CE 100 Index Notches 2.7% Gain as eCommerce Platforms Surge

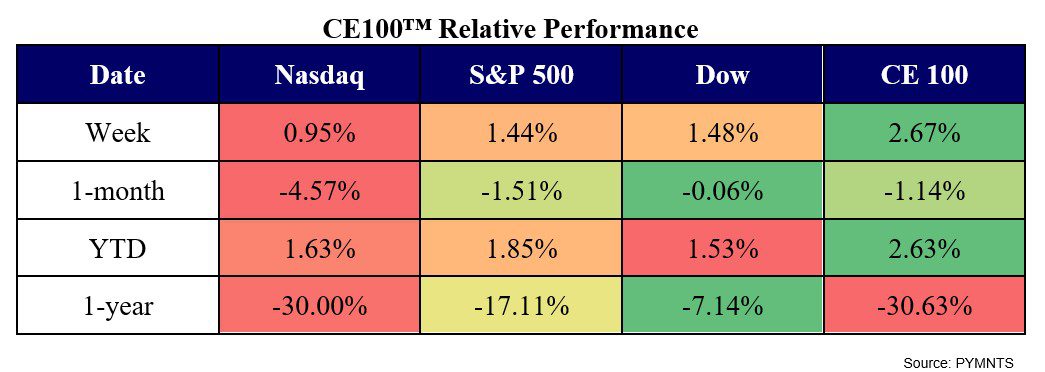

One week in, and the CE 100 Index has already gained some ground, up 2.7%.

This time around, the tailwind came as investors notably bid up stocks tied to several names based outside of the U.S.

The three best performing pillars were the “Shop” group, up 7.7%; the “Move” sector, which surged 4.7%; and the “Have Fun” index, which gathered 4.6% on the week.

Drilling down into the shopping sector, eCommerce and online platforms led the way.

Pinduoduo was at the head of the class with a 17.7% surge, followed by Ocado, up 16.5%, and Coupang, which gathered 13.6%.

Pinduoduo got a boost as China’s new foreign minister Qin Gang published an opinion piece that seemed to signal a desire to forge a better relationship with the U.S. Ocado also was in the spotlight as Morgan Stanley research noted that the online grocery firm had a “strong” December, with high single digit percentage point sales growth.

“Move” pillar momentum was buoyed by the likes of Booking Holdings, which gained 8.1% on the week. In at least some respects, the same enthusiasm buoying Chinese stocks would underpin travel-focused companies.

Outperforming the Broader Indices

In the meantime, the CE 100 Index outpaced the recent rally in U.S. stocks. Broader market indices were higher on economic data that showed that the pace of hiring and wage growth is cooling, indicating that the strength of some U.S. fundamentals has been firmly cemented.

With a somewhat sanguine outlook on the economy, and thus the ability/willingness of consumers to keep spending, the “Have Fun” group was up 4.6%.

Flutter Entertainment shares jumped 6.5% on the heels of news that subsidiary FanDuel and Boyd Gaming have launched the FanDuel Sportsbook and have opened a retail sportsbook, both in Ohio.

The gaming stock’s rally was trailed only slightly by Nike, which gained 6.4%. As PYMNTS reported, Nike debuted its Nike Training Club workouts on Netflix this week.

Payment-related names also gained ground as several sell-side analysts issued positive reports. Block was up 9.8% on the week as Baird upgraded the company to “outperform,” citing growth and the prospect of improving margins. Sezzle shares increased by 9.6%, as the company said at the end of the year that is now offering its credit-building service Sezzle Up in Canada.

Some Losses, Too

These gains were offset, at least a bit, by a slight dip in the “Be Well” group, which was down 0.2%.

Cigna/Express Scripts lost 8.8% on the week. United Healthcare slipped 7.6%.

In terms of individual names, some “Enablers” such as Snowflake (the stock declined 13.5% through the week) and MongoDB (off 13.7%) slipped. Salesforce signaled pressure on enterprise-focused tech businesses as the company said last week that it would cut 10% of its staff. Business clients are pulling back on their own spending, and the negative ripple effect is being felt across the business software sector.

PYMNTS noted that the positive performance of the past week might be tested as we head into earnings season. Macy’s reported after the markets closed on Friday that inflation had pressured consumers during the holiday shopping season, and said that its own net sales for the period will be at the lower end-to-midpoint of its forecasts.

For the CE 100, the first week went fine — it’s the other 51 that bear watching, and it’s going to be a long 2023.