Seven Years Later, Only 6% of People with iPhones in the US Use Apple Pay In-Store When They Can

Remember this?

It was about seven years ago – Sept. 9, 2014 – when Tim Cook took the stage at Apple’s WWDC and introduced Apple Pay.

What the world saw that day was a slick user experience that was quintessentially Apple – a mobile payments app that Cook said would replace the consumer’s physical wallet and revolutionize how they paid for purchases made in the physical store.

The media and industry pundits went bananas. Reports predicted that soon, plastic cards would be a relic, and that Apple Pay at the point of sale would markedly eclipse their usage and utility.

At launch, card networks and large issuers were teed up. So, too, were a handful of large merchants that already had contactless at the point of sale, waiting for consumers to waive their iPhone 6s and 6Ss across them at checkout. In the U.S., those merchants were pioneers, as only a few in the country had activated contactless at the POS at that time.

Seven years post-launch, new PYMNTS data shows that 93.9% of consumers with Apple Pay activated on their iPhones do not use it in-store to pay for purchases.

That means only 6.1% do.

That finding is based on PYMNTS’ national study of 3,671 U.S. consumers conducted between Aug. 3-10, 2021.

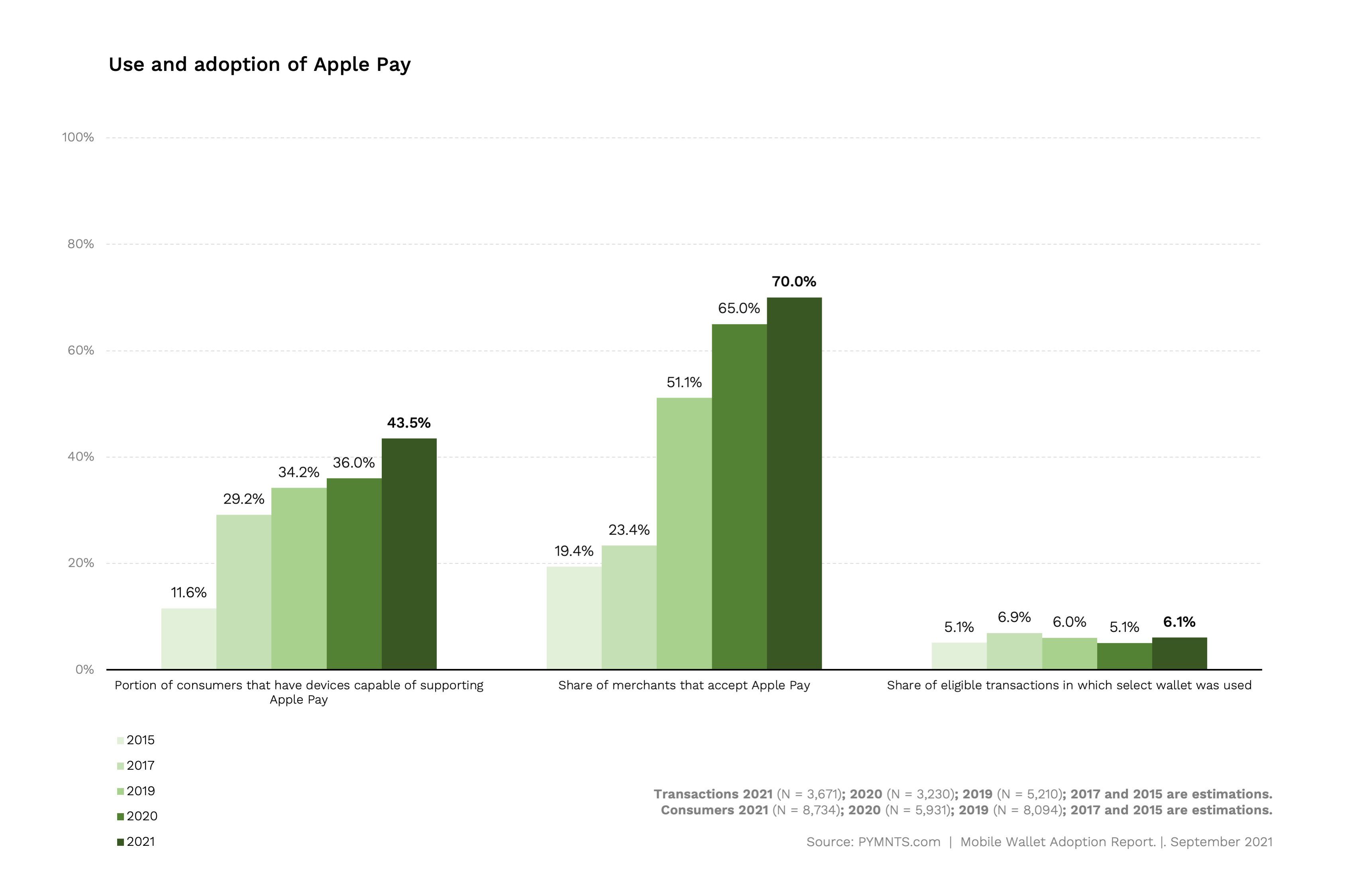

After seven years, Apple Pay’s adoption and usage isn’t much larger than it was 2015 (5.1%), a year after its launch, and is the same as it was in 2019, the last full year before the pandemic.

Disappointing, perhaps, but entirely predictable.

Disappointing, perhaps, but entirely predictable.

Read Also: Icahn Gets Apple Pay Math Wrong

Even now, in the age of digital-first consumers living in a connected, digital economy, Apple Pay’s stiffest competition in the store, ironically, remains that piece of plastic – the raison d’etre for its development and the intended target of its super-hyped potential in 2014.

In fact, the growth in total Apple Pay transactions since 2015 has come almost entirely from more stores having contactless terminals to accept it, more people having new iPhones that can use it, and the overall growth in retail transactions.

And almost none of that growth comes from more iPhone users wanting to use it instead of plastic cards.

The Problem of Not Fixing One

Apple Pay faced stiff ignition headwinds on all sides of its platform when it launched in 2014.

