There are of course reasons why AP and account receivable (AR) departments have clung to these legacy processes. For all their shortcomings, paper checks provide a measure of comfort and security, especially in dealing with large sums. Yet, this sense of security is in many ways a false one. The perceived benefits of paper-based payment processes are far outweighed by digital AP and AR automation solutions, which provide far greater levels of data visibility, security and speed. These innovations offer another important benefit in the midst of a public health crisis: They facilitate remote working relationships and minimize the need to exchange physical documents.

There are of course reasons why AP and account receivable (AR) departments have clung to these legacy processes. For all their shortcomings, paper checks provide a measure of comfort and security, especially in dealing with large sums. Yet, this sense of security is in many ways a false one. The perceived benefits of paper-based payment processes are far outweighed by digital AP and AR automation solutions, which provide far greater levels of data visibility, security and speed. These innovations offer another important benefit in the midst of a public health crisis: They facilitate remote working relationships and minimize the need to exchange physical documents.

These advantages are laid out in The Optimizing AP and AR Playbook, a PYMNTS and OnPay Solutions collaboration. Drawing on PYMNTS’ past studies and external research, the Playbook documents the costs that outmoded invoicing processes impose on businesses, and outlines a path toward more efficient and effective payments as well as AP and AR operations.

The Playbook focuses in particular on two types of innovations: virtual cards and eInvoices. The first enables companies to assign digital card numbers to vendors or other parties that are randomly generated and expire after their approved use. The latter allow businesses and vendors to exchange invoicing documents including means of payment via integrated electronic formats.

other parties that are randomly generated and expire after their approved use. The latter allow businesses and vendors to exchange invoicing documents including means of payment via integrated electronic formats.

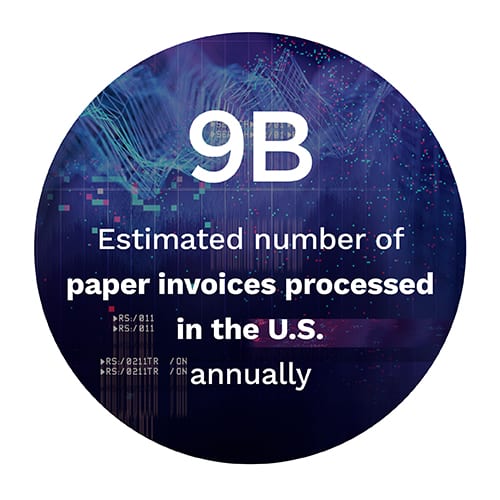

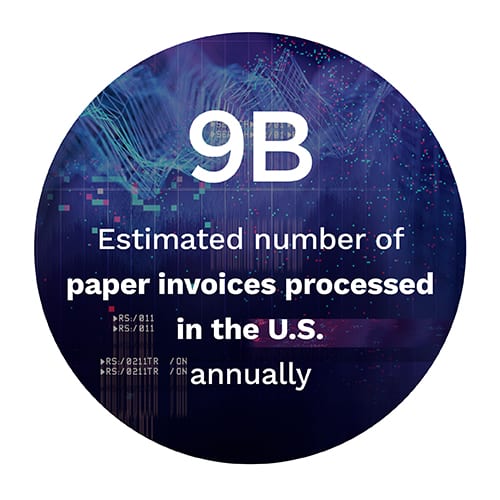

Some of our key findings are that United States businesses generate approximately $9 billion in paper invoices per year, representing approximately 75 percent of all businesses, according to the U.S. Federal Reserve. If these firms migrated en masse to electronic invoicing, also known as eInvoicing, they could collectively save up to $150 billion per year, the Fed projects.

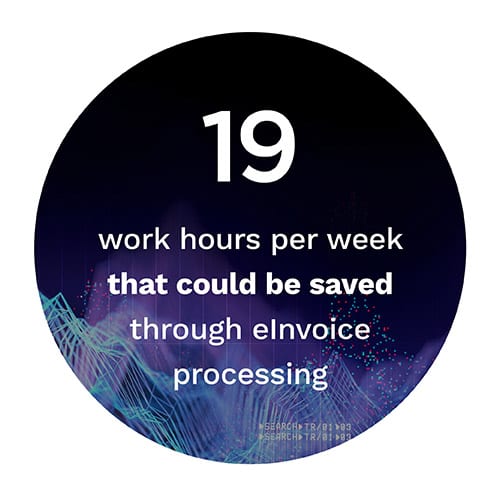

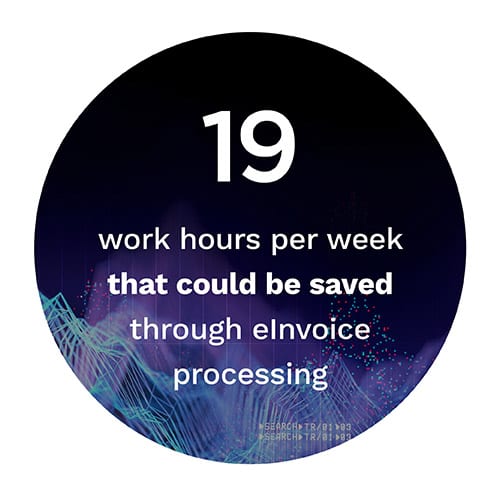

One r eason paper-based processes can be so costly is the potential for human error. According to one recent study, enterprise-level firms were able to audit less than 10 percent of expense reports, potentially allowing dubious expenses to slip through the cracks. AP and AR innovations like eInvoicing and virtual cards have resulted in significant and well-documented efficiency gains for businesses. Another recent study found that automating AP and AR processes led to an approximately 60 percent reduction in missing invoices and a 59 percent decline in delayed payment and reimbursement approvals.

eason paper-based processes can be so costly is the potential for human error. According to one recent study, enterprise-level firms were able to audit less than 10 percent of expense reports, potentially allowing dubious expenses to slip through the cracks. AP and AR innovations like eInvoicing and virtual cards have resulted in significant and well-documented efficiency gains for businesses. Another recent study found that automating AP and AR processes led to an approximately 60 percent reduction in missing invoices and a 59 percent decline in delayed payment and reimbursement approvals.

To learn more about the benefits of digital AP and AR solutions and how they can help firms escape the cycle of legacy business-to-business payment processes, download the report.

About the Playbook

The Optimizing AP and AR Playbook, a collaboration with OnPay Solutions, is a research report that documents the costs legacy invoicing practices impose on firms and lays out a path toward digital automation solutions.

Consumers have the potential to grow impatient if it takes more than a single click or tap on a screen to complete a purchase when they shop online. This stands in stark contrast to how the accounts payable (AP) departments at many businesses process payments. To a significant extent, this process remains stuck in the predigital era and is ruled by checks and paper-based invoices, which are often accompanied by weeks-long delays and cash flow problems.

Consumers have the potential to grow impatient if it takes more than a single click or tap on a screen to complete a purchase when they shop online. This stands in stark contrast to how the accounts payable (AP) departments at many businesses process payments. To a significant extent, this process remains stuck in the predigital era and is ruled by checks and paper-based invoices, which are often accompanied by weeks-long delays and cash flow problems.