This week, Fundbox, a B2B payments startup attempting to fix the “net terms” economy, raised $176 million in equity, a sign that changing the invoice settlement system presents a big opportunity.

In an interview with PYMNTS, Eyal Shinar, CEO at Fundbox, characterized this as an approximately $3.1 trillion problem.

Most firms would agree that paper checks aren’t ideal for B2B payments. Automation sounds like the way to go, but according to Cindy O‘Neill, president of Priority Commercial Payments, many companies misunderstand what AP automation actually means. In fact, AP automation doesn’t necessarily entail the actual payment of invoices.

“AP automation is the automation of the receipt of the invoice and the workflow to approval, meaning a supplier sends an invoice to the buyer, who goes to procurement and makes sure the invoice is approved for payment,” she said.

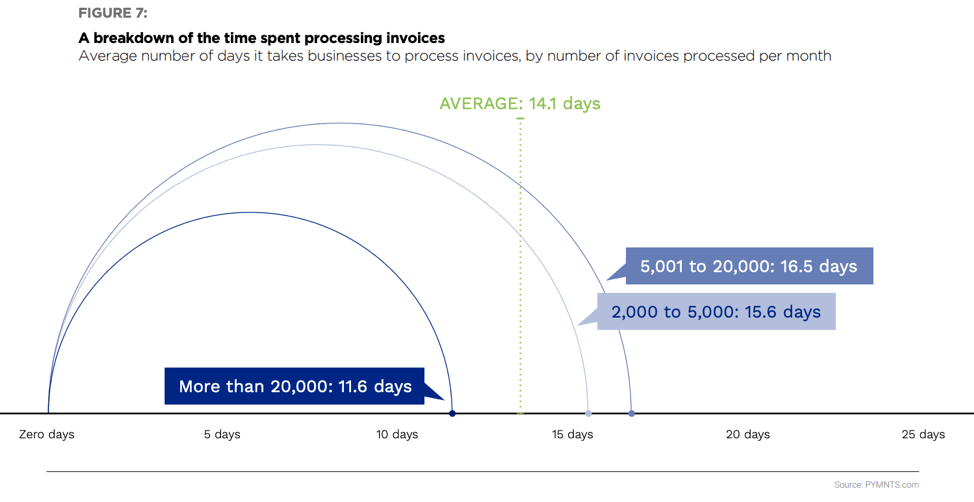

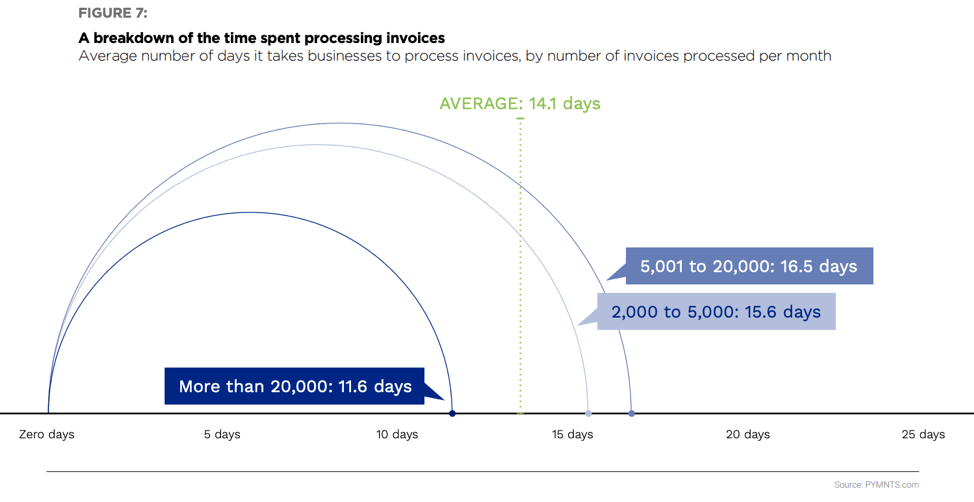

Payment only happens once an invoice has been approved. However, making payments faster is directly related to the speed at which invoices are processed. According to the latest Payables Friction Playbook, the average invoice takes two weeks and requires approval from two to five people before it is fully processed.

Invoice Innovations

Advertisement: Scroll to Continue

One of the topline findings from this report was that AP professionals who rate themselves as already highly efficient are the most interested in invoice innovations. Three-fourths (74.6 percent) of those who believe they have “very” or “extremely” efficient processes would like their businesses to adopt invoice receipt innovations. A similar number (73.4 percent) who believe their firms’ invoice approval operations are already efficient would like to implement innovations in the future.

Also counterintuitively, businesses that process more than 20,000 invoices per month appear to be far more efficient than others. More than three-fourths (77.2 percent) of AP professionals who work at firms that handle this invoice volume believe they process them “very” or “extremely” efficiently.

