These insights are according to a joint PYMNTS Intelligence-Amex research study, which found that on average, these companies, irrespective of their size or industry, projected a 50% increase in payments made and a 46% increase in invoices delivered.

Additionally, although only 13% anticipated significant growth in AP system payments in the next three years, this figure rose to 17% for relatively small businesses. For these smaller enterprises, the pivotal question remains whether their existing processes can effectively handle the anticipated increases, making automation of accounting processes a potential advantage.

The benefits of this shift are manifold. Companies that have embraced automation report experiencing more precise, efficient and streamlined operations. Moreover, automation has a positive impact on cash flow, leading to increased savings and reduced payment delays in shipping.

Automation also contributes to better vendor relationships as it ensures timely payments. This specific finding aligns with separate research from PYMNTS Intelligence, which found that 74% of mid-sized firms reported increased vendor satisfaction upon fully embracing AP automation. In contrast, only 40% of those employing partial automation shared similar positive outcomes.

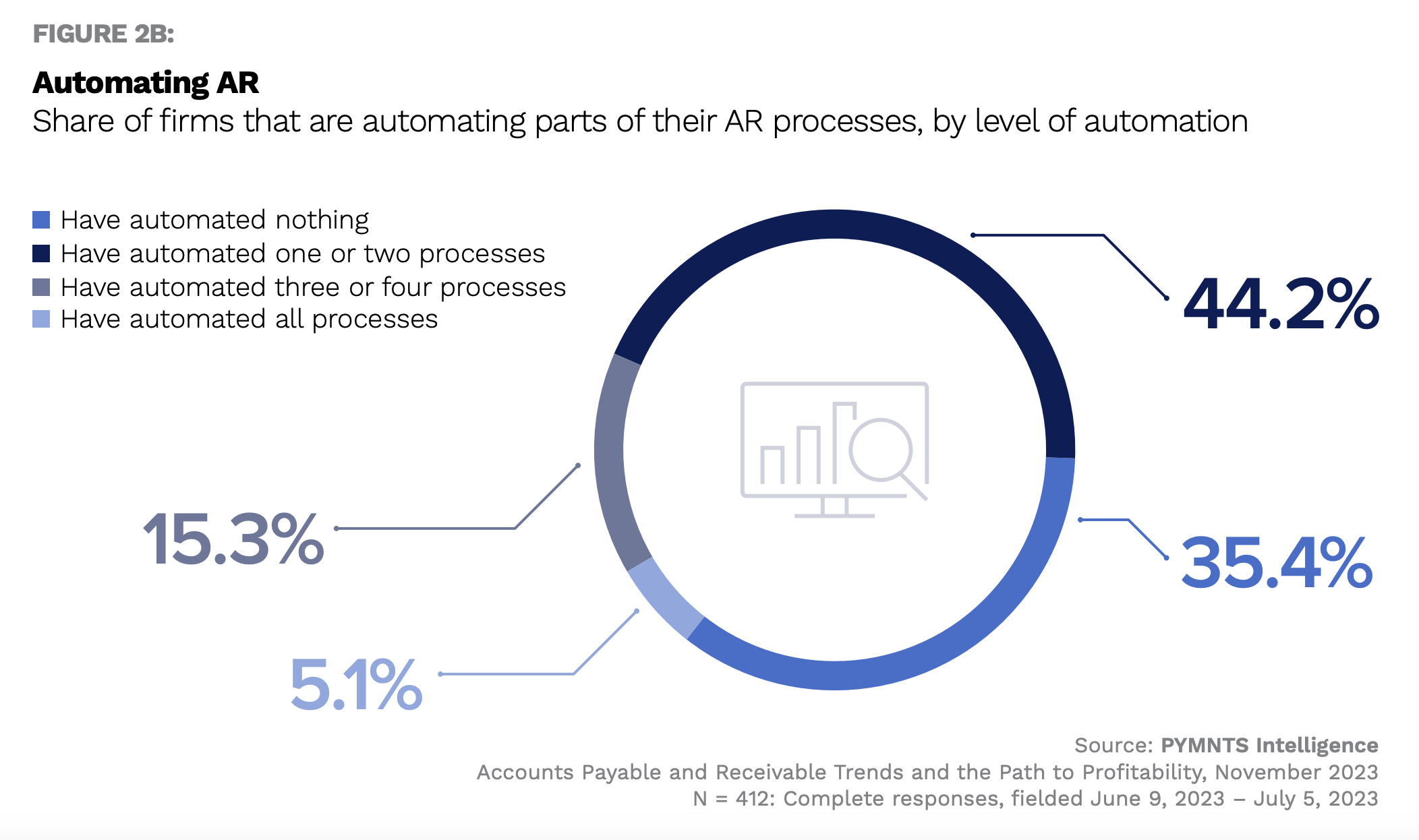

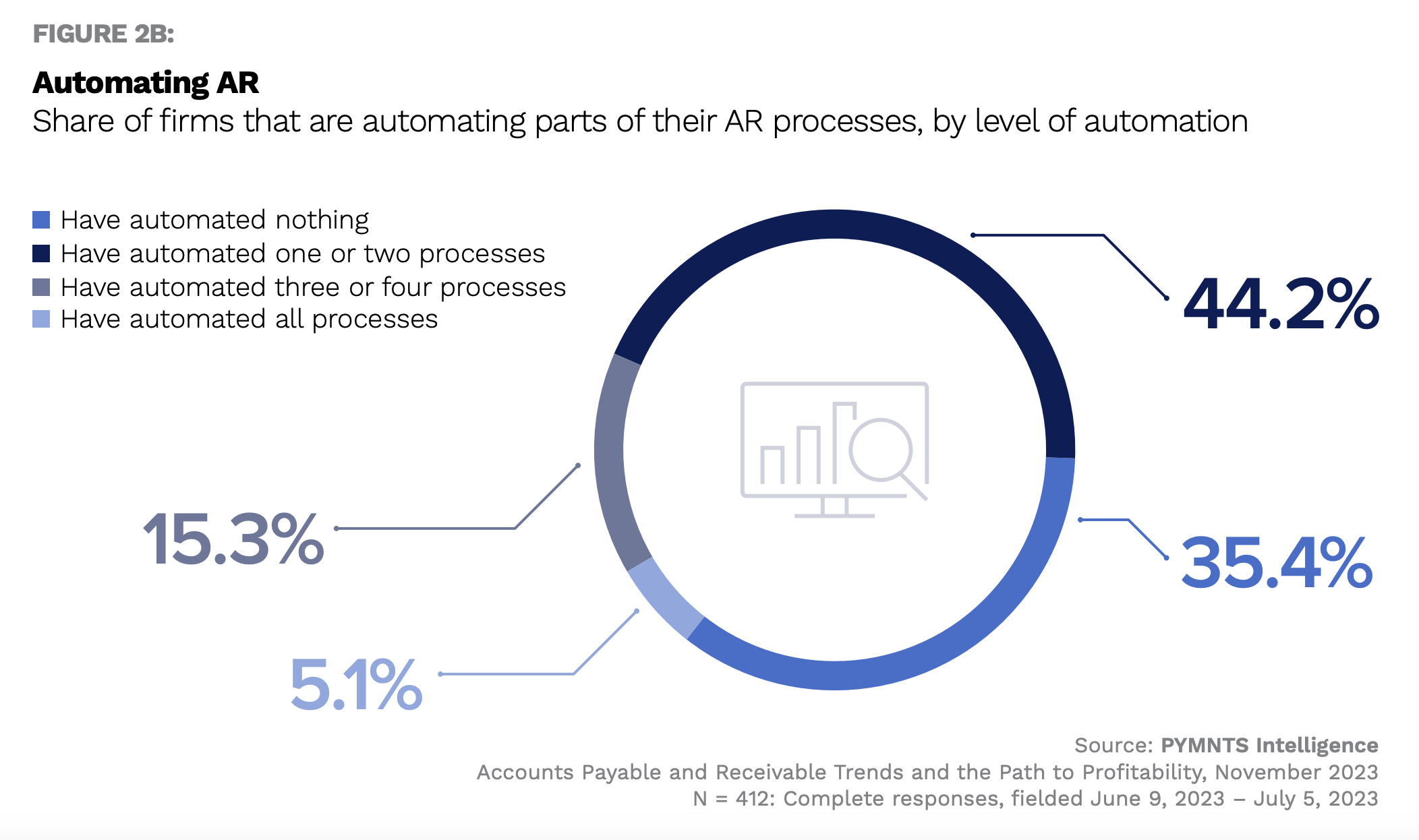

But per the Amex report, 36% of firms surveyed have yet to automate any aspect of their AP/AR processes, and only 15% have automated at least three processes. In contrast, a mere 4.6% have fully automated their entire AP/AR processes. The continued reliance on manual processing within these firms might impede their capacity to efficiently manage the increasing workload.

Advertisement: Scroll to Continue

A key factor contributing to firms’ reluctance to embrace automation is apprehensions about cost and complexity. Notably, over a third of companies have identified these concerns as the primary reasons for their hesitation. Nonetheless, the report underscored that technology or automation partners can play a pivotal role in alleviating these concerns by offering support and guidance throughout the integration process.

Furthermore, the report highlighted the importance of businesses conducting a thorough review of their current systems. This is crucial to ensure their systems can seamlessly incorporate a diverse range of payment options and align with the evolving demands of customers.

These demands include preferences for instant money transfers, mobile payment systems and credit cards/purchasing cards, which mid-size firms favor for both making and receiving payments.

In conclusion, businesses should expedite the automation of their AP and AR processes to enhance efficiency and cash flow, particularly in light of the anticipated increases in the volume of payments processed and invoices handled in the coming years.

For businesses that remain uncertain about embracing automation, the key lies in seeking the right support and guidance from technology or automation partners. With their assistance, businesses can surmount any barriers hindering automation adoption, unlock the myriad benefits it offers and thrive in the evolving landscape of AP/AR strategies.