Holiday Rebound: Apparel Retailers Drive Sales With Flexible Payment Options

Many American consumers are feeling the financial squeeze as the holiday shopping season goes on and will be turning to flexible spending plans to help put them at ease. More merchants are embracing buy now, pay later (BNPL) options to allow consumers to pay in four installments interest-free. This will not only help retail items be more accessible to more consumers but could help merchants bounce back from what may have been a rocky year in sales due to the pandemic.

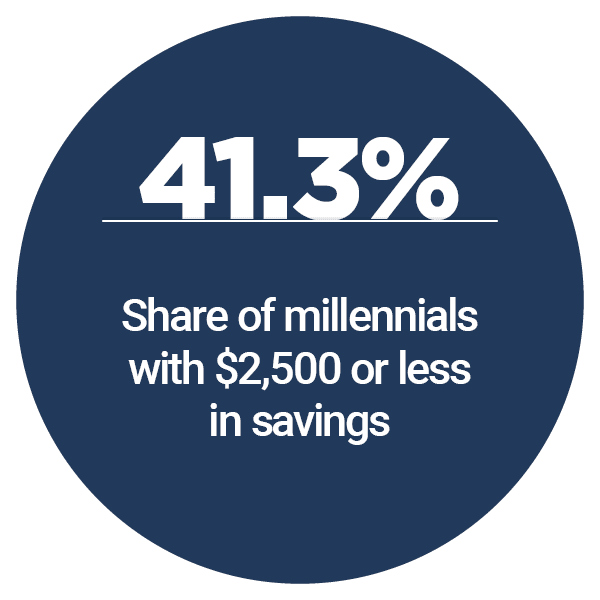

Recent research by PYMNTS and Afterpay found that millennials are especially enthusiastic about these flexible payment options, and prefer them more than any other generation. In fact, only 20.7% of millennials report being financially stable, compared to 79% of non-millennial consumers. BNPL could be especially useful in helping this demographic buy gifts and extend their purchasing power.

Recent research by PYMNTS and Afterpay found that millennials are especially enthusiastic about these flexible payment options, and prefer them more than any other generation. In fact, only 20.7% of millennials report being financially stable, compared to 79% of non-millennial consumers. BNPL could be especially useful in helping this demographic buy gifts and extend their purchasing power.

The latest “Buy Now, Pay Later Tracker®” examines how installment payment plans can help budget-conscious consumers, as well as help merchants see a rebound in sales this holiday season.

Around the Buy Now, Pay Later World

PYMNTS researchers recently found that many shoppers would avoid merchants that do not offer their preferred payment methods, and that it determines where consumers will make their purchases. The study revealed merchants that offer flexible payment plans could tap into a loyal, sizable pool of digital consumers. Forty-eight percent of those who prefer the method said that they would not purchase from retailers that fail to offer it, compared to 40% of those using mobile wallets and 37% of those using contactless cards who said the same.

Emerging payment solutions such as BNPL are becoming more intriguing to younger consumers as they seek to avoid the high-interest rates and debt concerns that can accompany credit cards. A recent analysis found that interest-free installment payment plans appeal to these consumers, in part because they offer the financial flexibility to buy more expensive purchases without taking on traditional credit risks. Nearly 20% of shoppers ages 22 to 30 lack credit histories that are robust enough to grant them credit card approval, for example.

Emerging payment solutions such as BNPL are becoming more intriguing to younger consumers as they seek to avoid the high-interest rates and debt concerns that can accompany credit cards. A recent analysis found that interest-free installment payment plans appeal to these consumers, in part because they offer the financial flexibility to buy more expensive purchases without taking on traditional credit risks. Nearly 20% of shoppers ages 22 to 30 lack credit histories that are robust enough to grant them credit card approval, for example.

There’s additional evidence that BNPL methods are emerging as a viable alternative to credit cards for many cash-strapped consumers this holiday season. A survey found that 39% of BNPL users leverage the services to avoid taking on credit card debt, while 38% use them to purchase items outside of their budget ranges and 25% aim to avoid credit checks.

For more stories on these and other BNPL headlines, read the Tracker’s News and Trends.

Unbound Merino Leverages Installment Payment Plans For More Accessible Shopping

Daniel Demsky, co-founder of all-merino wool travel clothing retailer Unbound Merino, is betting that offering his customers BNPL payment solutions will be the key to increased sales. To help make the retailer’s average cart totals of $170 more palatable for consumers, the company is offering installment payment options at checkout to help broaden their demographic and make their luxury wool products more accessible to more consumers. In this month’s Feature Story, Demsky details the company’s hopes to boost conversions this holiday and to help rebound its sales in the new normal.

To get the full story, download the Tracker.

Deep Dive: How BNPL Helps Unlock Consumers’ Purchasing Power

Deep Dive: How BNPL Helps Unlock Consumers’ Purchasing Power

Installment payment plans have skyrocketed in usage over the past several years. There are estimates that consumers around the globe are expected to spend $680 billion via such solutions by 2025, a 92% hike from the $353 billion spent last year. BNPL options are especially appealing among millennial consumers, and 27.3% of millennials tap installment payment plans to make purchases, according to PYMNTS research. This month’s Deep Dive explores the consumer trends toward installment payments and why merchants are embracing it as a way to boost sales in these challenging times.

Read the full Deep Dive in the Tracker.

About The Tracker

The “Buy Now, Pay Later Tracker®,” a PYMNTS and Afterpay collaboration, brings you the latest news and research from the BNPL and retail space. It features expert analysis regarding changing payment trends as well as insights from top insiders within the retail and fashion industries.