For consumers to use Apple Pay in the store, a merchant needed to accept contactless payment. That was 19% of U.S. merchants in 2015; it’s estimated to be 70% of merchants in 2021.

Consumers also had to have a particular model of iPhone to activate Apple Pay – the iPhone 6 or 6S. That was 39% of consumers with iPhones in 2015; today, that’s 96% of iPhone users. To provision a card in their Apple Pay wallet, the consumer’s bank needed to have an agreement in place with Apple Pay.

Those 2015 headwinds have largely been neutralized.

The one that remains seven years later is convincing more than just the early mobile payment adopters and Apple enthusiasts that Apple Pay solves a problem at the point of sale that using their plastic card does not.

The challenge is persuading consumers that the value of Apple Pay is big enough to trade off the ubiquity and utility of the plastic card they know how to use, is accepted everywhere they shop, and doesn’t require using a particular device to pay for their purchase.

And proving that the value of using Apple Pay is also durable enough to become a habit rather than just a novelty of trying it once – and getting consumers to use it every time they shop in a store, and even showing a preference for those shops that accept it.

Apple Pay just hasn’t been able to clear those hurdles for almost 94 out of 100 iPhone users in the U.S.

Contactless Cards’ Gain Is Apple Pay’s Growing Pain

At the same time that Apple was trying to get more consumers to use Apple Pay, banks were issuing more contactless debit and credit cards for consumers to use at the growing number of merchants that have enabled contactless transactions.

Over the last seven years, those plastic cards have also gotten smarter at the physical point of sale, as issuers, merchants and FinTechs use software to enrich those transactions. Apple Pay’s competition from those plastic cards has intensified since 2014.

From the consumer’s standpoint, the cards they used to dip or swipe could be tapped – just as conveniently, quickly and easily at the point of sale as Apple Pay. Maybe even more easily, as thumbprint authentication was replaced with Face ID on newer-model iPhones.

In 2015, roughly 5% of eligible Apple Pay users – those with the proper iPhones, with Apple Pay enabled, who also shopped in stores that accepted Apple Pay – used it to make a purchase.

