The events of the past 18 months have been a complete game-changer for B2B transactions. The pandemic left countless firms with a partial or total remote workforce, accelerating the digital shift to B2B payments.

Accounting departments have had to pivot quickly to adapt to this new business landscape. The combination of the complications of remote work, the tumultuous economy and many businesses’ unfamiliarity with digital payments have challenged accounts receivable (AR) teams. The late payments and errors that stem from these difficulties could be devastating for cash flows.

The following Deep Dive explores the future of AR in the rapidly changing business environment and how new technologies could help accounting departments keep up with the evolving ecosystem.

Challenges Accounting Departments Face

Research indicated that most employers have switched to some form of remote work since the pandemic began. Thirty percent are allowing their staff to work from home full time, 18% have instituted a hybrid in-office and at-home model, and another 18% have sent some employees home while others remain at the office. Employees largely support this change, with 83% favoring a hybrid work model, and 63% of high-growth organizations having already opted for a productivity-anywhere approach.

Researchers concluded that people are better off when they can work regardless of physical location, meaning that if employers were to select a work model that fits most employees, working from home at least part time appears to be the winner.

This shift to remote work brings with it a set of AR challenges, however. Accounting practices that rely on in-person collaboration, communication and manual processes cannot occur when employees are potentially thousands of miles apart, and phone calls or teleconferencing may be inadequate. Nearly half of firms rely on manual AR processes, forcing them to make a difficult decision. One choice would be to invest in potentially expensive digital solutions that work better with an at-home work model, which would allow employees to work from home. The other choice would be to keep these manual processes, requiring employees to report to the office for work, but this decision could drive many productive workers to quit their jobs in favor of remote-friendly firms.

Businesses feel the squeeze from this new working environment, and the costs of not digitizing AR are very real. A PYMNTS study found that nearly three-quarters of both small companies with annual revenues from $25 million to $100 million and large firms making more than $1 billion per year reported an increase in payment delays since the pandemic began. Other payments challenges affecting most small and large businesses nearly equally were the inability to optimize costs and an increase in days sales outstanding (DSO).

New solutions are needed to adjust to the dual challenges of remote work models and economic uncertainty. AR processes that rely on automation could be a lifesaver for accounting teams struggling to adapt to the altered status quo.

Leveraging Automation to Meet the Demands of the Remote Economy

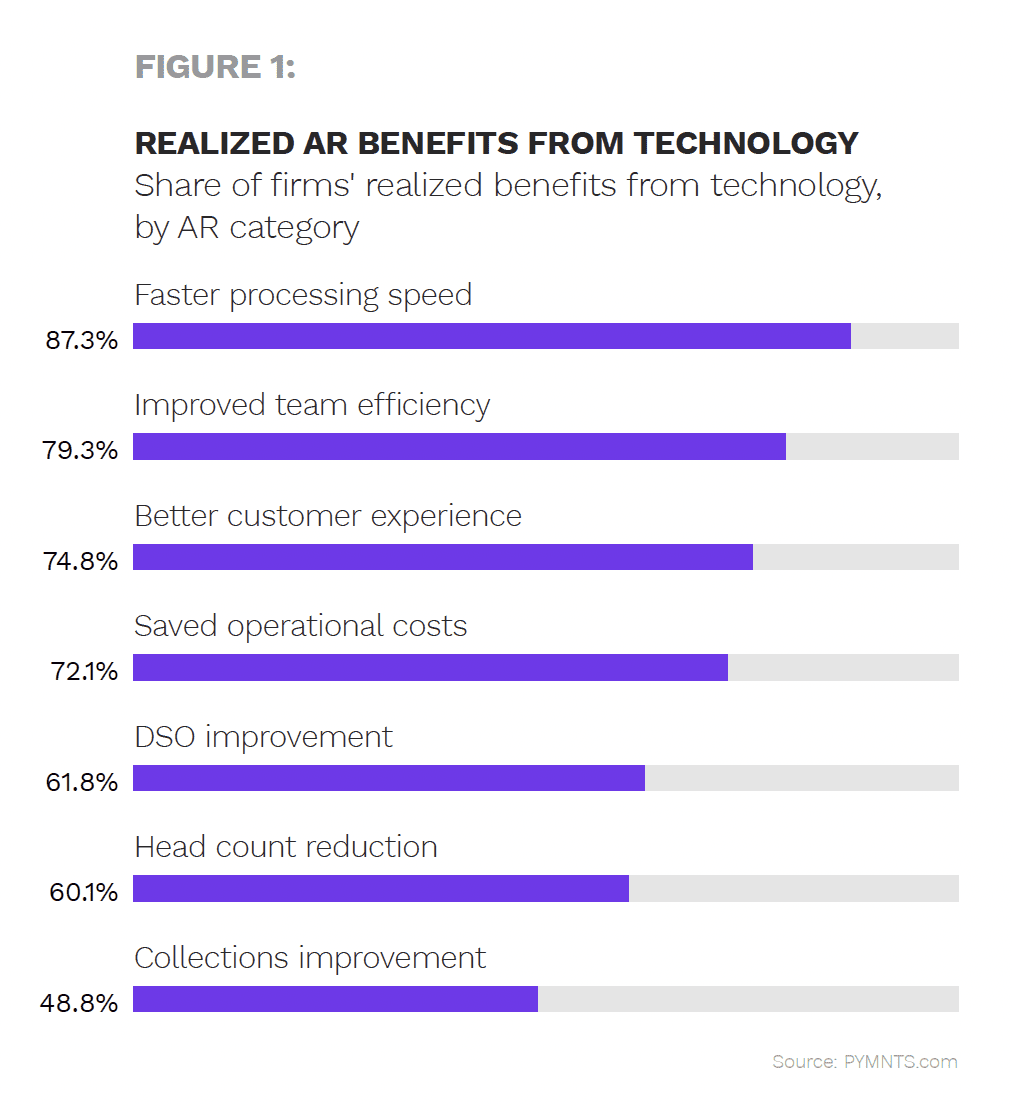

Automating routine AR processes can be a critical step in addressing remote accounting hurdles. More than 87% of firms that deployed AR automation reported faster processing speeds, 79% said it improved AR teams’ efficiency and 75% said it resulted in better customer experiences. Most firms also discovered that AR automation saved on operational costs and reduced their DSO.