AI, Behavioral Analytics Help Online Businesses Prevent Fraud, Find Good Customers

In response to the increasing severity of cyberattacks during the pandemic, IT departments incorporated stronger security processes and customer verification methods into cybersecurity defense systems.

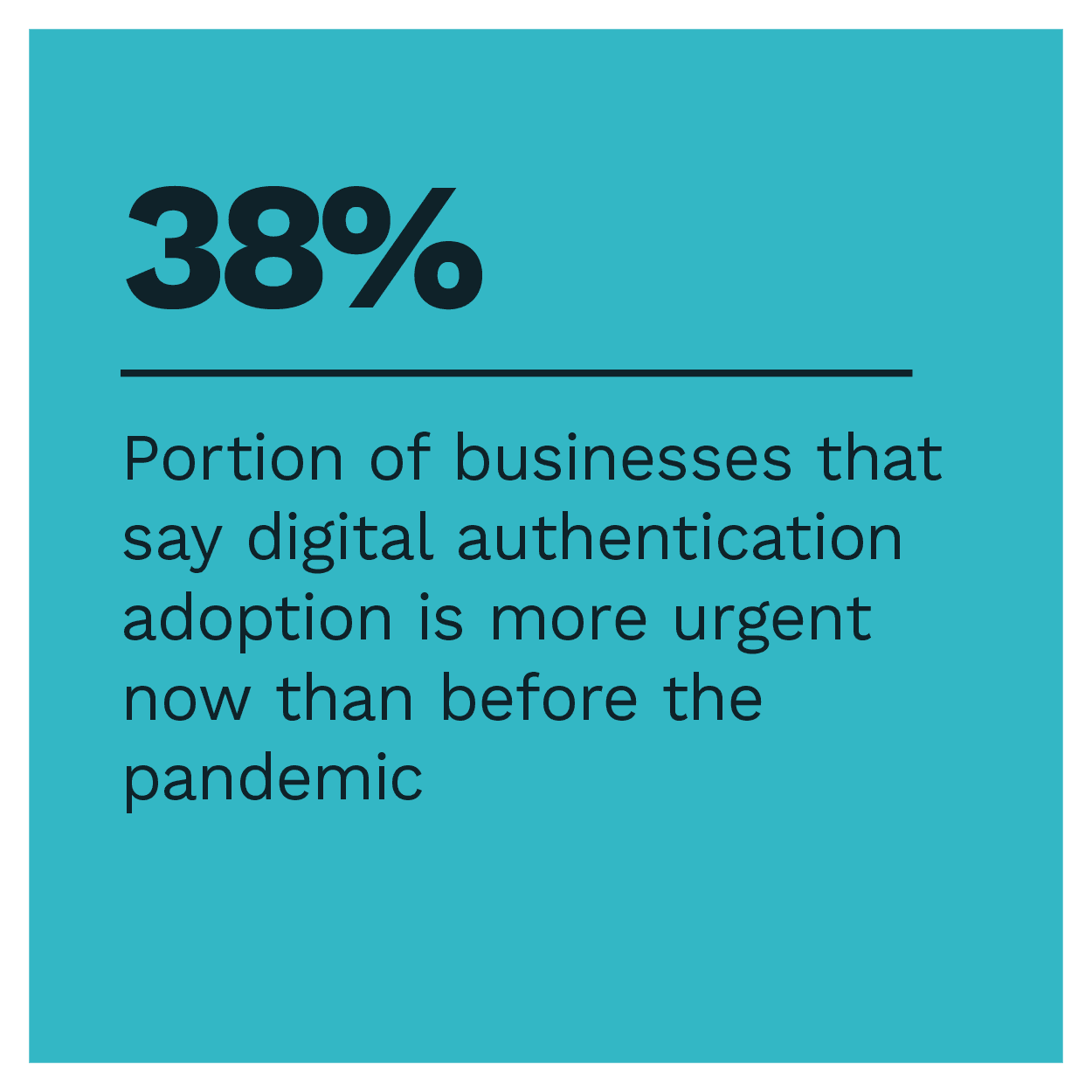

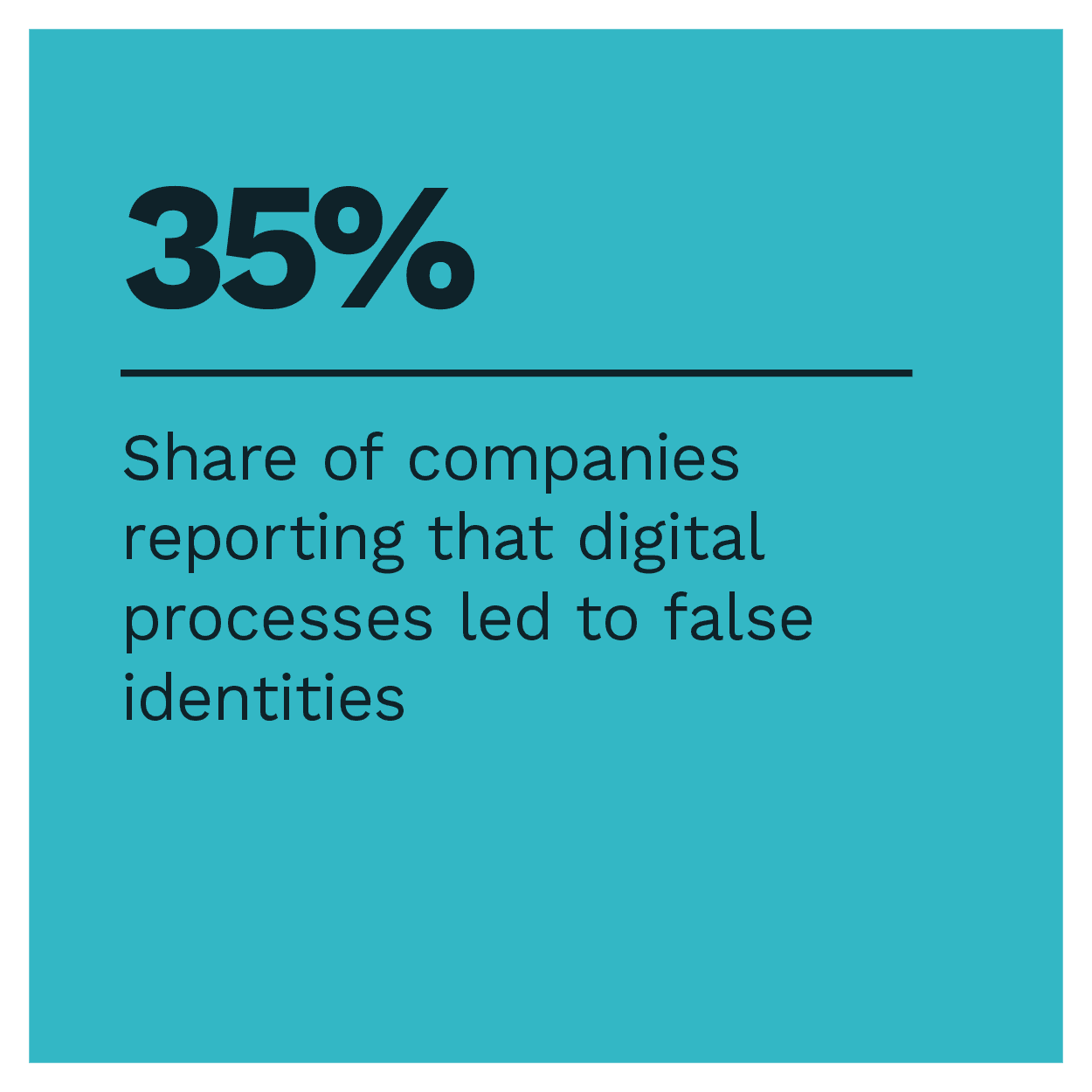

Incorporating these extra precautions was important, as 35% of companies said digital processes resulted in fraudulent user profiles, and 38% said digital authentication adoption is more imperative now than pre-pandemic. Some measures can create friction for customers, however, which threatens both consumer satisfaction and revenue streams.