In 2021, PYMNTS reports Apple Pay usage at 6.1%, about a 20% increase in the rate of use after seven years. Still very low.

But that’s Apple Pay today.

More interesting is Apple Pay’s future, one which might be foretold by examining the last 18 months of consumer payments behavior in the store.

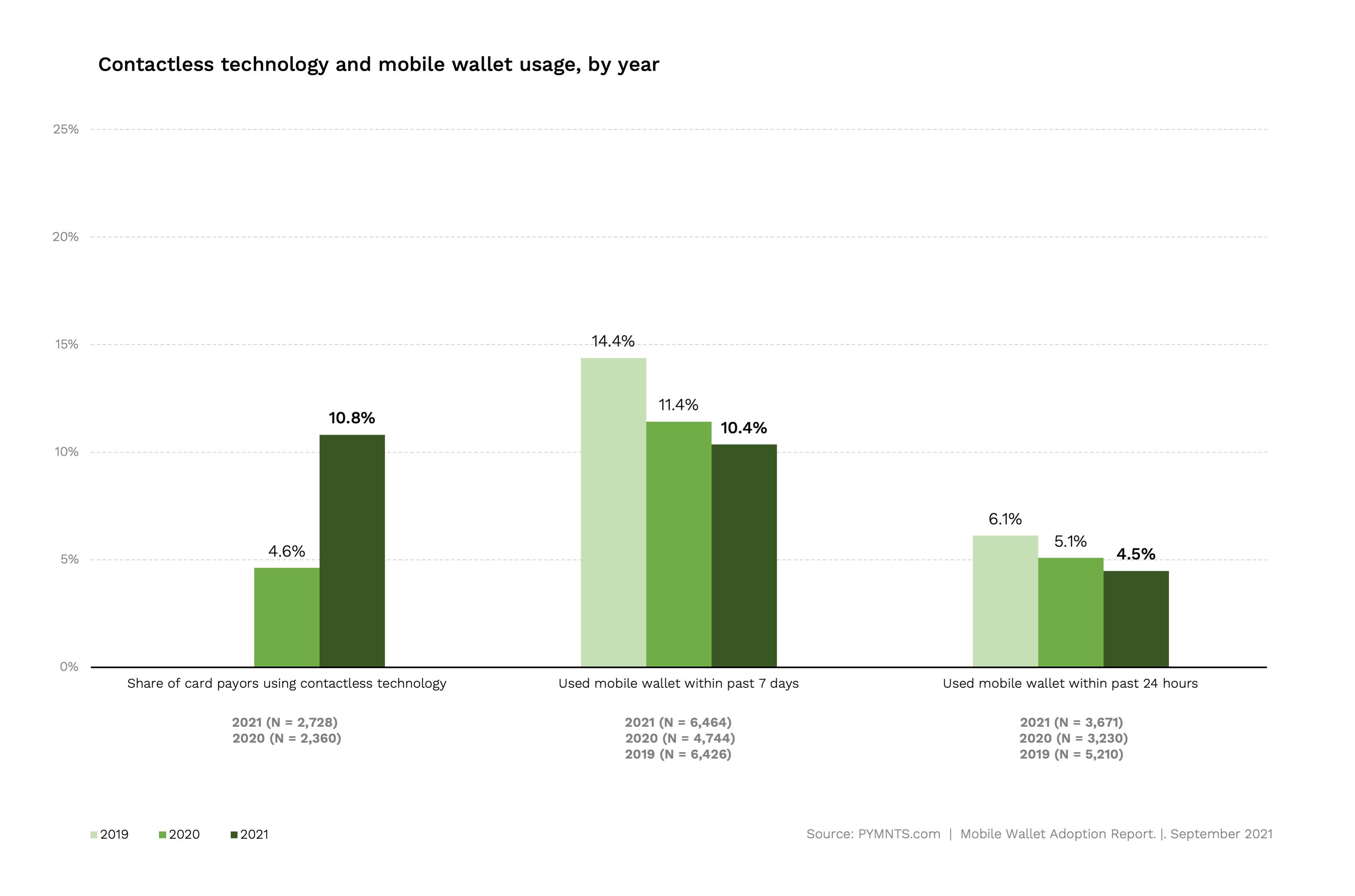

Since March 2020, contactless and touchless have become the consumer’s checkout mantra, as touching a point-of-sale terminal became a health and safety concern. If anything could have changed the trajectory of Apple Pay – and mobile wallets more generally – over the last several years, it should have been COVID.

