Deep Dive: How Online Marketplaces, Big-Ticket Sales Are Driving BNPL’s Business Impacts

Relatively new flexible payment plans such as buy now, pay later (BNPL) options have gained traction over the past year as struggling consumers have sought ways to better manage their financial lives.

The method has been hailed for how it appeals to younger shoppers who may be debt-wary or lack credit access, and PYMNTS’ research from late last year revealed that consumers who use BNPL typically make greater numbers of and higher value purchases than those who pay in other ways. BNPL’s growing popularity for in-store as well as online shopping also bodes well for its continued adoption as the economy reopens.

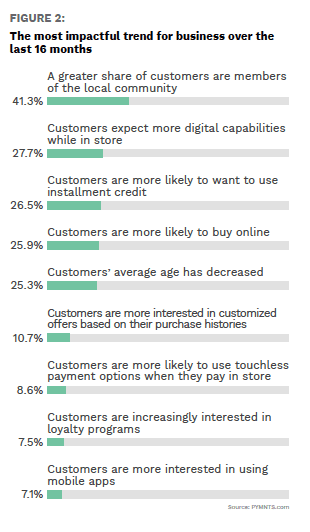

One of the most intriguing takeaways from PYMNTS’ latest research on business trends also comes from the BNPL space. Businesses believe that BNPL demand is still limited, but the method is nevertheless having a big impact on their decisions. Less than one-quarter of surveyed businesses felt that their customers had come to expect BNPL offerings during the past 15 months, yet BNPL came in third on their list of the most impactful trends in business — nearly tied for second with customers’ expectations for more digital capabilities within their stores.

PYMNTS interviewed 304 business owners, founders and solo entrepreneurs in May and June of this year about the latest trends in their businesses. The following Deep Dive analyzes the results with respect to current BNPL demand and explores the factors that appear to be driving that demand and boosting the method’s influence.

BNPL Services’ Big Impact

Merchants’ opinions on customers’ demand for BNPL services seem mixed, as 38 percent of business owners say that their customers were more likely to want these services over the past 16 months and an almost equal share — 36 percent — disagreed with that statement. Twenty-four percent neither agreed nor disagreed.

This clashes with recent data highlighting BNPL solutions’ growing popularity worldwide, however, suggesting the presence of a gap between merchants’ perceptions of consumers’ eagerness for installment payment plans compared to their actual heightening desire for these payment options. About one-third of the merchants that believed BNPL was important to customers — 10 percent of the total sample — ranked BNPL as the most impactful new trend in businesses, while another third placed it second. BNPL ranked third as the trend packing the biggest punch in commerce across all businesses surveyed. Its footprint may be limited, but BNPL appears to be making quite an impression on the businesses using it.

Demand for BNPL varied by sales channel and was strongest for online marketplaces and aggregators (53 percent), followed by merchant websites (45 percent), phone purchases (43 percent) and in-person purchases (38 percent). These results are consistent with BNPL’s digital-native roots, yet its potential as a contactless method for in-store purchases also positions it as a prime choice for adoption by the majority of shoppers who pivoted online this past year and are now returning to the physical retail world.

In-store adoption has been on the rise, with BNPL provider Afterpay reporting that nearly 4.5 million consumers have set up the Afterpay Card to shop in person since the solution went live in fall 2020. Another interesting development: Brick-and-mortar usage has been found to increase BNPL use across digital channels. Customers’ growing affinity for touchless methods since the pandemic began is predicted to last, so this trend is likely to remain a driver of demand for BNPL use over time.

The products consumers are buying with BNPL support the idea that a strong selling point for the method is making purchases affordable. The product categories that registered the highest installment demand were sporting goods (86 percent), automobile parts (67 percent), musical instruments (67 percent), health and beauty products (67 percent), clothing and accessories (58 percent) and building supplies (50 percent). Construction or contracting was the leading sector for installment credit sales (55 percent), followed by insurance brokerages (50 percent), professional services (37 percent) and retail trade (35 percent).

These findings harmonize with trends PYMNTS noted in February, when consumers were turning to BNPL to finance higher-priced purchases, such as electronics and appliances, as they outfitted their home environments while hunkering down. These latest results may also signal that BNPL has ample potential current and future use in the leisure, travel and outdoor activities arena as physical activities regain primacy, suggesting that there will be continued growth in demand as well.

The pandemic placed installment payment options on a powerful positive trajectory, with digital, contactless and economic benefits for consumers all appearing to have left a lasting impression on businesses as well. Time will tell whether this mark is permanent, but BNPL’s ascent seems poised to continue.