How We Pay 2021: BNPL And Credit Cards Are Magic Mixture For Millennials

If you’re looking for the runaway payments success stories of the past few years, the earth-shaker isn’t spendable crypto, points or anything exotic. Buy now, pay later (BNPL) gets the nod as the shopping and affordability innovation enabling billions of dollars in new transactions, paid one installment at a time.

With BNPL now virtually ubiquitous online and in-store, proffering a selection of providers from all over the map — Australia’s Afterpay, Sweden’s Klarna, U.S.-based Sezzle, to name just a few — consumers in general, and millennials in particular, are establishing patterns vital to the future of BNPL.

For the recent How We Pay study, PYMNTS surveyed thousands of U.S. consumers in three 2021 timeframes, uncovering emerging usage patterns and spending secrets of millennials with not just BNPL alternative credit, but also with credit cards — the classic way to get stuff now and pay over time.

Among key findings from the study is that the biggest names in BNPL aren’t always the most-hyped brands. Per the study, “PayPal Credit is the most popular BNPL product with 31 percent of consumers using it to pay for their last online purchase” — it’s up six percentage points since November 2020.

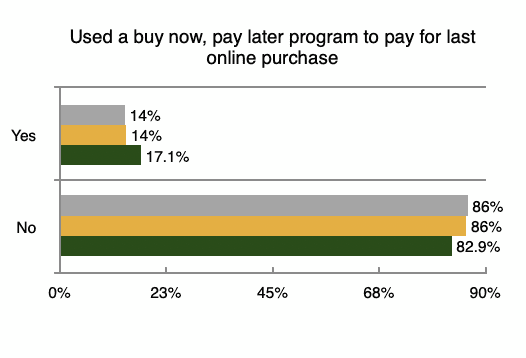

And though PYMNTS researchers found BNPL usage down from holiday highs, “it continues to be more commonly used for online purchases than for purchases at brick-and-mortar stores (13.8 percent vs 6.8 percent, respectively),” with in-store usage more or less tracking with eCommerce sites.

PYMNTS’ Provider Ranking of Alternative Credit Apps shows that the heated competition among BNPL brands. Based on millennial behaviors, BNPL’s fate, while very bright, faces some longer-term challenges.

Alt-Credit and Revolving Credit Cozy Up

Alt-Credit and Revolving Credit Cozy Up

According to How We Pay, usage of BNPL crested in the holiday 2020 shopping season, slowly falling off afterward. That’s partly an anticipated post-holiday spending pullback. But here again, it’s not across the board. The study finds that “those who paid for their online purchases with BNPL programs mainly did so using PayPal Credit (31 percent) and credit cards offered by merchants (22 percent).”

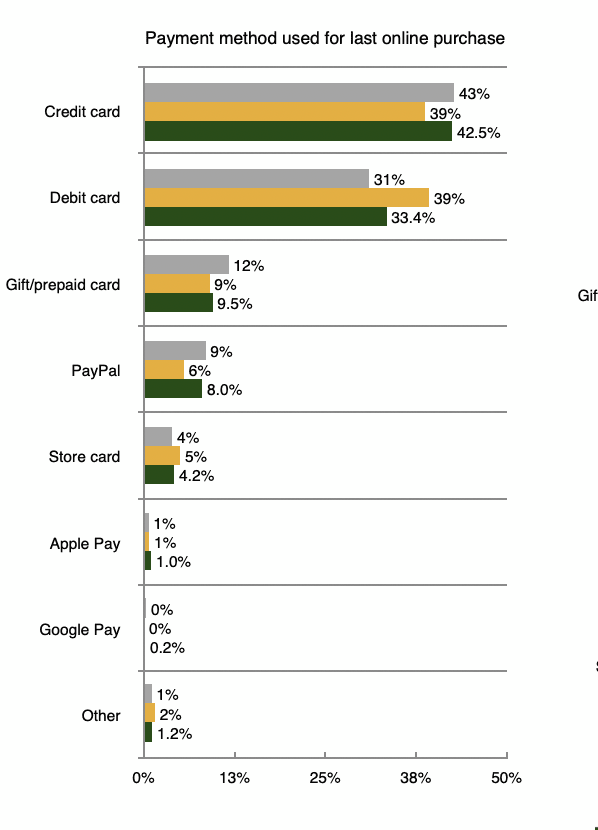

That’s the siren song of revolving consumer credit reasserting itself after a tough 2020, with the How We Pay study finding that “around 45 percent of millennials paid for their last online purchase using a credit card,” adding that debit card usage among millennials peaked in January, just shy of 47 percent.

As previously noted, PayPal Credit usage rose six percentage points since November. The millennial preference for PayPal is likely a mix of familiarity, affinity and universal acceptance — but BNPL isn’t all about millennials, or even the installment experience as it exists today.

Sezzle Chief Revenue Officer Veronica Katz recently told PYMNTS that “the promise of a next-gen shopper is that it’s not just millennials,” pointing to BNPL growth among consumers of all age groups in the past year. Even so, in Q2 2021, Sezzle’s customers are overwhelmingly millennials — and the same is true across the portfolio of BNPL options flooding into the marketplace.

BNPL Becoming A Way Of Life For Some

It’s noteworthy that BNPL in eCommerce settings continues to eclipse in-store, with nearly 14 percent of respondents using BNPL to pay for their last online purchase versus 6.8 percent in-store.

Socioeconomic variations observed between users of different BNPL options is one of the more fascinating takeaways from PYMNTS’ new How We Pay study. For example, certain BNPL brands appeal more to consumers living comfortably, which is to say, not having financial difficulties.

PYMNTS found Afterpay to be the most popular option among millennials who are on firm financial footing. In a somewhat curious reversal, American Express’ Pay It Plan It “is more common among those living paycheck to paycheck.” Online usage of Pay It Plan It is also higher among the college-educated by about six percentage points over the average for the three timeframes surveyed.

In a somewhat surprising parting shot from How We Pay, credit cards offered by merchants come out as the most popular in-store BNPL tool used since November 2020. Reading between the findings, conflict between credit cards and alt-credit apps may form into a new payments battleground.

According to PYMNTS’ April Buy Now Pay Later Tracker, “younger shoppers [are] especially likely to cite credit card avoidance as a reason to leverage BNPL methods: 31 percent of Gen Z consumers in the U.K. used BNPL plans to avoid credit cards, as did 23 percent of Gen X consumers.”

However, the lure of credit cards has lost none of its long-term luster as the real post-pandemic period appears on the horizon. Speaking with PYMNTS recently, Afterpay CEO Nick Molnar indicated that BNPL providers are more concerned with differentiating themselves in an ever-more-crowded pool, “and what differentiation innovators [can] add to installment payments to distinguish them” from proliferating options.

Read More On BNPL:

Read More On BNPL:

- New Data: Timing Is Key to Success of Installment Plan Offers

- BNPL Firms Ask for 5 More Months to Prepare for CFPB Rules

- Chase to Decline Credit Card Payments for Third-Party BNPL Plans

- Klarna Reportedly Prepping for Possible 2025 US IPO