Buy Now, Pay Later Is Having Its Kleenex Moment

Kimberly Clark introduced Kleenex in 1924 as a product used by movie stars instead of face cloths to remove their makeup and keep their skin soft. The key selling point was that the tissues could be discarded after each use, saving women lots of laundry time.

It wouldn’t be until Kleenex was rebranded in 1930 as a disposable alternative to the cotton handkerchief that sales really took off. (Little known fact: a Kimberly Clark scientist accidentally discovered this use case after battling a particularly nasty hay fever season.)

The product became so popular that the word “Kleenex” became the generic term to describe any brand of disposable tissue — even though it was (and remains) a registered trademark of Kimberly Clark.

Source: witness2fashion

The “Buy Now, Pay Later” space is going through a similar genericization — except in this case, no one owns the trademark.

But ask three people to define “Buy Now, Pay Later” and you might get five different renditions on the theme. Ask three more to define installment payments, and maybe you’ll get a similar result — at a minimum, there will be a lot of overlap.

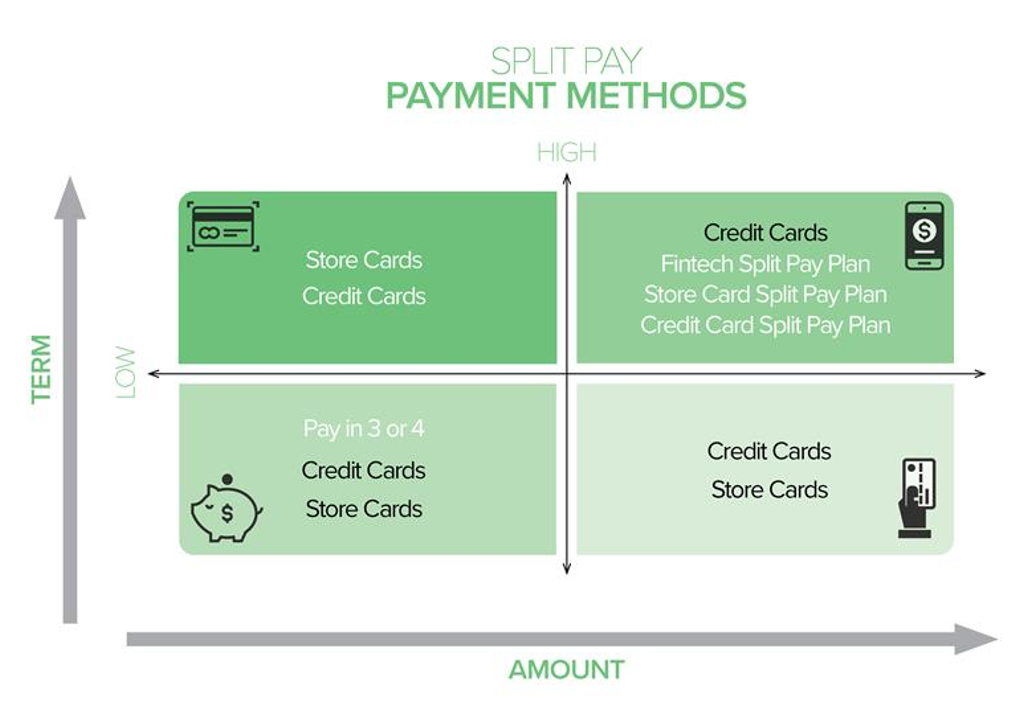

The point is that the payments industry has come to use the “Buy Now, Pay Later” moniker as shorthand to mean any online point-of-sale credit product that divides everyday retail purchases into smaller, equal payments over a set term to pay in full for a purchase.

Consumers do it, too.

Most use the “Buy Now, Pay Later” label to describe one of several split-payment schemes they may use from time to time to pay for purchases — from merchants, from their card issuers or from FinTechs that have brought a new wave of innovation to the credit space since the early 2000s.

That’s not wrong, but it does speak to the challenges of parsing data precisely to understand what split-pay options consumers are using to, well, buy now and pay later — and why.

Maybe it’s time for a new split-pay credit taxonomy.

The Split-Pay Credit Economy

In the last twelve months, PYMNTS Intelligence data finds that roughly 60% of all U.S. consumers used an online point-of-sale payment option that split a retail purchase into equal installments over a set term. The typical U.S. consumer used one twice over the last six months.

