WeWork Plunges as It Seeks Lease Renegotiations, Drives CE 100 Index Down 2.4%

A holiday-shortened trading week offered no respite for the CE 100 Index, which continued a general downward trend that’s been the hallmark of the last several sessions.

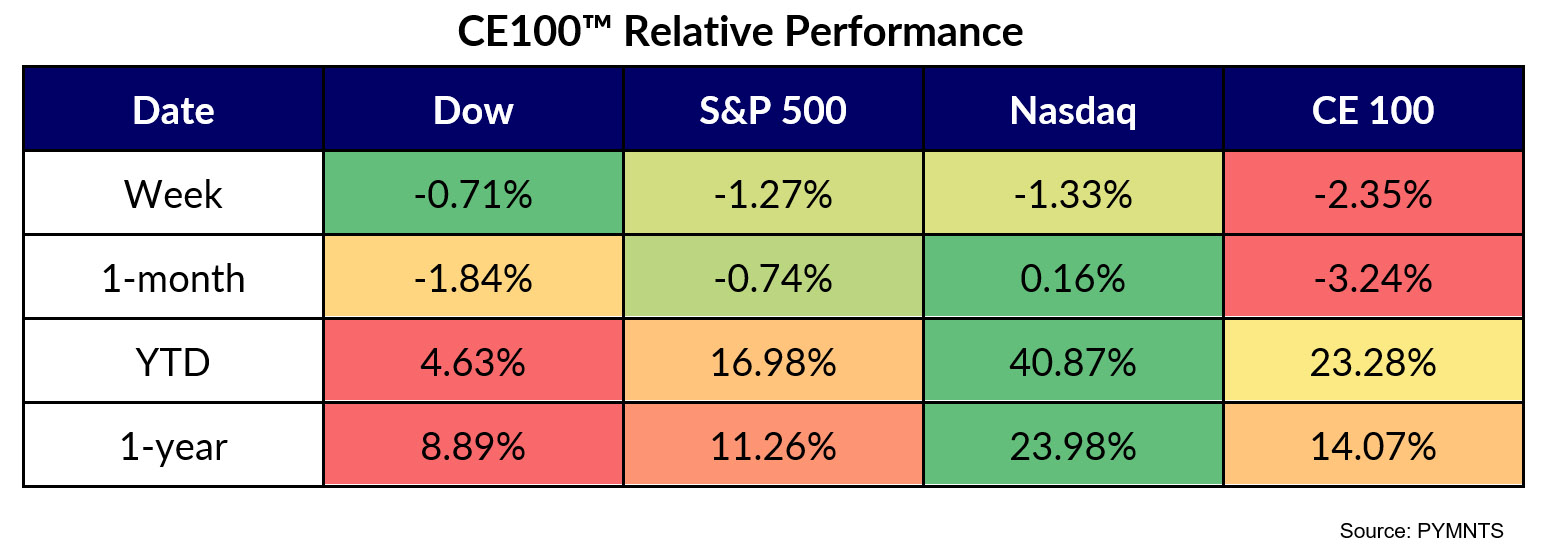

Yet again, all pillars lost ground as the overall Index gave up 2.4%. The seemingly inexorable week-after-week declines have chipped away at the year-to-date performance, which now stands at a positive 23.3%.

WeWork shares plunged by more than 39%, perhaps the most dramatic of decliners in the week, leading the “Work” pillar down 2.4% for the week.

WeWork Eyes Lease Renegotiation

WeWork CEO David Tolley said in an open letter posted online that the company will seek a “global engagement” to “negotiate nearly all of our leases,” as disclosed in the letter. The CEO also stated, “as part of these negotiations, we expect to exit unfit and underperforming locations and reinvest in our strongest assets as we continuously improve our product.” The company’s financial challenges have been well-documented in recent months and years. The most recent stock plummet comes after a 1 for 40 reverse stock split.

As noted here, late last month, WeWork said its warrants faced a delisting as the New York Stock Exchange (NYSE) determined they had reached “abnormally low” prices.

That same month, WeWork — which provides shared workspaces for technology startups and other businesses — warned in a Securities and Exchange Commission (SEC) filing that it had doubts about its future as a “going concern.”

News of the warrants delisting notification came the same week that The Wall Street Journal reported that several Wall Street firms — lenders to WeWork — were “exploring the possibility of a bankruptcy filing” that, in turn, would help the firm exit at least some of its more expensive office leases, while restructuring its financial position.

Peloton gave up more than 16%. News came last week that the family of a New York man has filed suit against the company, alleging that he was killed “instantly” as his Peloton bike fell on him during a workout and severed an artery. The suit comes as the fitness company, as we’ve reported, is in the midst of a rebrand that will strive to refresh the company’s app and introduce new subscription tiers.

Elsewhere, Nvidia lost roughly 6% on the week, reversing some of the gains seen in the wake of earnings and continued demand for the chips that power AI applications and use cases. Goldman Sachs had pointed to the company as one of several firms with marked tailwinds from the AI sector.

These losses overtook the gains seen by DraftKings, which surged 7.5%. DraftKing’s rise blunted some of the “Have Fun” pillar’s losses as the overall group slipped a relatively muted 0.2%. The Wall Street Journal reported that online betting platforms, DraftKings among them, view the new football season as “the biggest opportunity to convince fans to pull out their smartphones and place bets, and some are offering increased incentives this year to lure such gamblers.” DraftKings, by way of example, has been offering a $200 bonus for a $5 bet by new customers — a repeat of the offer that had been in place last year.