Trending: Buy Now, Pay Later Takes The Sting Out Of Stocking Up on Pantry Items

Retailers attempting to recover from the pandemic and take advantage of the holiday shopping season are under pressure to entice consumers back to the store. Those who still have coronavirus concerns and those who got used to shopping online have different ideas.

Buy now, pay later (BNPL) services that allow shoppers to put purchases on a four-month installment payment plan are gaining popularity. Approximately 29 million consumers have used a BNPL option in the last year, either in-store or online, showing they are here to stay. Merchants are therefore looking to encourage greater holiday spending by joining these BNPL provider store directories.

In the November edition of the “Buy Now, Pay Later Tracker®,” PYMNTS explores how BNPL is driving shopper traffic and how retailers are using the service as a way to recover from pandemic-related losses.

Around the Buy Now, Pay Later Space

Consumers are increasingly turning to BNPL options to help them put off paying for their purchases while avoiding the high interest rates charged by credit cards. As the holiday season draws closer, retailers are paying attention to this trend. It not only allows customers the convenience of paying in installments but also drives them to spend up to 50% more at the point of sale (POS) and could mean the difference between a return shopping trip or losing a customer to another retailer.

Meanwhile, many credit card companies, in a bid to steal away business from BNPL firms, are taking a closer look at the benefits of offering installment loans, although they aren’t thrilled about the idea of not charging fees and interest. Major credit card company Mastercard will soon launch technology in Australia to allow global banks to offer installment loans.

For more on these stories, visit the Tracker’s News and Trends section.

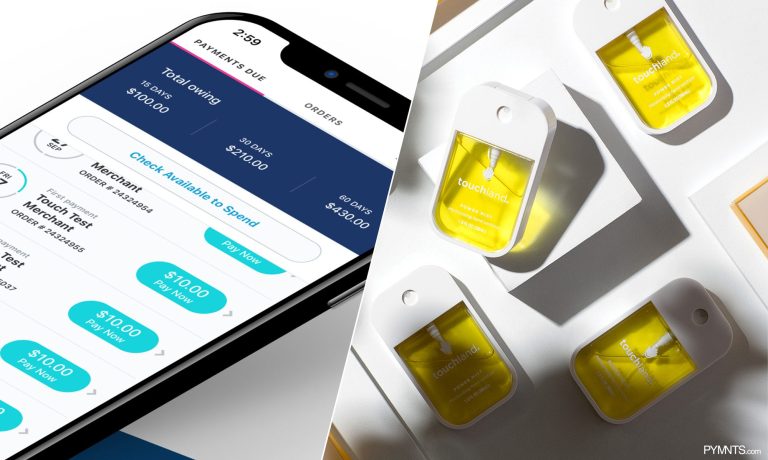

Touchland on How BNPL Can Help Companies Stand out Among Competitors

During economic downturns, consumers tend to shun larger purchases to avoid putting debt on high-interest credit cards. Offering BNPL plans that allow consumers to pay over time in manageable, interest-free installments could be one factor that changes their minds.

n this month’s Feature Story, PYMNTS spoke with Ned MacPherson, growth and consumer analytics lead at Touchland, a provider of premium hand sanitation products, dispensers and accessories, to discuss how providing a BNPL option for customers can not only take the burden of large purchases off customers but also provide firms with a means to connect with customers and gain insights into their purchasing habits.

Deep Dive: BNPL Options Change Shopper Habits, Force Retailers to Pivot to Compete

As the holiday shopping season draws close, retailers will be under the gun to offer deals that capture consumer spending, and BNPL plans may provide a crucial way to make spending more manageable. By offering installment plans without high interest rates, BNPL firms are making shopping more enticing while helping to boost the bottom lines of retailers that may have suffered during the pandemic. A report found that using a BNPL service saved customers up to $459 million in 2021 and generated nearly $8.2 billion in sales for small- to medium-sized businesses (SMBs).

As the holiday shopping season draws close, retailers will be under the gun to offer deals that capture consumer spending, and BNPL plans may provide a crucial way to make spending more manageable. By offering installment plans without high interest rates, BNPL firms are making shopping more enticing while helping to boost the bottom lines of retailers that may have suffered during the pandemic. A report found that using a BNPL service saved customers up to $459 million in 2021 and generated nearly $8.2 billion in sales for small- to medium-sized businesses (SMBs).

This month’s Deep Dive explores how installment payment plans may play a critical role in driving the economic recovery of retail.

About the Tracker

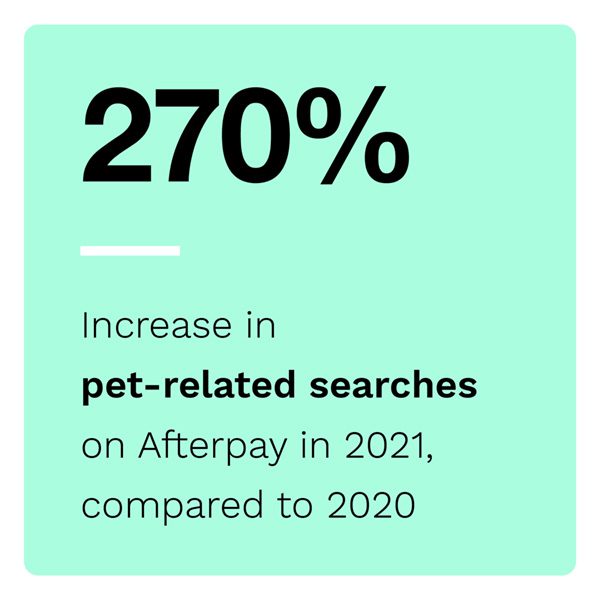

The “Buy Now, Pay Later Tracker®,” a PYMNTS and Afterpay collaboration, examines how BNPL options that enable consumers to pay for purchases over time with interest-free installment plans are no longer a credit card game and are fast becoming an effective tool in gaining the hearts — and spending power — of consumers.