That’s not what PYMNTS data shows.

The Incredible Shrinking In-Store Mobile Wallets Pool

What happened instead is this.

We asked people what payment methods they used to pay in the last 24 hours when shopping in a store and compared it to the same data captured in prior studies. We observe that between 2019 and 2021 cash use declined 20.1%; credit card use increased by 33.8%; and debit card use declined slightly by 7.2%.

Mobile wallet use in-store declined 26.2%.

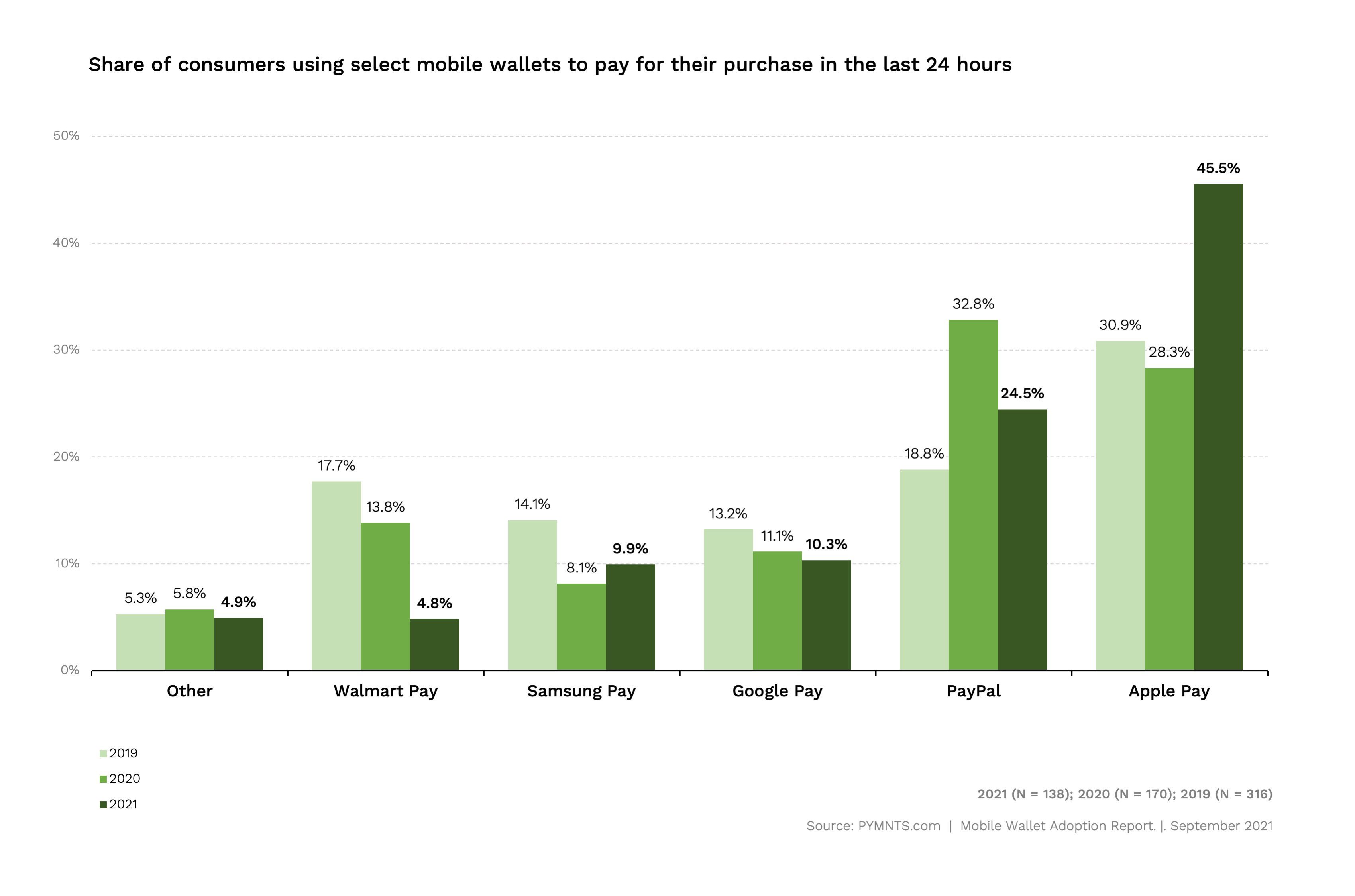

That said, Apple Pay usage in store, to its credit, has remained steady, though small, while the other mobile wallets have shriveled. Most of the decline of the mobile wallet use in 2021 is related to the decline in use of the other “Pays” in store.

Keep in mind that what PYMNTS is measuring is what people in the store are using there to pay at checkout. For the purpose of this study, Apple Pay’s and the decline in usage of other mobile pays cannot be explained by people not shopping in the store and therefore, not using it to make a purchase.

The Problem of Not Solving One

PYMNTS has been tracking Apple Pay adoption and usage since its launch, and has the most consistent time series marking its adoption and usage over the last seven years. PYMNTS analysis measures eligible purchases for which a mobile payments application is used – where the consumer has an eligible device (an iPhone that supports Apple Pay), has the mobile payments app set up on their phone (an activated Apple Pay account), and is shopping in an eligible store (one that has activated contactless at the point of sale).

Our goal is to document the trajectory of a mobile payments innovation that was intended to change how consumers and merchants do business in the physical store.

Today, Apple Pay remains the biggest in-store mobile wallet player, with 45.5% share of mobile wallet users. Over the last seven years, the total amount of Apple Pay transactions at U.S. retail stores has increased from an estimated $5 billion in 2015 to $90 billion in 2021.

Although that growth is commendable, it is largely the result of more people with iPhones upgrading to newer models and more merchants taking contactless payments, both leading to a general increase in retail sales – 12.9% greater in 2021 than 2019.

But to be successful, innovation must solve a problem, fix a source of friction or improve an experience that is so painful that consumers or businesses are motivated to switch.