Additionally, 73.7 percent of those who handle more than 20,000 invoices per month plan to invest in invoice receipt innovations, 69.9 percent in invoice approval innovations and 68.4 percent in invoice payment innovations.

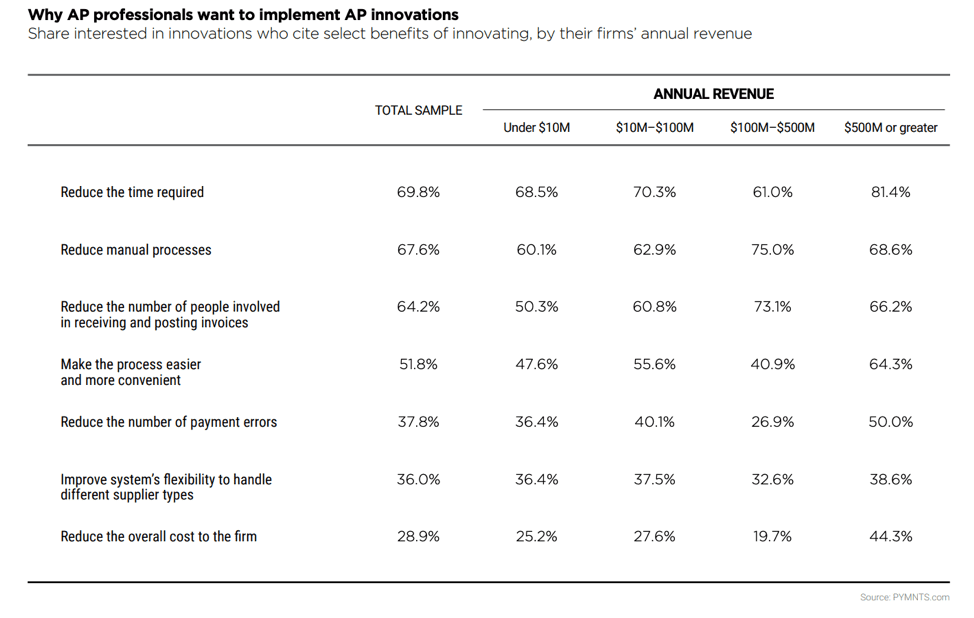

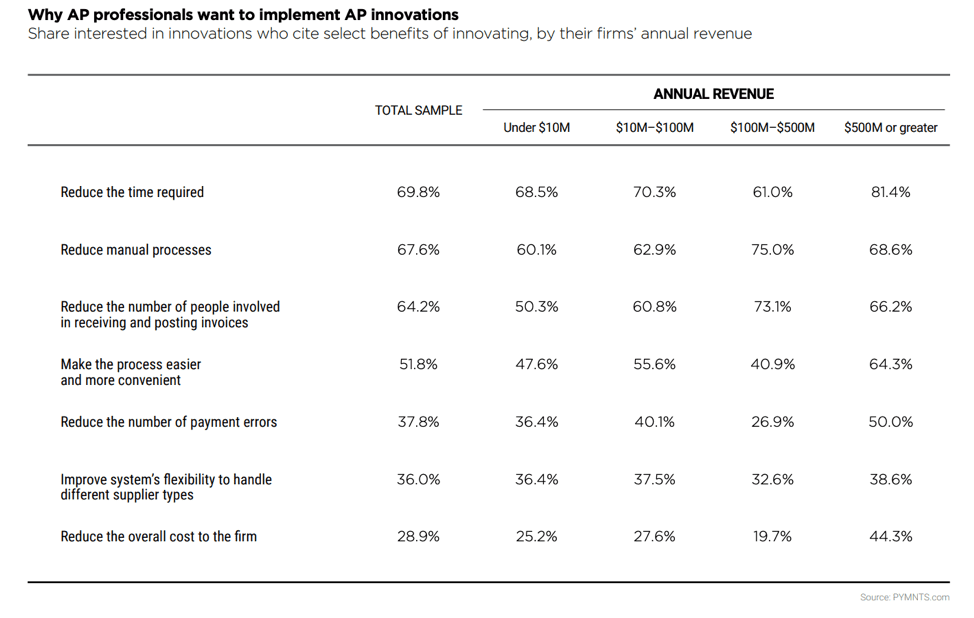

So, why are AP professionals – even efficient and high-volume processors – interested in innovations? Reducing time (69.8 percent) and manual processes (67.6 percent) were the leading reasons. Speeding up the process was even more important to firms with annual revenue of $500 million or more.

These responses indicate that the motivation behind innovation investments are less about reducing costs than about increasing efficiency.

