1 in 4 Millennial Shoppers Trades Down When BNPL Is Unavailable

Many buy now, pay later (BNPL) users alter their purchasing when the payment method is not available, with PYMNTS Intelligence research revealing that millennials are disproportionately likely to trade down to cheaper items when not offered the option.

By the Numbers

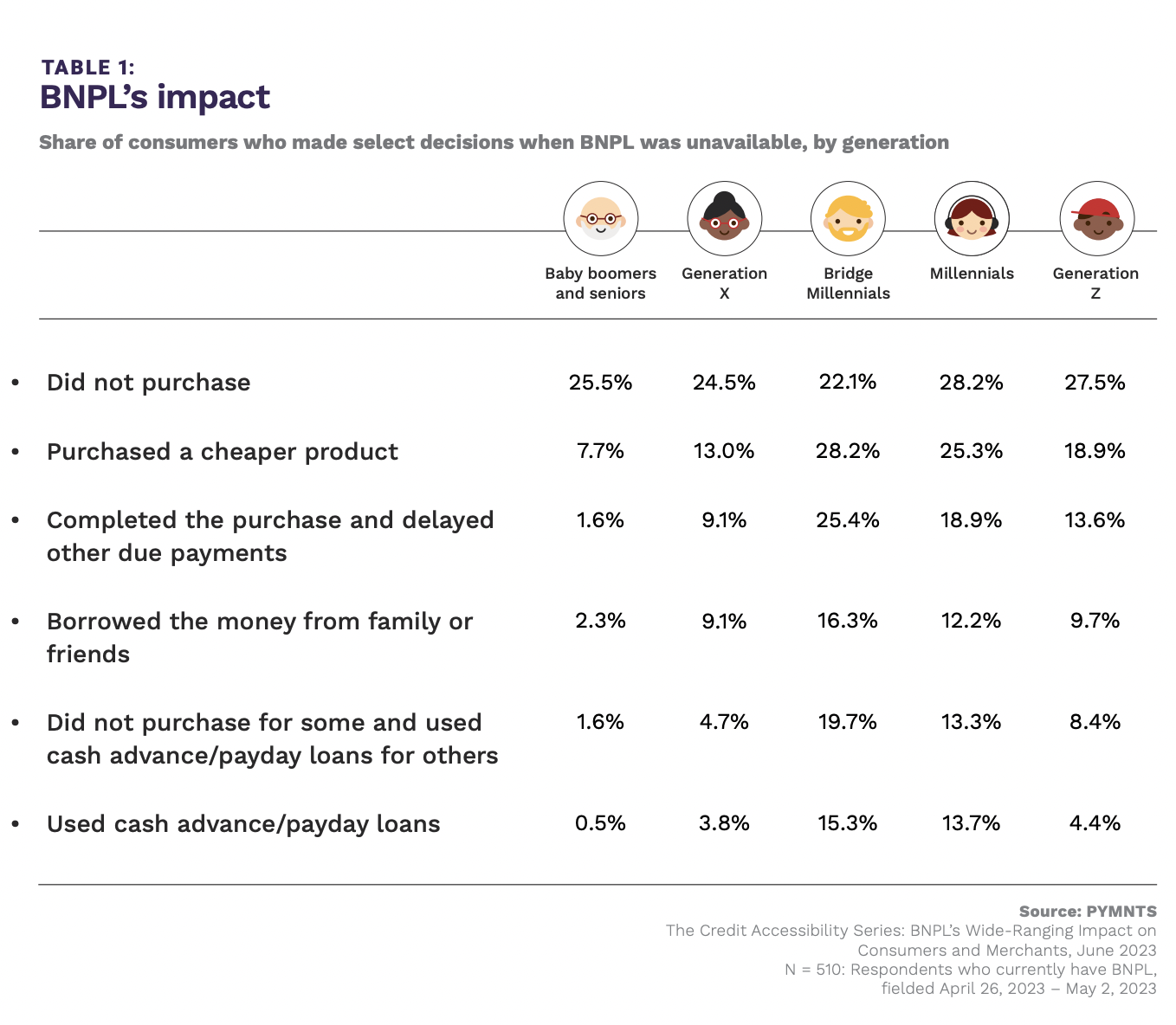

The PYMNTS Intelligence report “The Credit Accessibility Series: BNPL’s Wide-Ranging Impact on Consumers and Merchants,” created in collaboration with Sezzle, drew from a survey of more than 3,100 U.S. consumers to understand how they engage with BNPL options and how it informs their buying decisions.

The results reveal that, among the 16% of respondents that were using BNPL, a significant share would make changes to how or what they buy when the payment option is not available. While the most common adjustment is simply to not purchase a given item, a significant portion of millennials — more than 1 in 4 — said that they have purchased a cheaper product when BNPL was unavailable.

The Data in Context

Indeed, players in the space are seeing consumers seek out the payment method to manage their spending.

“Whether you have customers who are using BNPL because they need to or because they are using it for budgeting, there are multiple ways to use it, and that’s why BNPL is so successful and why it’s here to stay,” Sezzle CEO Charlie Youakim told PYMNTS’ Karen Webster in an August interview.

Youakim is not the only one observing rising demand for BNPL. Jacqueline White, president of i2c, told Webster in a recent “At the Edge” conversation that, in 2024, BNPL is going to be increasingly on consumers’ radars and a payment option they expect from all financial institutions and merchants.

“It’s never been more important for people to be able to hang onto their cash, as more consumers are looking to use BNPL to pay for the necessities of life … all the way around to fun things like travel and entertainment,” she said.