Thirty-seven percent of all consumers did that by getting a new loan from a FinTech. An equal share (37%) did the same — but from a merchant to buy something at a specific store. Most of the time these split-pay programs had zero percent interest. Retailers or manufacturers may have subsidized the plan as part of a promotional offer — and the short term, mostly smaller-dollar plans from FinTechs charge no interest or fees, provided the loan is paid according to terms.

Forty five percent of consumers used a split-pay point-of-sale option attached to their network-branded credit card, using their already approved and unused credit line to make the purchase. Over the last several years, more card issuers have offered these options. Most card issuer-centric plans are set up after the purchase is made via the issuer’s site or app.

PYMNTS Intelligence research also finds that there are different split-pay strokes for different split-pay folks.

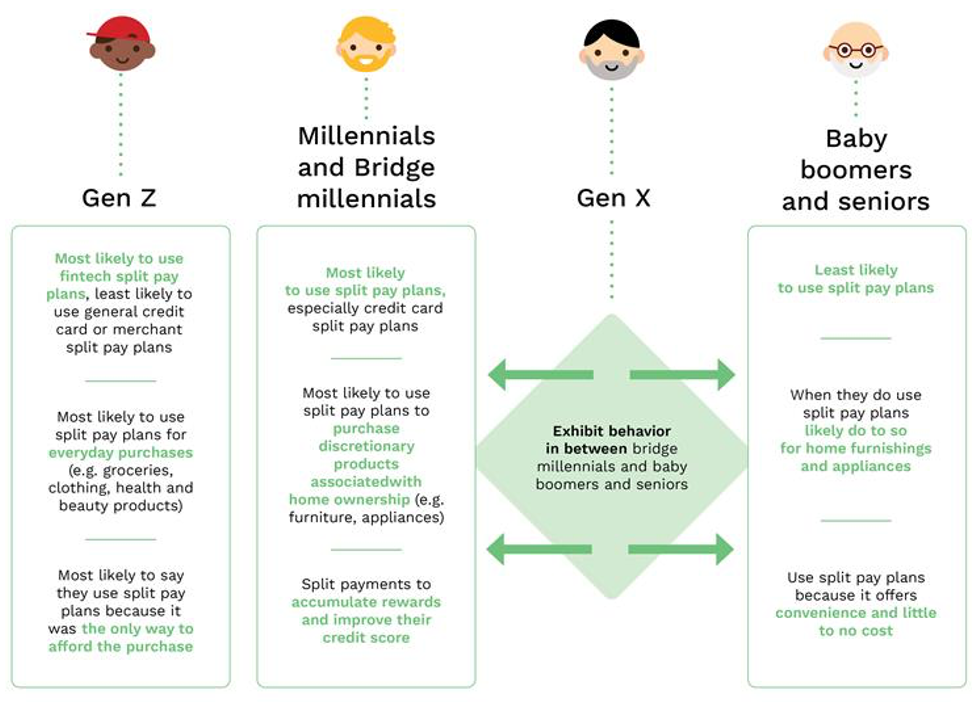

Boomers rarely use split-pay plans but say they like the convenience when they do. Millennials like the rewards with plans that attach to their credit cards; they prefer them about five times more than FinTech schemes that require new loans. Gen Zers use primarily FinTech plans to buy the things they otherwise couldn’t, including everyday essentials like food and gas — often because it is the only credit product available to them.

The Split-Pay Credit Personas

Roughly 80% of U.S. consumers have at least one credit card. According to the New York Fed’s latest report, those 209 million consumers have racked up $1 trillion in credit card outstandings, with another $3.6 trillion of available credit lines to tap.

Nearly two thirds of consumers (62%) have used those cards online and in store in the last 90 days to buy everything from groceries and clothing to travel — or to pay for out-of-pocket healthcare expenses. According to PYMNTS Intelligence, roughly 56% of consumers now revolve those balances. Far fewer (18%) used store cards to make purchases at merchants.

Here’s where the data on point-of-sale split-pay credit gets interesting. And it seems to have a lot to do with whether consumers already have cards in their wallets.

