Experian Launches Tool for Uploading Rental Payments to Credit File

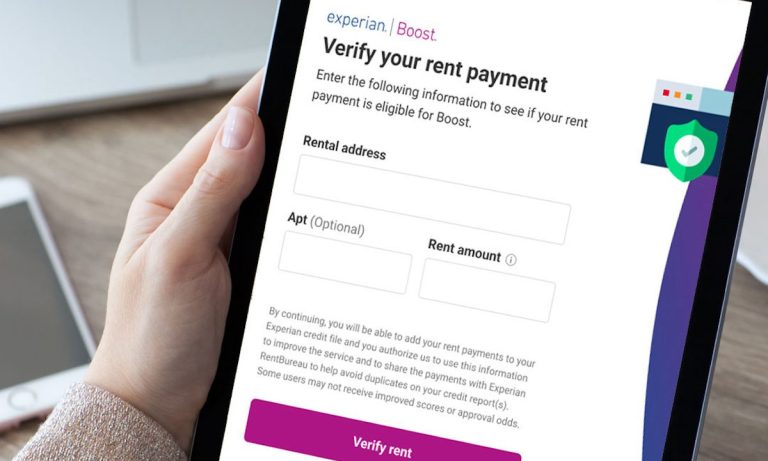

Credit reporting agency Experian is launching a new tool that can help people who pay rent contribute qualifying, “positive” residential rent payments directly to benefit their Experian credit file.

The move is intended to help renters in the United States have another way to up their credit scores, according to a Wednesday (Sep. 7) press release.

Experian Boost is the only solution that can “instantly improve a consumer’s FICO Score 8 through positive rent payments at no cost” (calculated based on the FICO Score 8 model), according to the release.

Although the FICO Score 8 model is a common scoring avenue, lenders could use a different FICO Score, or another type of credit score altogether, the release stated.

“Experian Boost is a game changer, and we’re excited to launch the first phase of this new enhancement that will allow consumers to instantly add rental payments to their Experian credit file,” said Jeff Softley, president of direct to consumer at Experian Consumer Services, in the release. “We are committed to continually improving Experian Boost to bring financial power to all.”

Based on the company’s preliminary analysis, 66% of consumers will see an instant increase in their FICO Score 8 resulting from the potential impact of positive residential rent payment reporting through Experian Boost, according to the release.

People receiving a boost who are also new to using the product saw a FICO Score 8 improvement of nearly 10 points on average, the release stated. Consumers who receive a boost with thin credit files or low FICO Scores could see an improvement of 14 points.

Experian has a history supporting the use of positive rent payments and was among the initial credit reporting agencies to include rent payments in consumer credit reports, per the release.

Read also:

Tough Rental Market Sees More Digital Payments, Cash Back, Discounts

Obligo Partners With Wells Fargo for No-Deposit Product for Landlords, Tenants