The Machine Learning Fix For Healthcare Disbursement Delays

Financial institutions (FIs), businesses and healthcare providers are adjusting their operations to suit the new reality that the COVID-19 pandemic has caused. Healthcare provideers, for example, are turning to telehealth solutions to service patients for routine appointments as to keep those individuals from entering hospitals or doctors’ offices and risking exposure. Providers are also attempting to find ways to speed up the disbursements process to both doctors and to patients expecting funds from health claims.

Financial institutions (FIs), businesses and healthcare providers are adjusting their operations to suit the new reality that the COVID-19 pandemic has caused. Healthcare provideers, for example, are turning to telehealth solutions to service patients for routine appointments as to keep those individuals from entering hospitals or doctors’ offices and risking exposure. Providers are also attempting to find ways to speed up the disbursements process to both doctors and to patients expecting funds from health claims.

Innovating for speedy disbursements in the healthcare space can be tricky, because many of these payments come attached with reams of complicated paperwork with sensitive and personal medical information that must be verified before the money can be sent. Both consumers and physicians, however, are more frustrated by the longer wait times that come with check disbursements at a time when financial strains are more widespread.

Innovating for speedy disbursements in the healthcare space can be tricky, because many of these payments come attached with reams of complicated paperwork with sensitive and personal medical information that must be verified before the money can be sent. Both consumers and physicians, however, are more frustrated by the longer wait times that come with check disbursements at a time when financial strains are more widespread.

In the latest Disbursements Tracker®, PYMNTS examines how the COVID-19 pandemic is impacting the healthcare industry and how it is exposing issues with check disbursements. The Tracker also examines what digital technologies or payment methods may help to ease these frictions, as well as how the pandemic is continuing to affect government agencies and small businesses as they struggle to meet their own disbursement and payment needs.

Around The Disbursements World

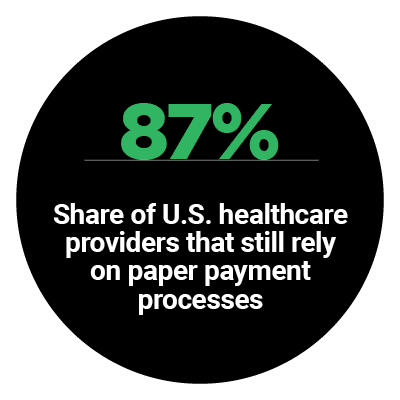

The pandemic is magnifying disbursement friction points for many healthcare providers, who are still relying on outdated methods such as checks. One study found 87 percent of providers in the U.S. are still utilizing such methods, for example, though interest in digital disbursement tools is climbing. Providers are less interested in innovating this process for their patients, however, with only 38 percent of those surveyed noting they would designate direct-to-consumer (DTC) disbursements as a top priority for the future. Patients may quickly find themselves more frustrated with the wait for check disbursements, especially in the wake of the pandemic. Providers must therefore remain on top of new needs to ensure they are still serving their patients with the speed they are expecting.

The healthcare industry must also examine the way it is treating payouts for its doctors and workers. Many providers are attempting to move their care online through the help of telehealth providers such as remote medical service Teladoc, but there are still some kinks that must be ironed out for such processes to run smoothly. Teladoc recently reported some initial struggles in sending out disbursements to the doctors signed up for its platforms, noting issues in receiving the direct deposit information of those physicians, for example. Others had checks sent to the wrong addresses, though Teladoc noted these errors only impacted approximately 2 percent of its payments. These glitches must be addressed as the use of telehealth solutions continues to increase in the healthcare space during the crisis.

The healthcare industry must also examine the way it is treating payouts for its doctors and workers. Many providers are attempting to move their care online through the help of telehealth providers such as remote medical service Teladoc, but there are still some kinks that must be ironed out for such processes to run smoothly. Teladoc recently reported some initial struggles in sending out disbursements to the doctors signed up for its platforms, noting issues in receiving the direct deposit information of those physicians, for example. Others had checks sent to the wrong addresses, though Teladoc noted these errors only impacted approximately 2 percent of its payments. These glitches must be addressed as the use of telehealth solutions continues to increase in the healthcare space during the crisis.

Disbursement stumbles have not been limited to the healthcare industry, either. The U.S. IRS, the agency responsible for sending out stimulus checks mandated by the country’s federal Coronavirus Aid, Relief and Economic Security (CARES) Act, is still reporting problems with its checks. The agency is seeing complaints from consumers who claim they are unable to see the status of their stimulus payments on the IRS’ website, with some stating they cannot find out if their money is on its way using the agency’s Get My Payment Tool. Determining the status of one’s payment is only the first hurdle: these consumers must wait weeks to have their checks delivered, something that is becoming more intolerable the longer the pandemic goes on and the more desperate citizens become.

For more on these and other stories, visit the Tracker’s News & Trends.

Clover Health On The Need For Speedy Healthcare Disbursements

Doctors, nurses and insurers are straining to make sure they can manage online telehealth services and remote billing as smoothly as possible. Complicated billing codes and paper-based processes that come attached to medical payments are one of the last things these physicians want or have time to deal with. Yet, these issues are now actively causing increased friction for healthcare providers during the COVID-19 pandemic, explained Andrew Toy, president and chief technology officer for health insurance startup Clover Health. Machine learning, however, can help facilitate near-instant payments to doctors, according to Toy. To learn more about how Clover Health is innovating the disbursements process for healthcare providers, visit the Tracker’s Feature Story.

Doctors, nurses and insurers are straining to make sure they can manage online telehealth services and remote billing as smoothly as possible. Complicated billing codes and paper-based processes that come attached to medical payments are one of the last things these physicians want or have time to deal with. Yet, these issues are now actively causing increased friction for healthcare providers during the COVID-19 pandemic, explained Andrew Toy, president and chief technology officer for health insurance startup Clover Health. Machine learning, however, can help facilitate near-instant payments to doctors, according to Toy. To learn more about how Clover Health is innovating the disbursements process for healthcare providers, visit the Tracker’s Feature Story.

How The COVID-19 Pandemic Is Pushing Digital Claims Processing

Digital claims disbursements are not as rare as they once were, with one study finding 80 percent of such claims in the U.S. were processed via automated clearing house (ACH) methods. This still leaves 20 percent left to be handled with legacy methods such as checks, however, which causes unacceptable delays, particularly during this time. Consumers who are already dealing with financial strains due to the virus’ impact do not have the necessary week or more to wait for checks to arrive. The need for quicker disbursements for these individuals is thus pushing interest in digital disbursements — and the technologies that may be used to facilitate them — forward in the healthcare industry. To learn more about how the pandemic is changing the perception of disbursements in healthcare and what digital payment methods are emerging as a result, visit the Tracker’s Deep Dive.

About The Tracker

The PYMNTS Disbursements Tracker ®, powered by Ingo Money, is the go-to monthly resource for staying up to date on the trends and changes in the digital disbursements space.