Netflix Surges 25% on Earnings and Leads CE 100’s 5% Weekly Gain

Earnings are trickling in as October moves into its last few trading sessions. And so far, we’re getting a look at some of the pockets of resilience where consumers continue to spend money.

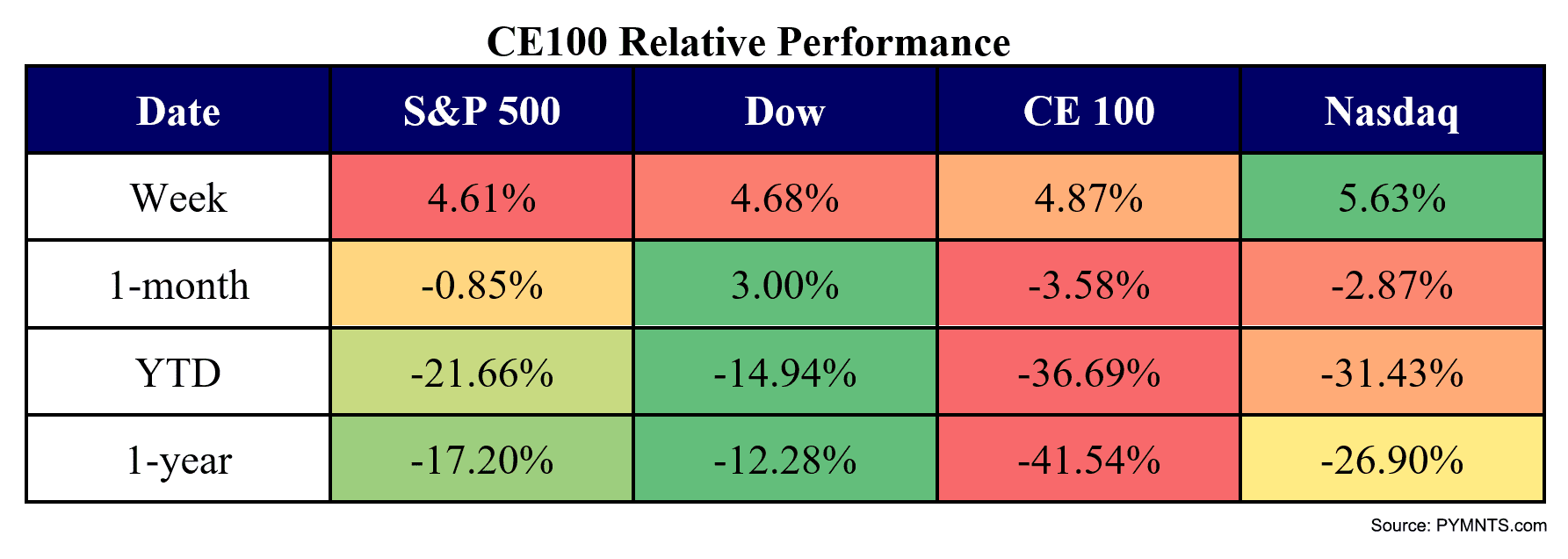

And thus far, as relates to our CE 100 Index this past week — where the index surged 4.9% — the platforms that serve leisure activities got a bounce from encouraging subscriber numbers and other data.

The “Fun” group gained 8.7%, where Netflix soared by 25% on the week.

Streaming and Gaming Gain Ground

As noted in this space, the third quarter numbers cheered investors. In the latest period, Netflix subscriber growth was up a better-than-expected 2.4 million last quarter — 60% of which came from Asia. The company will, per management commentary, be increasingly focused on revenue as a primary metric, with new tailwinds from advertising and paid sharing.

“When we look at that and the fact that we think that this lower consumer-facing price [$6.99/mo. for the new ad-supported service] will bring in a lot more members, then we’re quite confident in the long term that this will lead to a significant incremental revenue and profit stream,” Netflix COO Greg Peters said on the company’s third-quarter earnings call.

Roblox was up a bit more than 20%, as its September data showed that the company’s daily active users were up 23% year on year to 57.8 million, and said that hours engaged were up 16%, to four billion.

Elsewhere, Intuitive Surgical rallied 19.2%, as revenues were up 11% in its latest earnings report to $1.6 billion, and a 13% growth in its da Vinci Surgical System installed base to 7,364 systems.

Shopping-related names bucked concerns over consumer spending — at least for this week.

Shopify bounced 14% higher. As reported this past week, the company has partnered with Novel, a code Web3 commerce platform, to make Web3 technologies accessible. As part of the partnership, per an announcement between the two companies, Novel launched an app on the Shopify App Store. Among the functionalities: Firms can use the Novel NFT Builder to create a collection of NFTs using their artwork.

These gains were tempered, at least somewhat, by the 2.2% loss in the Communications pillar, driven by Snap’s 22.5% decline. The company’s global daily active user count came in at 363 million, up 19%, but its revenue growth has slowed to 6%, its slowest pace since listing via IPO five years ago. And average revenue per user was off 11% to $3.11.

And, as noted in commentary via its investor letter, management noted that “our revenue growth continued to decelerate in Q3 and continues to be impacted by a number of factors we have noted throughout the past year, including platform policy changes, macroeconomic headwinds and increased competition,” adding that, “We are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital.” Forward visibility is “challenging,” the company said.