Amazon Business Enters BNPL Space With Affirm Partnership

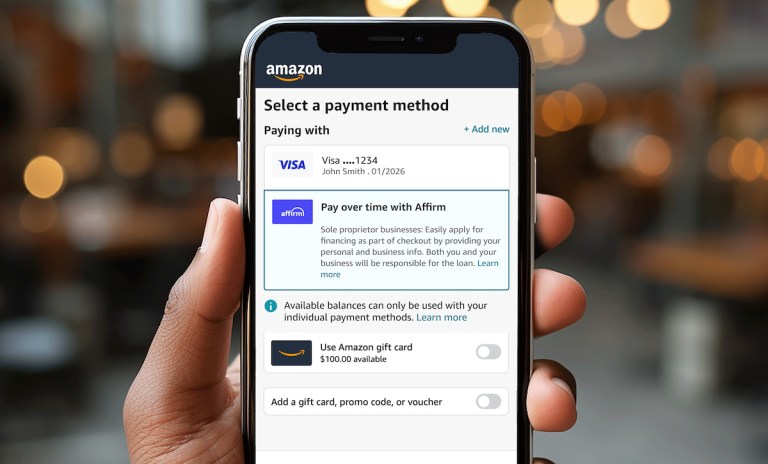

Amazon Business is offering buy now, pay later (BNPL) services in collaboration with Affirm.

Amazon Business started rolling out Affirm Thursday (Nov. 2) to eligible sole proprietor businesses. It will be available at checkout to all eligible Amazon Business sole proprietor customers by Black Friday, according to a Thursday news release.

“We’re constantly striving to make Amazon Business the best place for small businesses to fulfill their buying needs,” Todd Heimes, director of Amazon Business Worldwide, said in the release. “Integrating Affirm as a payment option helps us do just that, while providing more flexibility and convenience to our customers. The technology, ease of integration and ability to support a broad range of transactions — especially as Affirm is already used by millions of Amazon customers today — make this a natural extension of our larger partnership.”

The partnership marks the debut of Affirm’s B2B pay-over-time solution for sole proprietors, per the release.

After picking Affirm at checkout on Amazon Business and entering some information, small business owners will receive an instant credit decision and can choose from pay-over-time installments of three to 48 months if approved, according to the release.

“For example, a $200 purchase at 15% APR would cost a customer $34.81 for six months, totaling $208.84,” the release said.

Affirm first launched on Amazon’s website and mobile app in 2021, and became a payment option on Amazon Pay earlier this year.

The company’s expanded partnership with Amazon comes as small- to medium-sized businesses (SMBs) are seeking new avenues of funding as traditional sources of financing dry up.

“SMBs may be driven by a sense of urgency, as only 26% have access to the equivalent of at least 60 days’ worth of revenue, and 17% have no ready access to emergency funding,” PYMNTS wrote last month.

SMBs want to interact with banks and online lenders as their top choices for funding, which opens the door for these same firms to offer alternative funding — especially short-term financing options that help SMBs shore up working capital, get the money they need to purchase inventory or pay bills, and guard against today’s macroeconomic headwinds.

“Among recent examples of alternative financing is Galileo Financial Technologies’ partnership with Mastercard,” the report said. “The collaboration enables banks and FinTechs to extend Galileo’s BNPL offering, via Mastercard Installments, to small businesses.”

The loans, tied to virtual cards, are designed to be paid out to help smaller businesses cover expenses and fund their operations and are repaid over four installments.

For all PYMNTS B2B and Retail coverage, subscribe to the daily B2B and Retail Newsletters.