Worldpay On Modernizing Security Defenses To Foil eCommerce Fraud

The European Union’s long-anticipated 5th Anti-Money Laundering Directive (5AMLD), which modernizes security rules to reflect the needs and threats facing today’s economy, took effect in mid-January, and its impacts are already being felt across the payments space.

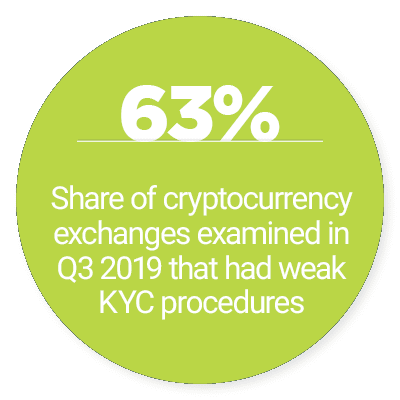

5AMLD’s impacts include strengthening anti-money laundering (AML) and counter-terrorist financing (CTF) regulations in the cryptocurrency space — something that has not pleased all the affected crypto companies . 5AMLD requires them to implement safeguards, such as performing Know Your Customer (KYC) checks on money transfers above certain values. However, several crypto exchanges and wallet providers have decided to shutter or relocate to countries with weaker security regulations, rather than comply with the new obligations.

. 5AMLD requires them to implement safeguards, such as performing Know Your Customer (KYC) checks on money transfers above certain values. However, several crypto exchanges and wallet providers have decided to shutter or relocate to countries with weaker security regulations, rather than comply with the new obligations.

The January “AML/KYC Tracker®” examines 5AMLD’s significance, as well as other efforts to thwart the fraud attempts challenging the financial sector.

Around the AML/KYC World

Fiat-focused digital wallets must also boost their security. Mobile wallet users of India-based FinTech Paytm were recently targeted by scams in which fraudsters falsely claimed that the customers needed to resolve KYC problems. The criminals used the pretense to persuade customers to hand over personal details or provide remote access to their phones, enabling the scammers to steal PINs and access bank accounts linked to victims’ digital wallets.

Person-to-person (P2P) payments are far from the only channel under attack, however. Global Payments-as-a-Service (PaaS) platform provider Modulr wants to better safeguard the wholesale and commercial payments it facilitates, recently adopting a new AML system that can provide real-time alerts about high-risk transactions. The company hopes the solution will help it more quickly investigate suspicious activity.

Combatting money laundering can require fast information flow. Approximately 80 banks in Japan joined JPMorgan’s blockchain-based interbank communications network to quickly discuss signs of potential money laundering. Facilitating rapid back-and-forth messaging may help the banks to better interrupt and block criminal transactions.

To find out more about these and all the latest headlines, download the Tracker.

Worldpay on Modernizing Security to Foil eCommerce Fraud

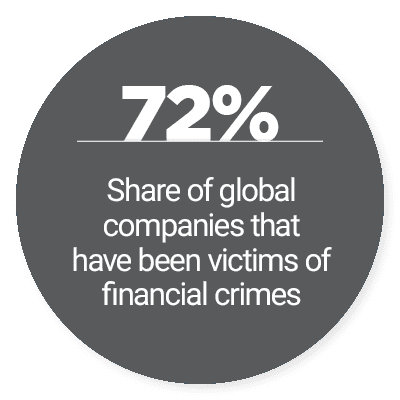

Merchants must participate in eCommerce if they want to remain relevant in today’s economy, but engaging in online transactions also exposes them to new forms of fraud. Safeguarding digital purchasing calls for merchants, card issuers and payment processors to all implement tight protections, and communicate readily about potential threats, said Ryan Fox, head of global identity services for payment services provider Worldpay from FIS.

In this month’s feature story, Fox explained how legacy security methods, like rules engines, cannot keep pace against modern fraudsters, as well as how artificial intelligence (AI)- based behavioral analysis and better data sharing are key to safer eCommerce. Download the Tracker to read the feature story.

based behavioral analysis and better data sharing are key to safer eCommerce. Download the Tracker to read the feature story.

Deep Dive: Payment Services Providers Level Up Their KYC, AML Strategies

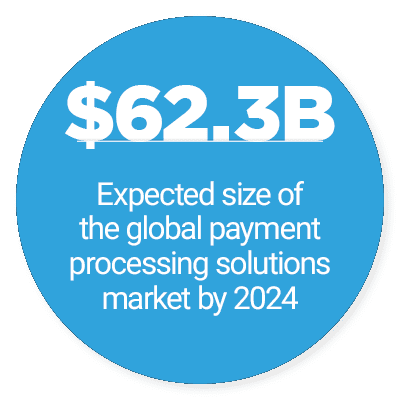

Payment services providers (PSPs) must work vigilantly to keep fraud off their services, and any failures to do so can mean lost customers and regulator-enforced penalties. These payment companies must thoroughly vet customers during onboarding and throughout the customer relationship to keep their operations safe.

This month’s Deep Dive examines how strong KYC and AML approaches can help PSPs protect their platforms against emerging security challenges, while reducing the likelihood that legitimate customers are mistakenly flagged as fraudsters. Get the full story in the Tracker.

About the Tracker

The “AML/KYC Tracker®,” a PYMNTS and Trulioo collaboration, provides an in-depth examination of current efforts to stop money laundering, fight fraud and improve customer identity authentication in the financial services space.