Optimism in Fleet and Mobility Sector Fuels Use of Working Capital

All companies in growth mode need access to capital, whether to fund short-term operational needs, mitigate unexpected expenses or execute plans for growth. One key demographic of these firms are growth corporates, the mid-market firms generating between $50 million and $1 billion annually that are not yet corporate juggernauts but have the potential to get there.

PYMNTS Intelligence’s “2023-2024 Growth Corporates Working Capital Index: Europe Edition,” a first-of-its-kind study commissioned by Visa, looked at more than 150 global growth corporates operating in Central Europe, the Middle East, and Africa (CEMEA); Europe; Latin America and the Caribbean (LAC); the Asia-Pacific (APAC); and North America to better understand which working capital solutions are currently available in their regions, which ones are locally preferred and how growth corporates intend to leverage the capital in the coming months.

Among those operating in the fleet and mobility sector, market optimism is especially strong, at least compared to other companies we surveyed — and that shows in these firms’ plans.

Ninety-six percent of fleet and mobility companies plan to tap into some type of working capital solution in the coming 12 months, which represents an increase of 14% relative to last year. Our research shows this anticipated need for working capital solutions could double, mainly due to the uniform optimism that executives in this sector share — optimism likely grounded in the 17% increase in projected users that fleet and mobility executives anticipate serving.

So, which working capital solutions will fleet and mobility companies be leaning on in the months to come?

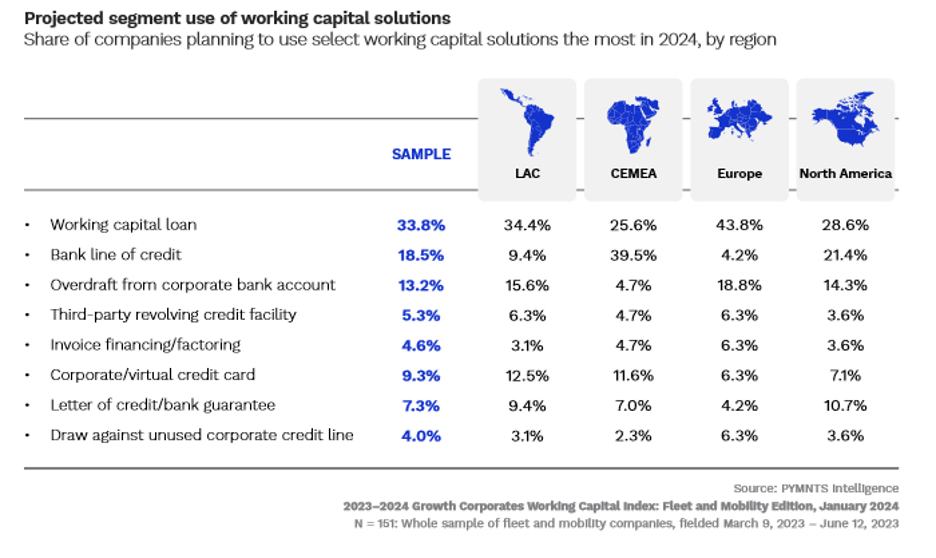

Across the board — regardless which corner of the globe they occupy, although no fleet and mobility firms in our study hailed from APAC — they show a strong inclination towards working capital loans (34%) and bank lines of credit (18.5%).

Regionally, things get more interesting. Fleet and mobility companies based in LAC (15.6%), Europe (19%) and North America (14.3%) all show a preference for overdrafts from corporate accounts should loans and bank lines of credit be when additional funding is needed. Corporate and virtual credit cards appeal to companies in LAC (12.5%) and CEMEA (11.6%). Letters of credit hold appeal to corporate officers in North America (10.7%), LAC (9.4%) and CEMEA (7%).

The strong economic optimism in the fleet and mobility sector is inspiring executives to use working capital solutions to meet their growth objectives. As PYMNTS reported, this signals “clear opportunities for external working capital solution providers to cater to the fleet and mobility segment.”