Concerns about inflation and the potential for another interest rate hike are only increasing the fierce levels of uncertainty corporate CFOs must now navigate — and that uncertainty comes at a high cost.

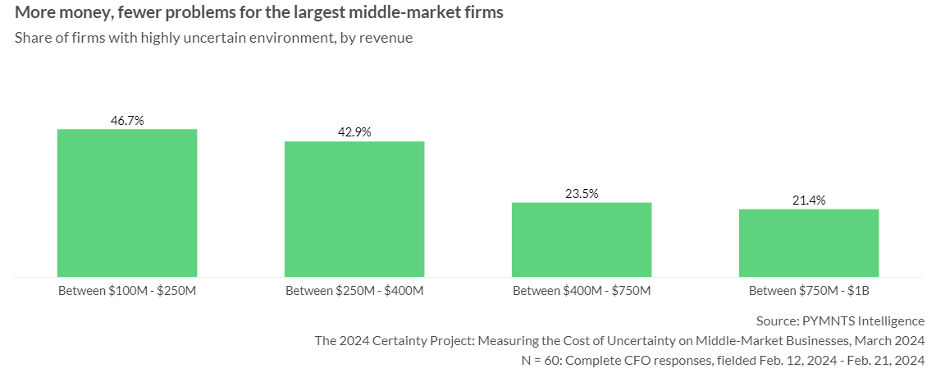

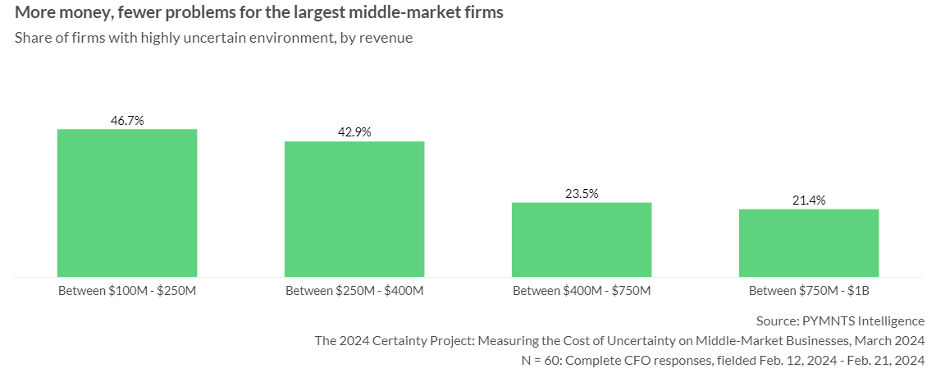

And, as PYMNTS Intelligence found in completing its “2024 Certainty Project Report,” the smaller the company, the greater the cost of uncertainty.

Collectively, chief financial officers (CFOs) of middle-market companies tell PYMNTS Intelligence that uncertainty cost their organizations, on average, about $21 million in the last year.

But not all losses are created equally. For those CFOs who manage small- to mid-market companies (with revenues between $100 million and $250 million), a $21 million loss can have a far greater impact than it does for CFOs managing larger corporations (those earning $750 million to $1 billion annually). For these smaller middle-market organizations, such a loss could likely upend day-to-day operations and unravel strategic planning for the reminder of the year.

The “2024 Certainty Project Report” draws on survey results from 60 CFOs of U.S. companies that earned annual revenues between $100 million and $1 billion last year. The report found that these firms’ CFOs are especially vulnerable to economic uncertainty.

PYMNTS Intelligence found 47% of CFOs from smaller firms (those with revenues of $100 million to $250 million) currently operating in highly uncertain business environments. Meanwhile, only about 21% of CFOs managing larger companies (with revenues between $750 million to $1 billion) must negotiate similar uncertainty.

Advertisement: Scroll to Continue

This delta stems from the fact that smaller firms, although often more flexible and agile than their larger counterparts, are much more vulnerable to factors beyond their control, such as supply chain disruptions and demand fluctuations. They also have less bargaining power when dealing with suppliers and less leverage in contract negotiations. Disruptions in any of these can lead to higher operational costs and thinner profit margins.

Additionally, smaller companies typically offer a limited roster of products or services, meaning they may be more dependent on a single product line or market.

Those middle-market companies that identified unpredictable customer demands, inventory issues, product availability and new business acquisitions as their biggest areas of operational uncertainty lost, on average, $41 million, or 7% of revenue last year. Firms that encountered supply chain challenges lost an average of $11 million, or 3.8% of revenue.

But there is good news. Many of the middle-market CFOs we surveyed said were tapping into a variety of resources to help them better manage the uncertainty their companies face.

Middle-market CFOs have begun to lean more on analytics for forecasting and software upgrades. This shift has improved predictability, driving positive results in 94% of cases. But, while using technology has been beneficial, relying solely on data collection has not been a foolproof strategy. Collecting data improved predictability in 67% of instances, showing that data alone is necessary, but not enough to navigate uncertainty successfully.

The report found that — for most middle-market companies — the best way to navigate market uncertainty may be to adopt a balanced strategy, one made up of both better data and improved processes.