OfferUp’s General Counsel On Keeping Marketplace Shoppers Safe From Scammers

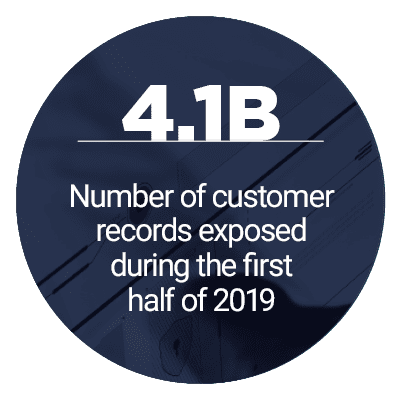

Online tools are saving customers time on acquiring goods and services. Unfortunately, these tools are also saving time for fraudsters, who are seeking to acquire those customers’ funds. Shoppers can quickly fall victim to eCommerce marketplace fraud, which led to bad actors to making off with a full $450 million in the U.S. in the past two years. Marketplaces (as well as financial services firms, grocery retailers and other businesses), therefore, must step up their protections against the wave of online attacks.

This month’s “Digital Fraud Tracker” explores how technologies like artificial intelligence (AI) and machine learning are helping companies better defend their customers.

Around the Digital Fraud World

Small banks often lose up to 5.8% of their total revenues to loan fraud — twice the loss that larger banks experience, according to a recent study. Financial institutions (FIs) are not without resources, however, and can use advanced learning technologies to better analyze customer data for patterns indicating the likelihood of loss.

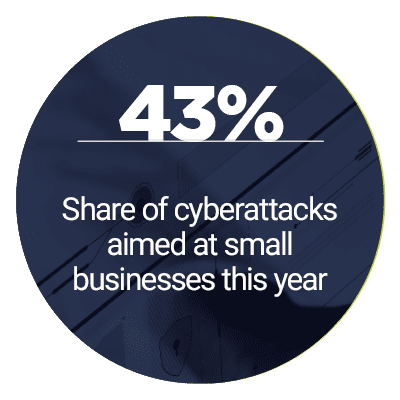

Small and mid-sized businesses (SMBs) often face trouble as well when accepting digital payments. These businesses, and many U.S. government agencies, are reporting being subject to eSkimming attacks, in which malicious code is inserted into platforms to steal customers’ payment details. The FBI recently released a roundup explaining the attacks, and providing advice on how to defend against them.

The European Central Bank is also reporting significant fraud challenges, with $2 billion lost annually to illicit actors. Card-not-present (CNP) fraud is a particularly sizeable threat, and fraud is increasingly afflicting eCommerce and cross-border trade. European payment solutions provider Nets and professional services provider KPMG teamed up recently, leveraging the latter’s AI-powered anti-fraud engine to rapidly analyze transactions and cut off fraud attempts early.

Find out more about these and the rest of the latest headlines in the Tracker.

Tackling Millennials’ $71M eCommerce Fraud Problem

Online marketplaces need to keep users safe as shopping increasingly goes digital. Even tech-savvy millennials fall victim to scams, with this generation losing $71 million to eCommerce fraud over the past two years. However, the marketplace that can keep fraud levels minimal is the marketplace that will survive, according to Nathan Garnett, general counsel of OfferUp, a marketplace for person-to-person (P2P) sales.

In this month’s feature story, Garnett explains how to use machine learning tools to detect early signs of fraud, as well as provide customers with verification options and safety tips to keep themselves — and their money — safe. Read the full story in the Tracker.

In this month’s feature story, Garnett explains how to use machine learning tools to detect early signs of fraud, as well as provide customers with verification options and safety tips to keep themselves — and their money — safe. Read the full story in the Tracker.

Deep Dive: Increasingly Advanced Bots Face Off Against Increasingly Sophisticated Defenses

Bad actors continue to develop more advanced forms of malicious bots, forcing companies to up their defenses in response. Today’s fifth-generation bots leverage AI and machine learning for advanced attacks, while protection measures use two-layer detection engines, application program interfaces (APIs) and more to stave them off.

This month’s Deep Dive details the latest malicious bot threats, and the efforts to keep them at bay.

About the Tracker

The “Digital Fraud Tracker,” done in collaboration with DataVisor, is the go-to monthly resource for updates on trends and changes in the world of digital fraud.