Amazon Sellers Expand to New Channels for Audiences and Sales

Amazon sellers want to reduce their dependence on the eCommerce giant, PYMNTS data shows.

Although 71% of sellers using eCommerce marketplaces view the platforms as essential and report a 90% satisfaction rate, some are expecting to branch out, and the impact could be seismic.

For example, a recent survey found that nearly all Fulfillment by Amazon sellers who had not yet sold with other marketplaces planned to sell on rivals’ platforms in 2023. These competing platforms include Walmart Marketplace, Google Shopping and Facebook Marketplace. The move is motivated by increased fees, with half of surveyed sellers citing it as their main driver for looking elsewhere.

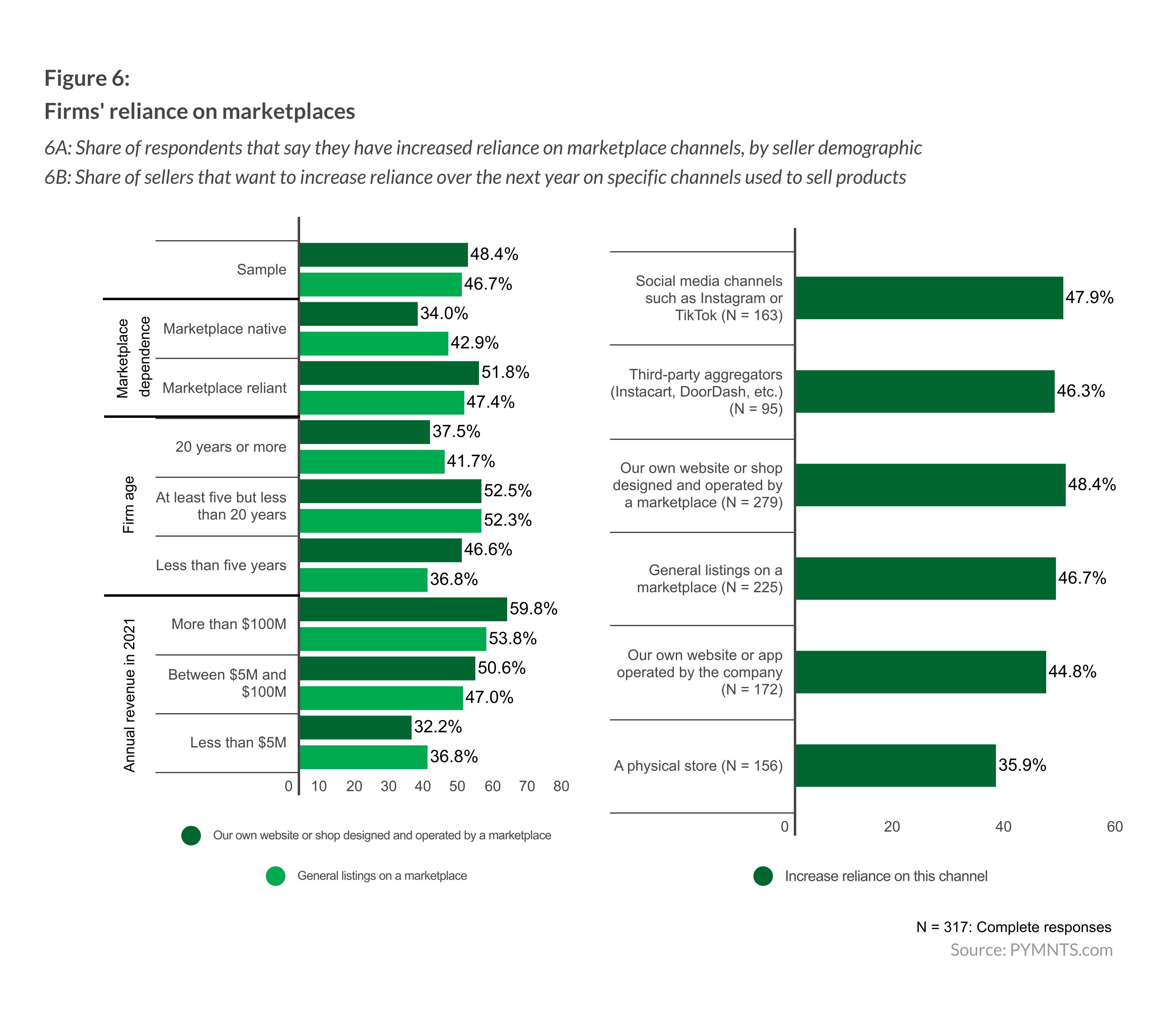

A PYMNTS study of online sellers earlier this year found that marketplace sellers were also eyeing greener pastures with their channel selection, with nearly half wanting to be less reliant on a single channel and instead rely more on social media channels, custom websites or third-party aggregators. These trends together illustrate a firm resolve among many of these sellers to diversify their marketplace platforms.

Amazon, having noticed the expected exodus, is rolling out initiatives to keep sellers on their platform.

In July, it announced a pilot program for the Amazon Seller Wallet, which allows sellers to transfer funds directly into their bank accounts and can facilitate cross-border sales, among other features. More recently, Amazon introduced Express Payout, which releases funds to sellers in 24 hours, a far shorter timespan than the several days a typical ACH payout takes to clear.

Amazon went even further in its drive for seller retention last month by launching a merchant cash advance option. The eCommerce giant joins competing marketplace programs such as Shopify Capital (available in 14 countries) and PayPal, which has offered lending to sellers processing $20,000 through their platform since 2013.

These initiatives may not be enough to retain Amazon’s vast merchant base, as sentiment shows. Sellers considering other channels to trade through now have a host of options, including platforms that are smaller yet still vast such as Shopify, or those associated with PayPal like Etsy and eBay.

Some agile alternatives are also making a splash in the marketplace sector. One is Fashion Cloud, a B2B eCommerce platform created in 2015 to reduce fragmentation and inefficiency in the European fashion industry. Currently, 600 brands and 20,000 retailers use the software solution, and the company raised approximately $26.6 million in its latest round of funding.

Other sellers are turning their backs on marketplace platforms entirely and leveraging social media and alternative channels to boost sales. While this strategy may pose some risk, PYMNTS research shows that nearly two-thirds of sellers promote their business on social media, hinting that even the most steadfast marketplace sellers could be seeking to diversify their reach.

As the economy continues its rollercoaster trajectory, at least in the near future, fewer sellers are willing to stake their fortunes solely on a single platform. The more agile marketplace-native firms are blazing the trail for successful online sellers in the future, emphasizing diversification in customer reach.

It stands to reason that marketplace-reliant firms may follow their path. Sellers considering making small steps away from a single platform — even one as ubiquitous as Amazon’s — are making the smart choice. After all, they can now explore multiple options to grow their customer base instead of entrusting their future revenue to an entity they do not control.