Buy Now, Pay Later Plans Help Parents Stock Up on Back-to-School Necessities

The United States economy is showing signs of recovery with consumer confidence on the rise, but shoppers are still not going back to their 2020 payment ways.

The United States economy is showing signs of recovery with consumer confidence on the rise, but shoppers are still not going back to their 2020 payment ways.

Adoption and awareness of buy now, pay later (BNPL) methods that can add a level of financial flexibility to consumers’ spending is growing. One study found that 86% of U.S. consumers now know about installment payment methods, while 48% have already used them to make transactions.

Adoption and awareness of buy now, pay later (BNPL) methods that can add a level of financial flexibility to consumers’ spending is growing. One study found that 86% of U.S. consumers now know about installment payment methods, while 48% have already used them to make transactions.

This growing popularity has led to increased attention for today’s BNPL providers, both by merchants and by key players in the financial ecosystem. Payment and financial service provider Square recently completed a $29 billion acquisition of BNPL provider Afterpay, for example, the largest acquisition of an installment payment provider to date. This speaks to installment payments’ value and illustrates that they can provide benefits beyond simply offering a new payment type at checkout.

In the September “Buy Now, Pay Later Tracker®,” PYMNTS takes a close look at how BNPL providers are transforming into hubs for marketing and data-driven insights as well as payment solutions.

Around The Buy Now, Pay Later Space

BNPL is pushing further into the financial mainstream in the U.S., especially among younger generations such as millennials and Generation Z consumers. One recent study found that 27% of millennials and Gen Z customers had used installment payment plans in June, for example. This is a sizable figure, especially as more than half of consumers in these generations report that they do not have credit cards. These statistics indicate that younger shoppers remain wary of accruing debt or paying fees when making purchases, and that BNPL is increasingly becoming a more popular choice as they seek alternatives to traditional credit.

U.S. consumers are far from the only ones adopting BNPL payments in higher numbers. These payment methods are also becoming more popular in markets such as Indonesia, the nation with the fourth-highest population globally. One recent report found that nine out of 10 consumers within the market are at least aware of installment payment methods, with 27% of respondents having used BNPL by the end of 2020. Adoption is also slated to continue growing, with 49% of Indonesian consumers claiming that they plan to expand their use of installment payments in the future.

respondents having used BNPL by the end of 2020. Adoption is also slated to continue growing, with 49% of Indonesian consumers claiming that they plan to expand their use of installment payments in the future.

BNPL methods can offer numerous benefits for today’s retailers, especially as installment payment providers themselves look to add to the services they support. BNPL provider Afterpay, for example, recently announced that it would launch two new features. The first offering is Afterpay IQ, a data analytics tool that uses artificial intelligence (AI) to provide data-driven insights to companies by examining their customer demographics as well as in-store and online consumer behaviors. The new Afterpay Ads tool, meanwhile, enables retailers to run promotional brand campaigns on the BNPL provider’s app. Both solutions are aimed at helping businesses boost customer conversion and create deeper loyalty among shoppers.

For more on these and other stories, visit the Tracker’s News & Trends.

How BNPL Is Making Back-To-School Purchases More Affordable For Arteza Customers

Fall is just around the corner, and parents and guardians are busy hunting for the best deals on school supplies. Supporting payment methods such as BNPL that can help to break purchases both large and small into easier-to-manage portions — without the typical fees associated with methods like credit cards — is one way that merchants can ease consumers’ financial concerns. Offering these methods can also help retailers broaden their own customer bases, explained John Caskey, vice president of technology for online art supply store Arteza.

To learn more about how BNPL can aid cost-conscious customers and retailers looking to improve conversion, visit the Tracker’s Feature Story.

Deep Dive: How Merchants Can Leverage Their Partnerships With BNPL Providers For Marketing And Data-Driven Purposes

Deep Dive: How Merchants Can Leverage Their Partnerships With BNPL Providers For Marketing And Data-Driven Purposes

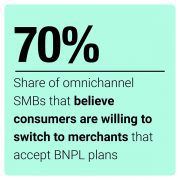

BNPL payment methods provide convenient, financially flexible options for consumers, and more and more users are seeking out these options at the point of sale. Merchants looking to grow customer loyalty and engagement could utilize their relationships with BNPL partners to tap into integrated marketing options as well as payment features.

To learn more about how merchants, especially small to mid-sized businesses (SMBs), can turn to BNPL providers to help influence customers’ shopping decisions and grow sales, visit the Tracker’s Deep Dive.

About the Tracker

The “Buy Now, Pay Later Tracker®,” a PYMNTS and Afterpay collaboration, brings you the latest news and research from the buy now, pay later space. The September edition examines how installment payment plans can boost merchants’ marketing efforts and provide them with rich data insights into customers’ purchasing habits.