In South Africa, Cash Is Consumers’ Hands-Down Choice

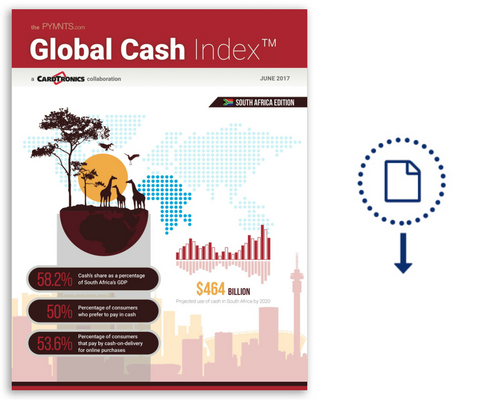

For South African eTailers, accepting cash is not an ‘if,’ but a ‘must.’ According to the latest PYMNTS Global Cash Index™ South Africa Analysis, cash powers over 50 percent of consumer transactions and accounts for 58 percent of GDP. And while the technological infrastructure catches on, eTailers must accept cash to stay competitive, says Vusi Ndwandwe, head of retail and business banking at Absa Bank. Plus, over 200 data points that track South Africa’s state of cash, in the report.

When the money transfer app M-Pesa entered the South African market in 2010, the company behind the app, Vodacom, set a target of reaching 10 million users within three years since its launch. The company was intent on repeating the success it had first achieved in Kenya.

Six years after launching in South Africa, the mobile money giant ceased operations in the country after managing to register a mere 76,000 users.

In retrospect, M-Pesa’s failure in South Africa could have been foreseen, which is of course always easier to say in hindsight. With more than half of consumer transactions still being paid in cash, South Africa is inherently a cash-driven economy, where despite the growing penetration of mobile phones, consumers continue to use cash to pay for day-to-day needs.

To gauge the evolving state of cash in South Africa and dig into why mobile payments are struggling to gain adoption, PYMNTS recently caught up with Vusi Ndwandwe, head of retail and business banking at Absa Bank.

“When it comes to payments in South Africa or Africa, in general, cash is still a king. Sometimes, the picture is not painted accurately,” Ndwandwe said of the popularity of digital payments on the African continent.

Powering Rides to Retail

In South Africa, consumers often pick cash over cards for making their purchases, and that’s a fact that brands local and international are heeding for finding success.

Take ride-hailing giant Uber, for instance. While the country has a large number of credit card users, when the time came for Uber to expand its operation, accepting cash was a no-brainer.

“When you see the market potential that cash unlocks, it’s very hard to ignore that,” said Alon Lits, Uber’s general manager for sub-Saharan Africa, at the time of the rollout in May 2016.

And rightfully so. Total cash currently being used in South Africa represents more than 58 percent of the country’s GDP, according to the PYMNTS Global Cash Index.

Meanwhile in the eCommerce industry, top South African eTailers such as Takealot.com are casting a wider net for capturing unbanked and cash-loving shoppers by extending payment options such as cash on delivery in conjunction with card-based payments.

“Cash on delivery is really gaining momentum,” Ndwandwe said, adding that top retailers are seeing consumers use cash for payments for close to a quarter of their sales.

However, with improved point-of-sale infrastructure in-store, cash is now facing stiff competition from credit and debit cards and is now the second-most-used payment method.

P2P is Cash’s Forte

Over the years, South Africa, with the largest economy on the African continent, has seen rapid development of an infrastructure for supporting card-based payments; however, when it comes to P2P payments, digital payments haven’t managed to cut in on a sizeable piece of market share.

Cash continues to be the go-to method for P2P payments, Ndwandwe said. Digitizing P2P transactions would require further development of the existing infrastructure, he added.

While banking customers can send P2P payments, they are only able to do so with customers of the same bank, and the vast majority of the country’s population maintain a single bank account, according to Ndwandwe.

“There are all-closed loop systems in each bank, but not interbank” networks, he said of the technological barriers that add friction to digital P2P transfers.

Meanwhile for consumers, cash continues to be a friction-free solution for making P2P payments, not just for banked consumers, but also for the remaining 33 percent of the population who do not have access to a bank account.

Growth of Cash in the Near Future

With growing competition from alternate payment methods, cash’s popularity has relatively declined in South Africa, but with growth in the country’s GDP, cash usage is projected to increase.

In 2015, South Africans used a total of $183.7 billion in cash, up from $156.9 billion in 2010, according to the PYMNTS Global Cash Index. One of the major factors that has contributed to this growth is the country’s propensity for using cash for low-value transactions.

“Sixty percent of cash usage is in low-value transactions,” Ndwandwe said.

High-value transactions, on the other hand, are now completed through direct debit or credit push payments to comply with anti-money laundering laws and other regulatory requirements, he noted.

Along with digitization of high-value transactions, card-based payments are quickly gaining popularity and have now become the fastest growing payment method, he said. Nonetheless, Ndwandwe believes that cash usage will continue to grow in the country, with consumers continuing to use their debit cards for withdrawing cash instead of paying with them directly.

Payments and Technological Barriers

Other than the convenience that cash offers, there are several reasons that factor into South African consumers’ choice for cash over cards and mobile payments.

In a recent survey conducted by the Boston Consulting Group, 33 percent of South Africans cited fear of fraud involving the use of ATMs and mobile banking as the No. 1 reason for transacting in cash.

Additionally, a lack of resources has hampered growth of digital payments.

“For digital payments to really take off, it’s not just the infrastructure that you need, but there are also cost issues,” Ndwandwe said, adding that in the long run, mobile payments may prove to be a game-changer with growth in penetration of smartphones.

However, even with smartphone usage growing in South Africa, other barriers continue to remain in place. Most notably, perhaps, until consumers start feeling comfortable with using payment features on their phones, mobile and other electronic payments won’t see widespread adoption, Ndwandwe explained.

Most of these frictions, however, are similar to those experienced in other developing markets.

As the South African market continues to evolve, the balance between share of digital payments and cash is likely to reach a point of congruence where both will go hand in hand. But for now, cash still rules the roost.

To download the analysis, please click below…

About the Index

The PYMNTS.com Global Cash Index™, a Cardtronics collaboration, focuses on the use of cash for making payments and as a payment method that equally plays a role with cards, checks, direct debit and other methods of settling up between consumers and businesses. Unlike most reported estimates of cash, our proprietary data analysis focuses on the use of cash for making payments rather than hoarding.