New Report: Payments, Transparency Build Trust In The Gig Economy

The pandemic affected the freelance market in varying ways, with many workers facing increased economic uncertainty and drawing upon their savings as work opportunities became scarce.

The U.S. government has developed programs to help, such as the Pandemic Unemployment Assistance (PUA) program, but freelancers are still waiting weeks in some cases to receive their relief checks.

These workers are therefore searching for ways to develop new and lasting relationships with companies, many of which are also looking to finish outstanding projects during the COVID-19 pandemic. It is also imperative that both of these parties can ensure trust in the other, making quick and painless identity verification processes critical. Payments must also be disbursed as quickly and seamless as possible to freelancers who may be experiencing financial pressures due to the pandemic, representing a sharp learning curve for companies still r elying on manual invoicing or payments processes.

elying on manual invoicing or payments processes.

In the latest Gig Economy Tracker®, PYMNTS analyzes the ways in which the pandemic has impacted the freelance economy, and how expectations both for creating new relationships for identity verification processes and for payments has changed as a result. The Tracker also examines how automated tools could help reduce friction for identification and payments in the space.

Around The Gig Economy Payments World

Companies are also making changes to the freelancer invoicing process in the hopes of enabling faster payments, such as French FinTech Shine. Shine, which offers online banking services for ad hoc workers, is adding a capability to its current invoicing feature that allows users to insure their outstanding invoices. Shine banking customers will pay a fee — 2 percent of the total invoice — in order to insure these documents against delayed or missing payments. Shine will then contact those firms with outstanding payments on the freelancers’ behalf with the intention of getting these funds to waiting freelancers more quickly.

Gig economy platforms themselves are also making additional changes to keep both their workers and their customers safe as the pandemic continues. Rideshare service Uber has instituted a new rule for its drivers and for passengers, requiring both parties to wear face masks during rides. Drivers are required to upload selfies of themselves wearing these masks at the beginning of every shift, using the Real-Time Identity feature developed by Uber to upload these photos to the mobile platform. Riders are also allowed to cancel their trips with no fees attached if they see their drivers are not wearing these masks, according to the company.

Gig economy platforms themselves are also making additional changes to keep both their workers and their customers safe as the pandemic continues. Rideshare service Uber has instituted a new rule for its drivers and for passengers, requiring both parties to wear face masks during rides. Drivers are required to upload selfies of themselves wearing these masks at the beginning of every shift, using the Real-Time Identity feature developed by Uber to upload these photos to the mobile platform. Riders are also allowed to cancel their trips with no fees attached if they see their drivers are not wearing these masks, according to the company.

Concerns over public health could lead to significant changes in the freelancer economy, especially in California where the state has seen a resurgence of the debate surrounding its Assembly Bill 5 (AB5) or “gig economy law” in recent months. Ridesharing companies Lyft and Uber found themselves facing a lawsuit filed by Attorney General Xavier Becerra, which alleges the two platforms have miscategorized their drivers as independent contractors. The suit, which argues these workers should instead be classified as employees under California law, also alleges that this miscategorization means the two companies do not have to pay for the health benefits traditionally given to employees. The lawsuit is the most recent battleground in this debate, in which Lyft and Uber — as well as other gig economy platforms — have repeatedly contested changes brought about by AB5 since it was first implemented in 2019. The repercussions of the lawsuit’s outcome will be critically important for the future of the gig economy in the state.

For more on these and other stories, visit the Tracker’s News & Trends.

How Online Marketplace goLance Is Engineering Trust In Freelance Relationships

The pandemic has affected the way companies communicate with their employees, including freelancers, but it has not changed what both of these parties are looking for out of these relationships. Firms want to make sure the freelance workers they are hiring are who they say they are and have the skills required, while freelancers need to trust they will receive wages through the payment method they expect. Facilitating open and transparent channels for these two entities to communicate is integral not only to strengthen that process of identity verification, explained Michael Brooks, CEO and founder of online freelance marketplace goLance, but also to foster lasting trust between firms and freelancers.

The pandemic has affected the way companies communicate with their employees, including freelancers, but it has not changed what both of these parties are looking for out of these relationships. Firms want to make sure the freelance workers they are hiring are who they say they are and have the skills required, while freelancers need to trust they will receive wages through the payment method they expect. Facilitating open and transparent channels for these two entities to communicate is integral not only to strengthen that process of identity verification, explained Michael Brooks, CEO and founder of online freelance marketplace goLance, but also to foster lasting trust between firms and freelancers.

To learn more about how transparent communication could aid in identity verification and build necessary trust, visit the Tracker’s Feature Story.

Why Slow Invoice Reconciliation Is Leading To Financial Pains And Rising Costs

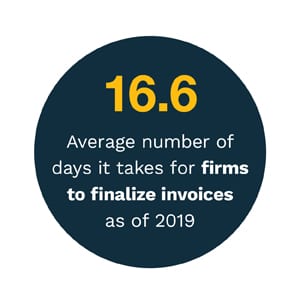

Gig workers may also be waiting for outstanding or delayed payments from companies for which they have already completed projects – payments that could prove critical to paying their bills while the pandemic’s economic impact continues. Yet 58 percent of accounts payable (AP) teams in North America lack any sort of invoice workflow automation in their approval processes, meaning much of the finalization for these payments is still done manually. This results in delays getting payments to waiting freelancers, a common frustration to these individuals.

To learn more about how firms are tackling manual invoice reconciliation frictions and how the use of automated tools could help, visit the Tracker’s Deep Dive.

About The Tracker

The Gig Economy Tracker®, a PYMNTS and Tipalti collaboration, examines the latest changes to payments in the gig economy and how freelancers and partner services are responding to shifting financial needs.