PYMNTS Intelligence: Leveraging Omnichannel BNPL to Boost Revenues and Customer Loyalty

Omnichannel shopping was on full display this holiday season, with buy now, pay later (BNPL) playing a starring role against a backdrop of economic turbulence. Where these trends meet offers a significant market opportunity for retailers, but merchants need to beware of potential hiccups in the shopping process and be ready to counter them. This month, PYMNTS explores how merchants can offer a positive omnichannel BNPL experience.

Merchants can profit from in-store BNPL done right

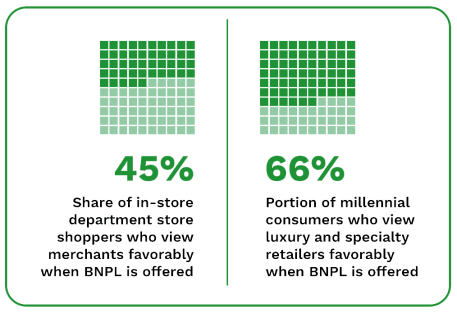

Studies have found that 70% of consumers spend more when using BNPL than they would otherwise, and 47% say they select merchants based on their partnerships with preferred BNPL providers. This can translate into huge potential revenue gains for merchants if they offer BNPL to their customers in-store as well as online.

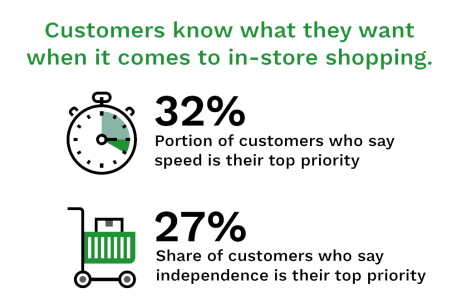

Convenience, however, is another rising demand on the payments landscape, and its absence can upstage affordability. Research shows that 32% of customers say the speed of shopping is their top priority, followed by an independent shopping experience, at 27%.

BNPL experiences across all channels must match these customer preferences to harness the increased profit that comes with this method. Deployed incorrectly, BNPL has the potential to sabotage the experience by forcing customers to enter their BNPL service provider sign-ins or perform additional steps at checkout, leading to delays. These complications run counter to the seamless shopping experiences consumers crave and can upend a sale.

Meeting the seamlessness test

Customers using online BNPL are free to complete sign-up at their leisure, but offering BNPL options in person can be tricky, as any added steps in the payment process are apt to slow checkout lines. BNPL options that are embedded in merchants’ POS terminals or integrate with shoppers’ existing payment methods have a greater chance of success. One way that merchants can reduce in-store BNPL friction is by offering services that leverage customers’ existing credit cards. Instead of taking out new loans, customers using these protocols will have holds placed on their credit cards, so the checkout experience is comparable to that of a normal credit card payment. This allows for a faster shopping experience that can convert and lead to future sales.

This option benefits merchants in other ways as well. By embedding white-label BNPL offerings at the POS, merchants can avoid paying BNPL service provider fees and can even determine price thresholds for offering BNPL so that its costs do not eat into their profit margins. The other benefit is that store-branded BNPL is likelier to generate long-term customer loyalty for the store itself as opposed to the BNPL provider’s brand.

Omnichannel 2.0: Call centers

Taking omnichannel a step further, other avenues through which merchants can leverage BNPL outside of in-store and online include call centers, either in-house or at external shopping channels. Offering BNPL on credit card rails can save time and costs here as well, reducing the need for drawn-out applications and payment procedures. It can also lead to greater conversion and store loyalty, adding one more way for merchants to meet customers wherever they wish to shop.

Partnering with technology providers can simplify integration of these offerings with merchants’ systems using application programming interfaces and can pay for itself with increased revenues. Forward-thinking merchants will want to explore their options as BNPL’s explosive growth continues.