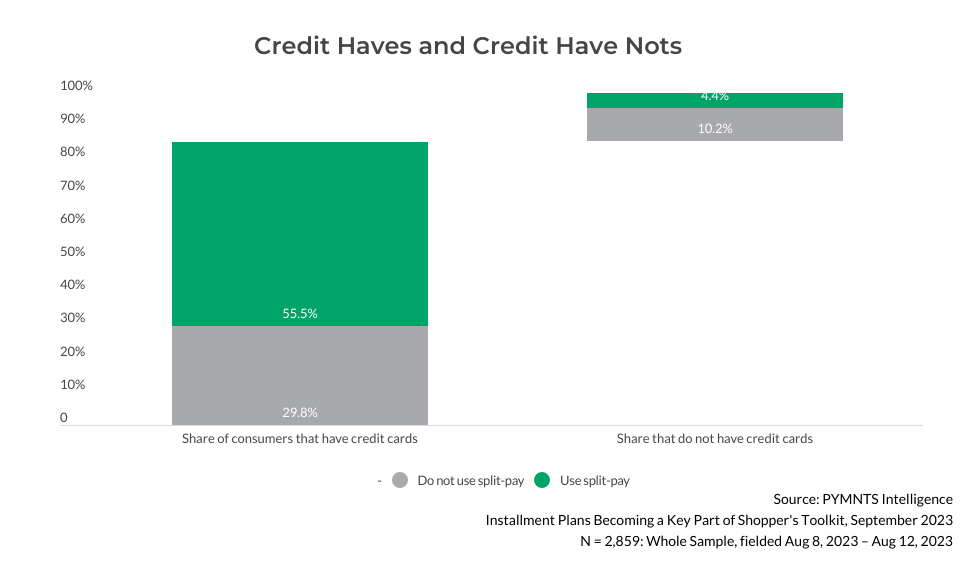

PYMNTS Intelligence studies find that there are three distinct point-of-sale split-pay personas: those who have credit cards (from a merchant or from a card issuer) and also use point-of-sale split-pay credit options from time to time (56% of consumers), those with credit cards (from a merchant or from a card issuer) and who do not (30% of consumers), and those without any credit cards who use FinTech programs to make and pay for purchases (4.4% of consumers). The remaining 10% do not have credit cards (from a merchant or from a card issuer) and do not use split-pay plans.

Credit Card-Carrying POS Split-Pay Users

More than half (65%) of U.S. consumers with any form of credit card used a point-of-sale split-pay credit plan to make retail purchases as part of the online checkout flow.

