen that just about anything can happen. Could there be a Visa Squared, Chase Squared, Apple Square, MasterPass Squared, PayPal Squared, or Discover Squared in our future? I have absolutely no idea, but don’t think I’d rule Square or anything out just yet.

The payments and commerce space gets more interesting by the day.