The coronavirus pandemic has left consumers staying home when possible to stop the virus’s spread. It has also made them wary of taking on debt because their financial circumstances could change at any moment.

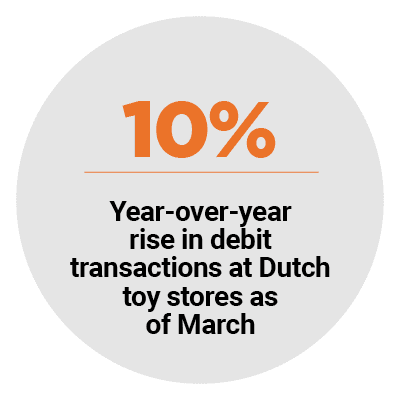

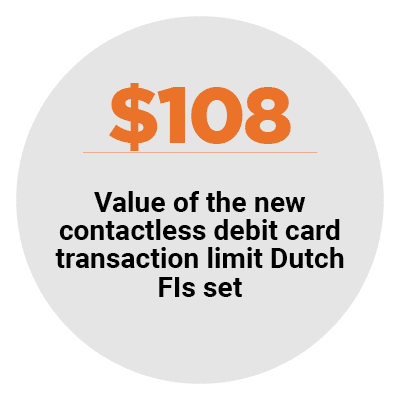

These shifts have made digital banking and debit transactions more important than ever. Financial institutions (FIs) are now working to extend services into customers’ homes, for example, and consumers are making fewer credit card payments amid uncertainty over what their employment statuses and budgets might be when the bills come due. Consumers are also avoiding cash out of concern that the virus could linger on physical object and are thus favoring virtual and contactless payment cards instead. FIs need to adjust their offerings accordingly to suit consumers’ new needs.

The Next-Gen Debit Tracker® explores how the COVID-19 outbreak is impacting commerce and banking, as well as accelerating uptake of digital services and payment tools.

The Next-Gen Debit Tracker® explores how the COVID-19 outbreak is impacting commerce and banking, as well as accelerating uptake of digital services and payment tools.

Around the Next-Gen Debit World

FIs and FinTechs are promoting social distancing by providing online card applications and virtual payment cards to help customers avoid using cash or visiting bank branches. Mexican FinTech Cuenca announced such services, with its digital cards and card applications especially helpful for Mexican customers who used to pay for eCommerce transactions in cash at local convenience stores. Such users cannot do so now because many of these locations are closed during the pandemic.

Indian FI Paytm launched virtual and contactless plastic debit cards to help customers circumvent using cash or having to hand over physical cards to retailers. Not exchanging physical items can reduce chances of exposure to the virus, making virtual and contactless debit an attractive option. The Paytm cards can be used both in-store and online.

Debit cards are also helping consumers receive funds. Many United States residents are starting to receive federal relief via direct deposits or checks in the mail, but Los Angeles, California, is turning to prepaid debit cards to offer its own pandemic-related financial assistance. Providing funds on these cards helps unbanked individuals access the money immediately, without having to turn to check cashers.

Find out more about these and the rest of the latest headlines in the Tracker.

Pandemic Puts  Digital Banking in the Spotlight

Digital Banking in the Spotlight

Consumers complying with stay-at-home orders are turning to digital banking services to help them manage their finances while avoiding public spaces like bank branches. Traditional FIs are taking the cue to up their digital offerings, and they can learn about how to extend convenient services into online and mobile environments by following their digital-only counterparts’ experiences. In this month’s Feature Story, David Vélez, CEO and founder of Brazil-based, digital-only FI Nubank, explains the bank’s process for creating secure, convenient digital experiences and why the pandemic is driving even greater reliance on debit payments.

Download the Tracker to read the full story.

Deep Dive: Reaching Stay-At-Home Customers  With Smooth Digital Services

With Smooth Digital Services

Banks and credit unions (CUs) that can meet rising demand for digital services may exit the pandemic with customers who are more loyal than ever. Creating compelling online and mobile services is no simple task, however, and FIs must find ways to make their offerings convenient and secure. This month’s Deep Dive examines the digital banking efforts of FIs worldwide and how video tutorials, expended call center support and other efforts can help consumers adjust to remote services.

Find the full story in the Tracker.

The Next-Gen Debit Tracker®, a PULSE collaboration, provides an in-depth examination of debit’s changing role in both banking and retail and gives a data-rich, insightful look on how providers can innovate within this area.