BNPL May Help Consumers Avoid Trading Down, Trading Off on Everyday Essentials

Buy now, pay later (BNPL) may be the payment “lifeline” that keeps consumers from trading down on everyday essentials — and may in fact them help them get the goods in the first place.

Earnings season has not even begun in earnest, but the commentary from a variety of companies — from consumer-packaged goods companies to retailers to grocers — has taken note of the fact that consumers are pulling back on some purchases.

Consuming Less and Trading Down

As noted here, the observations of consumers’ tightening their belts have come from the likes of Nestlé.

“People are consuming less. Are they eating less? Are they wasting less? Are they eating more out of home? Difficult to know,” Nestlé EVP, Chief Financial Officer François-Xavier Roger said in a recent interview. “I don’t think that it will last but let’s not forget that we do operate in slightly declining markets by volume, which did not happen that much in the past.”

Kroger management has made similar remarks.

The pressure’s been in place for months. As PYMNTS Intelligence data found as far back as May, in the report “Consumer Inflation Sentiment: The False Appeal of Deal-Chasing Consumers,” roughly 70% of consumers said they expected inflation to be firmly in place at least through the next 12 months.

And that’s translated to a bit of triaging at the register, where 58% and more than a third of individuals have traded down to cheaper merchants for retail and apparel spending, respectively. Drilling down a bit, 57% of shoppers have reduced clothing purchases and 26% have started buying lower-quality clothing.

There’s evidence, however, of a growing awareness, and use of, BNPL as a choice that can be leveraged by consumers to get those everyday essentials — and not just big-ticket expenses — into the shopping cart.

In the “Credit Accessibility” series report delving into BNPL, done in collaboration between PYMNTS and Sezzle, the data show that more than 40% of consumers will “cancel” a purchase if BNPL is not offered at checkout. BNPL, then, becomes a competitive advantage for most merchants, and the payment method is becoming table stakes.

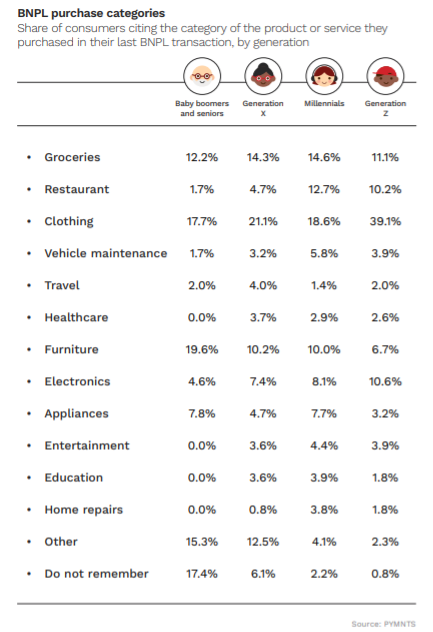

As to where they’re using BNPL: The accompanying chart shows that a mid-teens percentage rate of individuals, no matter the generation, have opted for BNPL at the register for their groceries. The percentage increases for clothing, for 17% of the oldest generation (boomers and seniors) all the way to a whopping 39% for Gen Z.

The appeal cuts across all income levels, too, as 17% of high-income households have used BNPL for recent purchases.

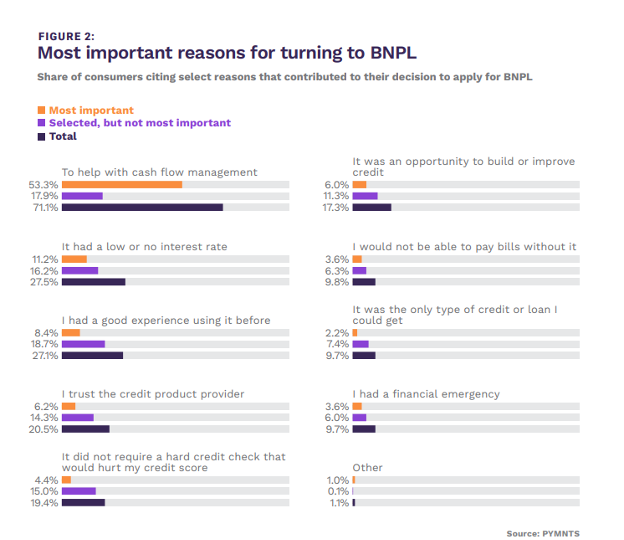

We’ve documented in this space in recent months that use of traditional credit cards had been gaining steam through 2023; installment plans have incentivized consumers opting for BNPL in part because of the lower/no interest rates, as detailed below. That’s a factor that’s been the “most important” feature for more than a quarter of users. BNPL has been most valued as a cash flow management tool for 71% of consumers.