79% of US Consumers Are Highly Satisfied With BNPL

Split-payment or installment plans such as buy now, pay later (BNPL) enable consumers to shop more strategically, buying items one day and paying for them with a set schedule of payments over time to better manage their budgets.

According to PYMNTS Intelligence’s “Divided, Not Conquered: Acquirer and Merchant Confusion Clouds Split-Payments Landscape” report, a collaboration with Splitit, this approach to shopping has proven to be a big hit with consumers, with 3 in 5 of them telling us they used some split-payment option at least once in the last year.

The plans have proven to be especially popular with younger shoppers, which makes sense given that they typically have less spending power and are developing credit habits, meaning installment plans might serve as a useful way to budget for larger purchases.

This can explain why 65% of Gen Z consumers we surveyed used some type of installment payment plan in the last year. Millennials also like the plans: 25% of them increased their use of installment plans in the last year.

BNPL appears to be picking up the most steam among younger consumers. Forty-nine percent of Gen Z shoppers and 52% of millennials have used BNPL at least once in the last year, with 23% of shoppers in both segments increasing their BNPL use during that time.

One driver behind the popularity of installment plans in general — and BNPL in particular — is the high level of satisfaction consumers across all generations report when being able to delay payments.

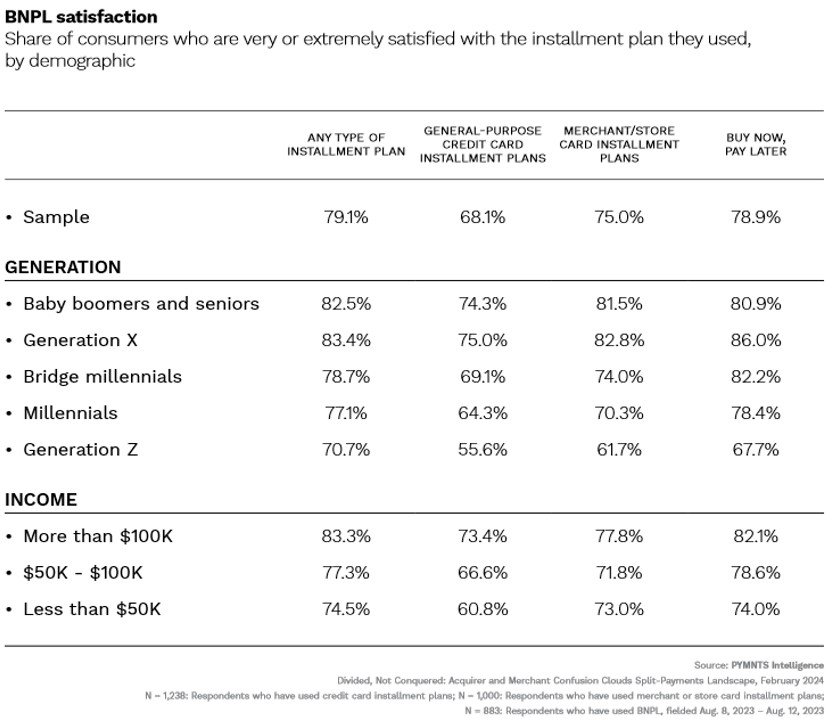

In general, 79% of all consumers say they are very or extremely satisfied with any type of installment shopping. That percentage climbs to 83% when baby boomers, seniors and Gen X consumers are asked. When asked about merchant- and store-specific car installment plans, satisfaction levels are similarly high, with 82% of baby boomers and seniors giving them high marks and 83% of Gen X endorsing them.

As the graphic illustrates, the popularity of BNPL is especially strong for older shoppers. Eighty-one percent baby boomers and seniors are highly satisfied with BNPL, while 86% of Gen X shoppers and 82% of bridge millennials share the enthusiasm for BNPL.

Despite the previously mentioned popularity that BNPL holds among Gen Z shoppers, these young plan users are slightly less likely to be highly satisfied with the experience. While 68% of them say they are highly satisfied with the BNPL experience, that level of satisfaction is noticeably lower than what other generations shared.

But it’s not just BNPL: Gen Z consumers are also less likely to be thrilled with merchant-card installment plans (62%) and even less so about credit card plans in general (57%). Perhaps this slight lack of satisfaction reflects a general uneasiness around taking on any debt whatsoever at this time; Gen Z is also the lowest-earning group we surveyed.

Even though these shares of the very satisfied are low in comparison, all are above 50%. In short, they signify most installment plan users are very happy with the choice.