Will CBDCs Be a Game-Changer for Cross-Border Remittances?

Cross-border remittances — where hundreds of billions of dollars flow internationally, typically as individuals send money home to friends and family — may be ripe for a digital makeover.

To that end, the nonprofit Digital Dollar Project said Thursday (Aug. 3) that it had completed a pilot study that tested the feasibility of cross-border remittances using central bank digital currencies (CBDCs).

In the whitepaper published in accompaniment to the announcement, the DDP noted that in an examination of the potential to utilize a U.S. CBDC, the pilot was the “first private sector initiated experiment” and demonstrated “how a robust, secure and efficient cross-border payments settlement process working with a potential U.S. CBDC could provide benefits” to remittance activity. The private sector participants included Western Union and BDO Unibank.

In reference to the mechanics of the pilot, the paper noted that the CBDCs were simulated to traverse the U.S. to Philippines corridor and were issued to Western Union, acting as customer of BDO.

Modernization on the Horizon?

“The pilot demonstrated that rather than displacing the service offerings of Western Union and BDO Unibank, CBDCs present an opportunity to modernize processes and promote efficiencies for private sector companies and their customers,” the DDP wrote, underpinned by distributed ledger technology.

Western Union, for its part, sends about $95 billion in remittances annually, part of a larger industry that, as the World Bank estimates, tops $626 billion.

The DDP said in its report that the streamlining of the transactions and the flow of funds across borders comes because “by utilizing a tokenized digital dollar as a bearer instrument, both messages and value can be transferred simultaneously between parties, reducing settlement risk and dependence on large pre-funded accounts.”

The CBDCs could conceivably flow between sender and received via digital wallets, which would broaden financial inclusion, said the DDP.

There’s been a continued shift to digital channels for cross-border transactions. Western Union posted mid-single-digit growth there and MoneyGram showed digital sales up 30% in recent quarterly reports. Direct, P2P payments are gaining ground across geographies and platforms. In another example from this year, Visa+, which allows P2P payments to be sent and received across different platforms via Visa+ Payname, which is a “receive” only personalized payment address.

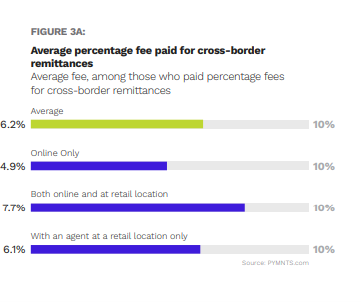

In September 2021, PYMNTS/Stellar Development Foundation noted in joint research that costs remained significant components of remittances. The average fee paid was 6.2% of the transaction, the data shows as seen in the chart below. The data shows 32% of cross-border remittances sent to friends and family in need and 50% of consumers sending online cross-border remittances used mobile wallets to do so — indicating that the stage may be set to use CBDCs to send money, with the digital wallet as the endpoint.