Over the last seven years, the payments ecosystem has been heads-down focused on innovating the consumer’s experience when engaging with retailers – one where payments and technology goes beyond the sameness of swapping a physical form factor at a designated place in the store for a digital one, at that same designated place when making in-store purchases.

One where the entire experience is rethought for a digital-first consumer who now views shopping as a continuum – in-store one day, online for delivery the next, online for curbside pickup the day after that. And one where payments is the glue that offers that continuity of experience across channels and retailers.

And one where not checking out is the ultimate in-store checkout experience.

The Path for Apple Pay

There’s been tremendous innovation in that regard, fast-tracked over the last two years. And although it has often involved mobile phones, it hasn’t involved Apple Pay or any of the other so-called Pays. At least not yet.

Looking ahead, now that contactless penetration and iPhone upgrades have largely run their course, there are two paths for Apple Pay, both difficult. Particularly difficult since the shift in how consumers stage and pay for their transactions now reflects a digital-first shift in and outside the physical store, and where the value of mobile apps is moving beyond just making a payment happen.

Path one is for Apple, the smartphone, to take share from Android to make the eligible Apple Pay pie bigger and to ride retail’s continued growth. Currently, Apple has a 52% share of smartphones in the U.S., up from 47% in 2019. That seems hard, if not pretty unlikely.

Path two is for Apple to get more iPhone users to use Apple Pay in the store.

That’s something that Apple has failed to do over the last seven years – including over the last two years, when contactless payment in-store was its ( and every Pay’s) oyster.

Seven years in, Apple Pay just hasn’t lived up to its potential for transforming the point-of-sale experience in the store. Maybe there is a grand plan that goes beyond offering users discounts to use it at checkout. But unless it does, its past is likely to be prologue – and its usage will likely be stuck at around 6% of iPhone users who like to wave their phones in the store when they buy.

At the same time, the 94% of iPhone users find other apps to use and other ways to innovate how they and their preferred merchants get together and do business.