Shoppers Expect Seamless BNPL Checkout Both Online and In-Store

Shoppers are returning to physical stores this holiday season, but digital habits adopted during the pandemic show no signs of abating. More than three-quarters of shoppers in a recent global survey said they are visiting brick-and-mortar locations at pre-pandemic levels, but they are increasingly combining eCommerce with in-store shopping. Consumer expectations for digital experiences are higher than ever and are spilling over into consumers’ in-person shopping as well. Frictionless checkout is now mandatory — wherever it occurs.

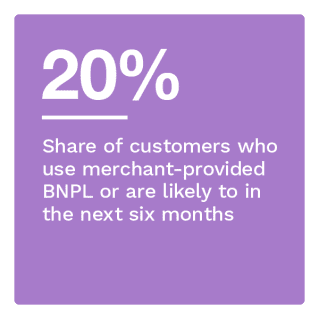

Consumers leaned into buy now, pay later (BNPL) options this holiday season as inflation strains their budgets, but despite its roots as an online payment method, BNPL has expanded to use in stores. With one-quarter of all shoppers blending in-store and online shopping this year, rewards await retailers that offer both online and offline BNPL — seamlessly.

The “Buy Now, Pay Later Tracker®” explores how BNPL usage is increasing across sales channels and how retailers can reduce potential in-store frictions to streamline the BNPL experience for a seamless checkout.

Around the Buy Now, Pay Later Space

BNPL’s popularity is spreading worldwide, and the Asia-Pacific region is quickly becoming a hotbed. A recent study found that the region’s BNPL industry is set to hit $92 billion in transactions by 2025, up from $23 billion in 2020. Expensive items are the most popular BNPL use case. The study further found that 50% of APAC customers were comfortable using BNPL, compared to 41% of consumers globally.

BNPL’s popularity is spreading worldwide, and the Asia-Pacific region is quickly becoming a hotbed. A recent study found that the region’s BNPL industry is set to hit $92 billion in transactions by 2025, up from $23 billion in 2020. Expensive items are the most popular BNPL use case. The study further found that 50% of APAC customers were comfortable using BNPL, compared to 41% of consumers globally.

Customers typically choose which merchant to patronize based on existing brand loyalty, but BNPL shoppers are largely looking for the best deals, according to a recent study. Forty-three percent of BNPL shoppers said they would use BNPL apps this holiday season to hunt for bargains, and 40% plan to do most of their holiday shopping in this fashion. While stores may be concerned with losing business to competitors, offering BNPL is a good way to level the playing field, with 31% of shoppers saying their budgets are much more flexible with BNPL than they would be otherwise.

For more on these and other stories, visit the Tracker’s News and Trends section.

Leveraging Omnichannel BNPL to Boost Revenues and Customer Loyalty

Studies have found that 70% of consumers spend more when using BNPL than they would otherwise, and 47% say they select merchants based on their partnerships with preferred BNPL providers. This can translate into huge potential revenue gains for merchants if they offer BNPL to their customers in-store and online. Still, demand for convenience is also rising, and its absence can upstage affordability. Research shows that 32% of customers say the speed of shopping is their top priority, followed by an independent shopping experience at 27%, meaning merchants must be aware of potential hiccups in the shopping process and be ready to counter them.

This month’s PYMNTS Intelligence explores how merchants can provide consumers with a positive BNPL experience when shopping in-store.

About the Tracker

The “Buy Now, Pay Later Tracker®,” a collaboration with Splitit, explores how BNPL usage is increasing across sales channels and how retailers can reduce potential in-store frictions to streamline the BNPL experience for a seamless checkout.