The impact of increased efficiency becomes more apparent when looking at the time required to process invoices. The first step of the process already creates a log jam. Although 66.2 percent of firms receive invoices within a day from when they are sent, 24.8 percent wait an entire week for their suppliers’ invoices to reach them. The remaining 9.1 percent of businesses wait two weeks or longer.

The average business requires 14.1 days and approval from two to five people in order to process a single invoice. In this case, AP departments that process higher volumes of invoices are also more efficient. It takes an average of just 2.9 days for these businesses to receive invoices, 3.5 days to approve them and 5.2 days to pay them. The whole process takes an average of 11.6 days.

Current Technologies

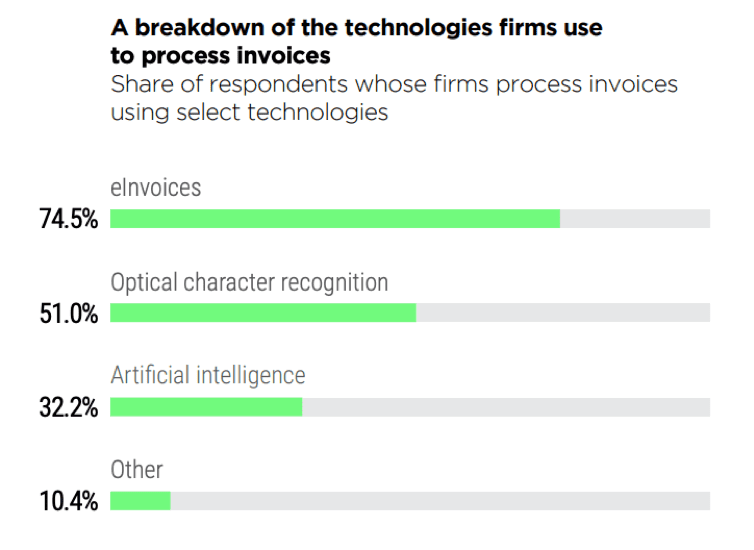

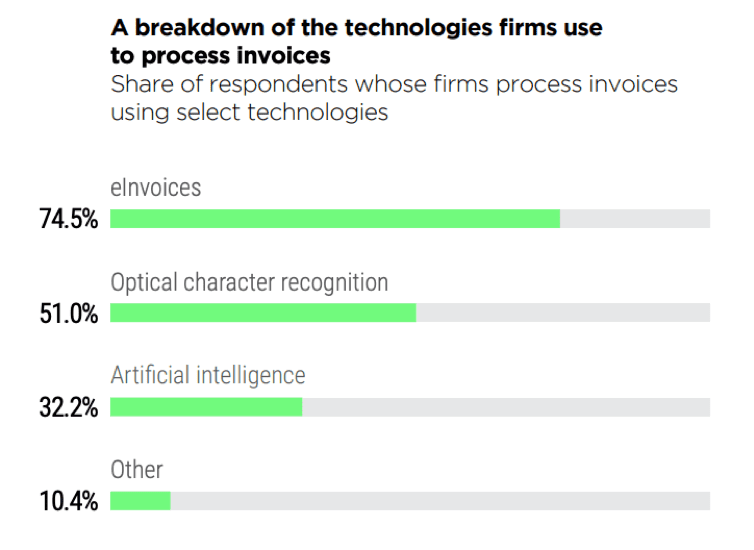

Most businesses use a mix of technologies to help process their invoices. The most common of these is eInvoices, allowing invoices to be digitally – often automatically – submitted, processed and paid. This tool is used by 74.5 percent of all respondents.

Once again, businesses that process more than 20,000 invoices per month make greater use of technology to help speed things along. Well over three-fourths (84.5 percent) of firms that process this volume say they use eInvoices. They also have greater use of optical character recognition (69.9 percent) than the average, though they have lower use of artificial intelligence (23.9 percent) than the average, as compared to firms processing fewer than 20,000 invoices per month.

It seems eInvoices are an attractive innovation among AP professionals at all companies, regardless of the number of invoices they process. A majority (56.9 percent) had interest. The second- and third-most cited innovations that respondents would like to implement are automatic order matching (43.8 percent) and ePayables with virtual cards (28 percent).

The next-most in-demand invoice innovations include email invoices, AI systems and software solutions that will manage invoices and OCR.