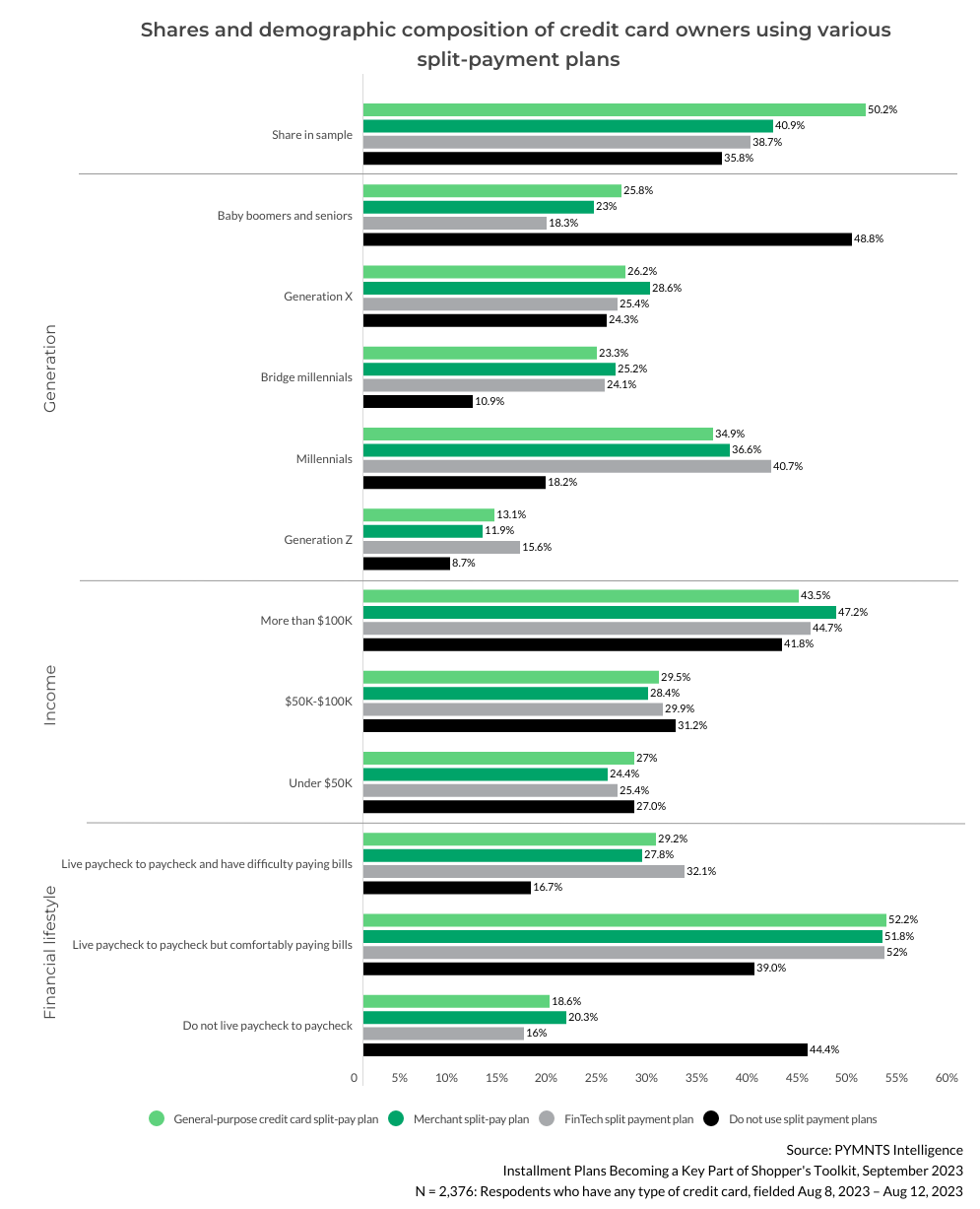

Fifty percent used a split-pay option attached to a network-branded credit card. The typical user is a bridge millennial earning $91K a year, living paycheck-to-paycheck and comfortably paying the bills. The median purchase amount is $558 over 4 payments, although credit card split-pay users say they find this option valuable when making discretionary purchases (clothing, accessories) of between $2000 and $10,000 over a 10–12-month term. The price points associated with network-branded spilt pay plans are significantly greater for all age and income cohorts.

The 82 million U.S. consumers who opt for a FinTech point-of-sale split pay program make purchases that are 29% lower in value. With a median purchase price of $395 over three to four installments, these split-pay users skew younger and are millennials and Gen Zers with an annual income that’s similar at $89,000. FinTech providers are the most common split-pay option among Gen Z credit card owners for three reasons: their card lines are lower, so they want to preserve a credit cushion in the event of an emergency; they may only have one credit card and need an additional form of financing to make a purchase; and/or there is little or no cost of doing so (which is what 45% of this persona finds appealing about this option).

For both personas, the availability and convenience of a point-of-sale split-pay credit option at any of the merchants they like to shop is the appeal.

Forty-one percent of credit card users, some 86 million U.S. consumers, used a merchant point-of-sale split-payment plan. The typical persona is a millennial or Gen Xer making over $100,000 living paycheck to paycheck while comfortably paying their bills.

These consumers say they prefer split-payment plans as a convenient way to manage their spending for much larger purchases — largely for home furnishings, appliances and electronics — and obviously at a particular store. The average purchase price is $1575 with a seven-month term.

For this persona, it is merchant preference that drives the interest and the use.

Credit Card Carriers Who Do Not Use POS Split-Pay

Over sixty percent of consumers with credit cards who don’t use point-of-purchase split-pay plans say they don’t see the need. They tend to be older (49% are baby boomers, only 8.7% are Gen Z) and high-earners (42% have incomes of over $100,000). They also say they don’t live paycheck to paycheck, so dividing purchases into monthly payments over time does not have the same appeal.

A quarter (26%) say these plans will lead them to overspend, and 15% say they already have enough debt and don’t want more.

The Consumer Without Credit Cards

Roughly 20% of the U.S. adult population does not have a credit card — 60% of whom say they don’t want one. The 40% of those who don’t have a credit card but want credit use point-of-sale split-pay programs to fill their credit needs.

These consumers are more likely to earn less than $50K, and nearly a third (31%) say that absent the split-pay option, a purchase would be impossible for something they want or need to buy.