Behavioral analytics have demonstrated great success in protecting sensitive data without compromising the customer experience. Deploying a multilayered authentication approach can help examine user behavior and differentiate between genuine customers and bad actors. It also helps organize applications and allows cybersecurity employees to focus their attention on high-level threats by analyzing large masses of data to prioritize security responses.

In the latest Monetizing Digital Intent Tracker®, PYMNTS examines how behavioral analytics can help businesses protect their digital platforms from bad actors without causing irreparable harm to their client relationships.

Around the Behavioral Analytics Space

The wave of consumers who migrated to digital channels during the pandemic inspired bad actors to execute more cyberattacks. As a result, identity theft losses reached $712.4 billion in 2020, up 42% year over year from $502.5 billion. Cybersecurity professionals responded with heightened security protocols and more complex defense systems. Some digital fraud solutions negatively impact the customer experience, leaving many legitimate users frustrated and locked out of their accounts. Most promisingly, behavioral analytics uses a series of techniques to analyze customers’ digital activities and prevent fraud while reducing false positives.

Cybercriminals have learned how to evade detection and surpass many companies’ defense systems. These breaches can have damaging effects on customer trust, as 80% of breaches contained users’ personally identifiable information (PII), according to a report. The uptick in attacks has left cybersecurity professionals exhausted, especially because many of the reported threats come from genuine users who have forgotten their credentials or entered them incorrectly. Automation and behavioral analytics can ease some of the burden placed on IT departments by increasing the speed of data collection and analyzing the input of users’ information to determine whether a party is legitimate or not.

Children have inherited their parents’ poor digital hygiene habits as they continue the practice of recycling passwords across various accounts. A survey of 1,500 children ages 8 to 18 found that most participants admitted to reusing passwords. Digital service providers should implement other authentication tools, such as behavioral analytics, to combat the adverse effects of such practices and add a layer of security to traditional identity verification procedures. This account validation procedure will help protect the consumer’s information if the account’s password is compromised.

For more on these and other stories, visit the Tracker’s News & Trends.

How AI and Behavioral Analytics Reduce Friction in the Digital Authentication Process

As many citizens strive for a sense of normalcy after months of pandemic-related restrictions, cybercrime prevention remains a top priority for internet security professionals. Several technological advancements emerged during this time to help combat the innovative tactics of increasingly sophisticated bad actors. Behavioral analytics presents significant potential for fraud prevention and user authentication, explained Kostas Noreika, co-founder of the FinTech company Paysera.

To learn more about why businesses are flocking toward artificial intelligence (AI) and behavioral analytics to better understand the actions of both their clients and potential fraudsters, visit the Report’s Feature Story.

Deep Dive: How Behavioral Analytics Are Strengthening Cybersecurity Protocols Without Jeopardizing the Customer Experience

During a time of many in-person restrictions and limitations, digital platforms showed the boundless capacity to serve consumers. The pandemic tore down physical barriers for many businesses and their customers, but the increased digitization also had negative repercussions. Bad actors became increasingly sophisticated, and as a result, 47% of organizations reported scammers and identity theft adversely impacted their operations in 2020. Cybersecurity professionals worked quickly to combat the rising fraud rates, incorporating advanced technology into their internet defense systems and hitting a few road blocks along the way.

To learn more about how behavioral analytics can reduce false positives without compromising the security software’s ability to prevent fraud, visit the tracker’s Deep Dive.

About the Tracker

The Monetizing Digital Intent Tracker®, a PYMNTS and Neuro-ID collaboration, is the go-to monthly resource for updates on trends and changes in behavioral analytics.