CE 100 Index Gains 0.5%, Led by Affirm’s Post-Earnings Surge

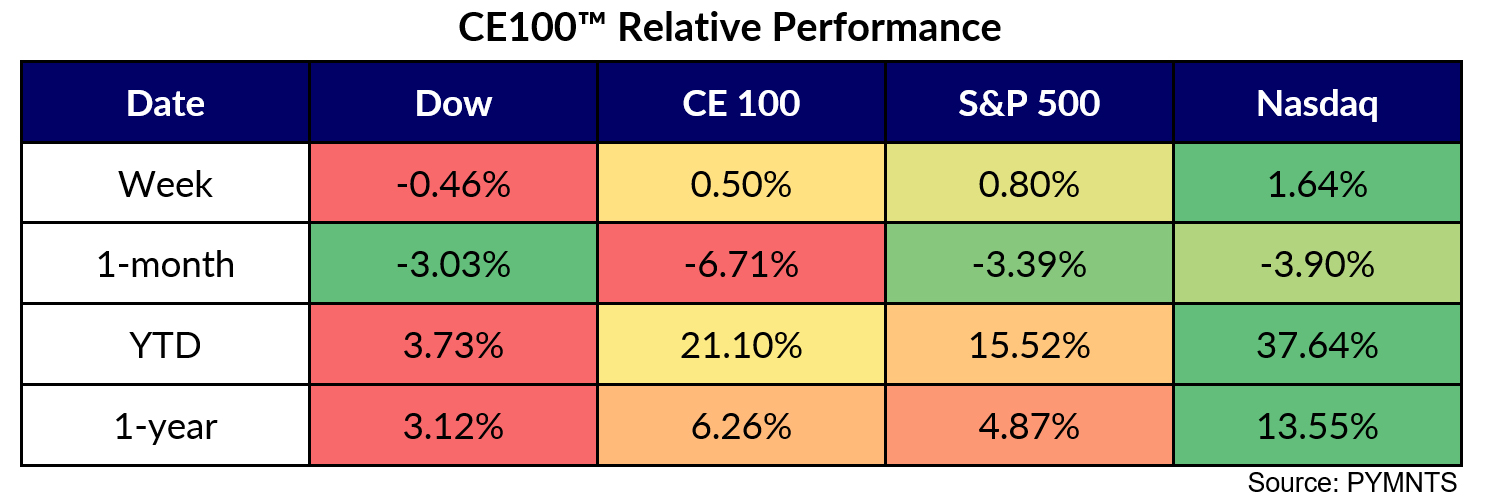

The CE 100 Index gained 0.5% in a week that reversed what felt like a long-standing trend — where all pillars lost ground, time and again.

The Enablers segment gained 2.2%, at the forefront of pillar-by-pillar performance as Fastly was up 13.7%. The company said this past week that it had acquired Domainr, an ICANN-accredited real-time domain availability API provider and announced the general availability of Certainly, its TLS Certification Authority.

Affirm Gets a Post-Earnings-Report Boost

Affirm led the Pay and Be Paid segment, which was up 1.7%.

Shares in Affirm soared 22.7%. The company reported earnings this week that showed repeat transactions per active customer were up 30% year on year and gains in active customer count of 18% to 16.5 million. The company’s earnings supplementals detailed a 25% rise in gross merchandise volume to $5.5 billion.

Active merchant count was more than 254,000, and during the quarter, the tally of merchants with more than $1,000 in trailing 12 months GMV was up 16%. General merchandise volume growth was up 61% YoY, fashion/beauty gained 14%. Delinquency rates improved sequentially, as the 30+ day delinquency rate was 2.3%, 0.3% better than the previous quarter.

Those gains were offset a bit by losses in Adyen, which sank 12.8%, continuing a post-earnings slide from earlier in the month. As reported, the company’s half-year earnings report took note of slower growth in America, which in turn caused it to miss its internal targets.

Peloton Slides on Customer Turnover Metrics, Earnings

Peloton shares slid more than 16.8% on the week, leading the Be Well group 1.7% lower. As reported here, Peloton’s earnings call last week showed that the company reported a loss that exceeded expectations and a reduction in new quarterly subscribers.

The quarter closed with 3.1 million subscribers, marking a 4% rise over the prior year, consistent with the company’s forecasts. Nevertheless, there was a decline of 29,000 subscribers sequentially. Peloton ascribed this drop to a “seasonal” reduction in hardware sales and a churn rate that exceeded expectations. Management said on the conference call with analysts that the latest quarterly performance reflected the impact of a shift in consumer spending towards travel and experiences.

Peloton also indicated a recall of its bike seat resulted in higher customer turnover than initially predicted. This metric stood at 1.4% for the quarter. As we noted in our own coverage of the earnings report, suspects that around 15,000 to 20,000 individuals opted to temporarily pause their monthly subscriptions in the wake of the May announcement of the recall, anticipating the replacement of their seat posts.

The recall impacted over 2 million bikes sold by the company since January 2018, incurring a cost of $40 million in the quarter, a sum higher than Peloton’s initial projections, per management commentary on the call.

Also during May, the company introduced a range of new pricing tiers for its fitness app, encompassing an unrestricted free membership option (without needing a credit card) and subscription levels priced at $12.99 and $24 per month. The app lets users access Peloton’s fitness classes and design customized workouts from any location, including their gyms.