Unsurprisingly, these consumers use point-of-sale split-pay programs in much the same way that their credit card-toting consumers use their cards: to buy everyday essentials like gas, groceries and food at restaurants.

For example, a third of consumers with credit cards who also use some form of split-pay plan report using them to buy groceries; 21% of consumers whose only credit option is via a FinTech say they do the same.

The Split-Pay Credit Economy and Consumer Financial Health

PYMNTS Intelligence recently completed a study on the impact of credit-builder apps and the use of alternative pay programs on the credit scores of consumers.

What we discovered is that consumers without access to traditional credit cards recognize that FinTech programs could be the only shot they have at getting and keeping credit. They appear to work hard to use those options responsibly, with many using them to build a more positive credit profile.

We find that 13% of consumers that used a point-of-sale split-pay program provided by a FinTech were able to increase their credit score by 100 points or more over a period of twenty-four months. That’s twice the number of credit card users who also said that improving their credit score was a key priority.

It appears that the discipline of credit-building programs, combined with the small dollar value and short-term payback periods of FinTech plans, may provide the guardrails needed by these consumers to use credit responsibly and build a positive credit profile. It’s also how FinTech lenders manage their risk — smaller loans that increase in value over time, provided that the consumer continues to repay their loans on time.

Those same guard rails exist for consumers using split-pay options attached to their credit cards. Even though we find that making those options known to consumers in the purchase flow can boost basket sizes, that higher spend is tied to an already approved credit line. Consumers who use them cite the ease and convenience of not having to apply for a new loan and splitting their payments into equal monthly installments using a credit product they have and use regularly.

What’s In a Split-Pay Name?

The online point-of-sale split-pay credit economy got its digital mojo in 2000 with BillMeLater (now PayPal Credit), a FinTech that innovated online point-of-sale credit by making the option available to any merchant that accepted it.

Over time, the split-pay concept has expanded to include innovators that attach split payment to network-branded cards during the checkout flow. Card networks are deploying their own installment programs that deliver the same user experience. More issuers make the option available post-purchase, even as they grapple with the impact of these programs on the interest income they derive from revolvers. Merchants are tapping robust credit marketplaces to match lenders with almost any consumer who shows up at the online point-of-sale and needs financing to pay for essential purchases.

All of these options and providers now enable on- and offline purchases through debit cards and mobile apps. Many are innovating the pre-purchase experience by offering consumers a credit line for that purchase to help manage spend and payback plans.

One of the most interesting insights that has come from analyzing the point-of-sale split-pay credit economy at such a granular level is that consumers like and use credit — in whatever form they are able to get and use it. But their relationship with credit has changed for all but the 10% of the consumer population who don’t use credit and say they don’t want any.

Even though September retail sales reporting touted a resilient consumer who’s an unstoppable spending machine, we find a retail sales number that is 3% less than sales in the corresponding 2021 period, when adjusted for higher prices and inflation. And a consumer who is quite literally buying less even though they are spending more dollars on those items than they were just a few years ago.

For consumers with credit cards, point-of-sale split-pay plans are another payment tool in their arsenal of credit options to manage their monthly cash flow to make the purchases they want and need. For those who don’t have cards to leverage or to use an an option, it is the credit surrogate that serves the same purpose.

For both, it offers the certainty of a payoff, with the predictability of equal payments over time. It’s also at a time when most consumers don’t see paychecks keeping pace with the higher prices they now pay. In fact, having a clear path to a payoff is the financial discipline that 60% of consumers say they like about these plans and why they use them.

This space will be an interesting one to observe as card issuers seek to create a user experience that is more FinTech than bank: a seamless experience provided as part of the checkout flow that can also help them attract new customers.

As FinTechs seek to create a user experience that acts more like a bank: branded cards that ride the card rails and can be used at any merchant a consumer wants to shop.

As merchants leverage new marketplace lending platforms to expand their customer base to include those credit scores that are sub-prime or even below.

As alternative credit providers use the opportunity to help consumers consolidate and manage their debt and improve their financial health.

And as consumers — 60% of whom now say they live paycheck to paycheck — have a new understanding of how much “higher for longer” interest rates costs them every month, and the impact of the fine print surprise fees on their financial health. Consumers will continue to press for better options across the credit providers they use for a more predictable and certain way to manage their monthly cash flow.