Nvidia’s Chips and OpenAI’s Cash Help Fast Track Generative AI’s Future

Among the best ways to gauge the interest in, and evolution of, new technology is to follow the money.

A few data points, measured in dollars through the past several days underscore the fast tracking that’s occurring for generative artificial intelligence (AI).

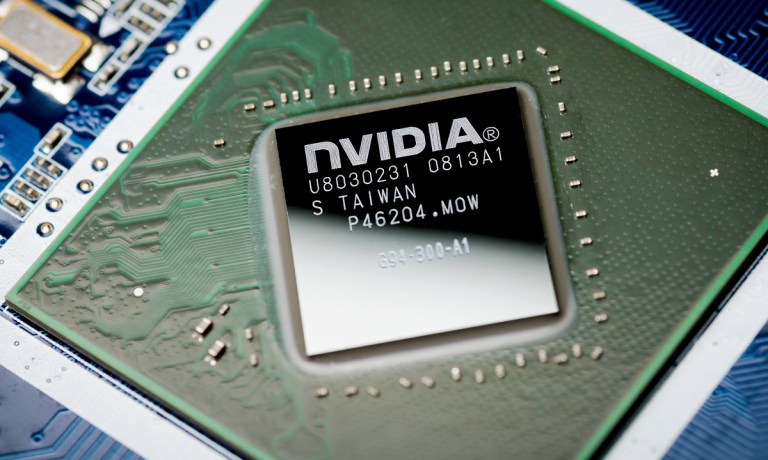

On Thursday, shares of chipmaker Nvidia soared by 24%, buoyed by demand for chips used in AI applications. Demand is so strong that the company’s revenue forecast for the current quarter is 50% higher than Wall Street had expected.

The company’s data center segment, which includes the AI chops, saw its revenues soar 14% year over year and 18% sequentially to about $4.3 billion.

Seeing Exponential Growth

Colette Kress, CFO, said during the conference call with analysts that “generative AI is driving exponential growth in compute requirements. … Generative AI drove significant upside in demand for our products, creating opportunities and broad-based global growth across our markets.” She noted later in the call, “Enterprise demand for AI and accelerated computing is strong. We are seeing momentum in verticals such as automotive, financial services, healthcare and telecom where AI and accelerated computing are quickly becoming integral to customers’ innovation road maps and competitive positioning.”

And in response to analyst questions about current guidance, Kress said, “When we talk about our sequential growth that were expected between Q1 and Q2, our generative AI, large language models are driving this surge in demand. And it’s broad-based across both our consumer internet companies, our CSPs, our enterprises, and our AI startups.”

Funding Spigots Opening

Elsewhere, and also as reported on Thursday, OpenAI’s OpenAI Startup Fund has detailed in Securities and Exchange Commission filings that it has raised $175 million — where expectations had been that it would raise $100 million.

The move comes just a few months after OpenAI reportedly had been considering a tender offer that would value it at $29 billion. Microsoft, of course, invested $1 billion into the venture in 2019 and became OpenAI’s exclusive cloud computing partner.

As noted in this space and in the PYMNTS report “Preparing for a Generative AI World,” the technology garnered more than $2.6 billion in investments in 2022 alone. And while some companies are focused on applications, others are focused on the hardware and software that makes it all, computationally speaking, possible.

Even before Nvidia’s massive blowout on Thursday, we noted that among the hardware and especially the chip-focused providers, Nvidia is undoubtedly the biggest player, with its GPUs cited in research papers 90 times more than the top AI chip startups combined. Back in 2022, the company’s data center GPU revenues totaled $3.8 billion. The full-year contribution from data center revenues came in at $15 billion for the fiscal year that ended in January 2023, which grew 41% year on year — and 2021 was up 53% from the previous year.

The data shows that enterprises are gearing up for what comes next — even if it’s not all certain what comes next when it comes to generative AI. But the chips are at the ready, the money’s at the ready — and we’re off to the races.