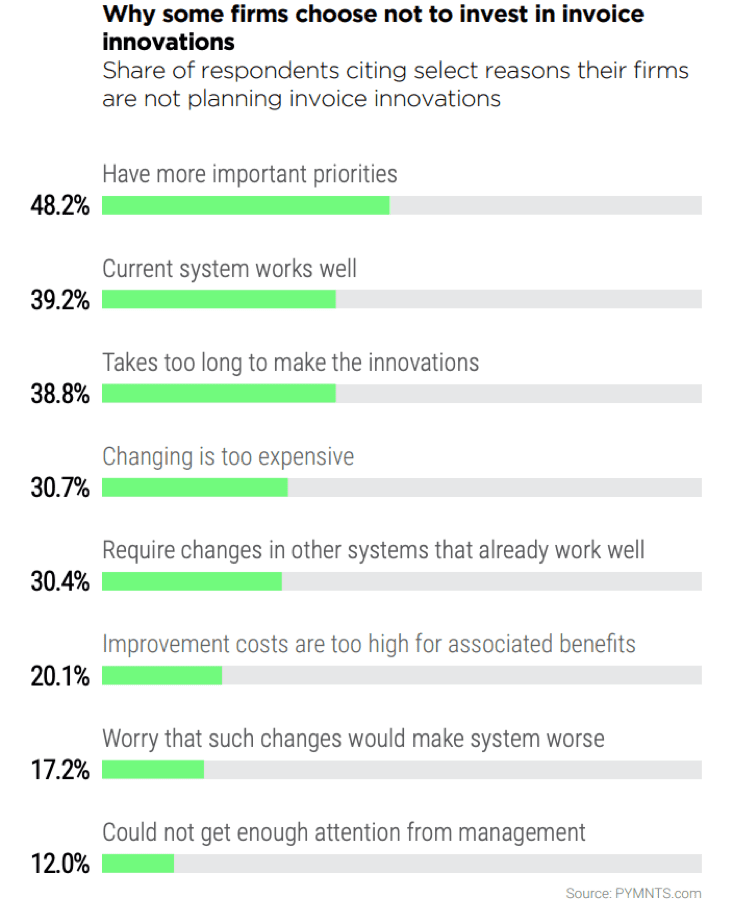

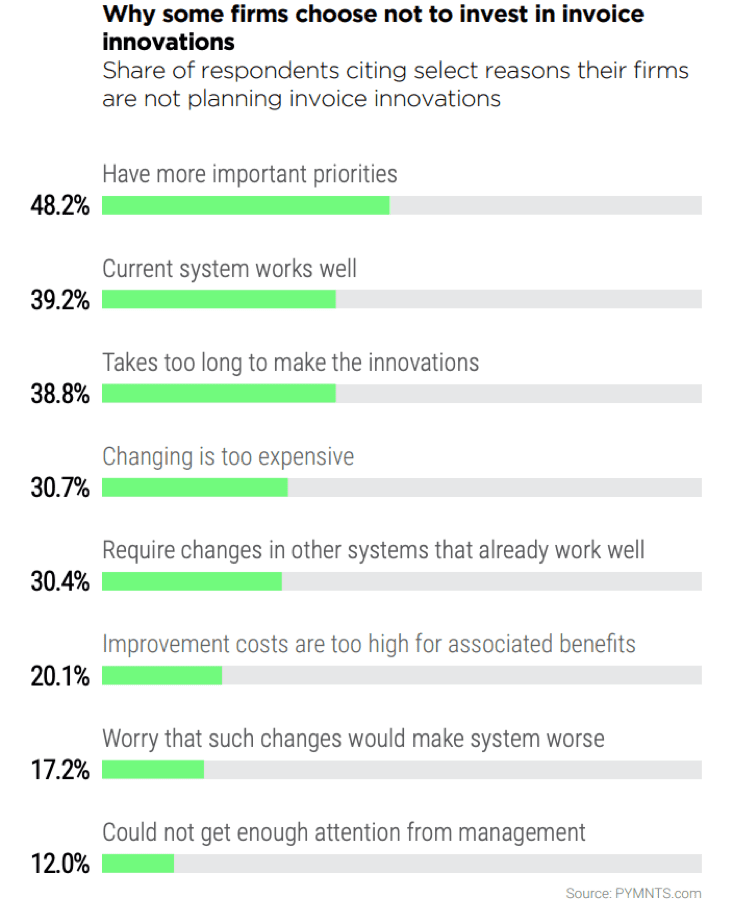

Despite so many expressing interest in a wide variety of innovations, 19 percent of AP professionals were not interested in investing in invoice innovations of any kind. The biggest reason is that their companies currently have other priorities that take precedent, cited by 48.2 percent of respondents who are not interested in invoice innovation.

Other logistical concerns include the time and cost it might take to switch from legacy systems, with 38.8 percent of respondents saying they feel invoice innovations would simply take too long to implement and 30.7 percent saying they feel changing their processes would be too expensive.

Most AP professionals know invoice innovations can improve their businesses and often want to adopt them. The trouble is that many AP departments are satisfied with the status quo, feel they are already efficient enough or simply have more pressing issues to address.