CE 100 Index Adds 1% as Porch Group Extends Post-Earnings Rally

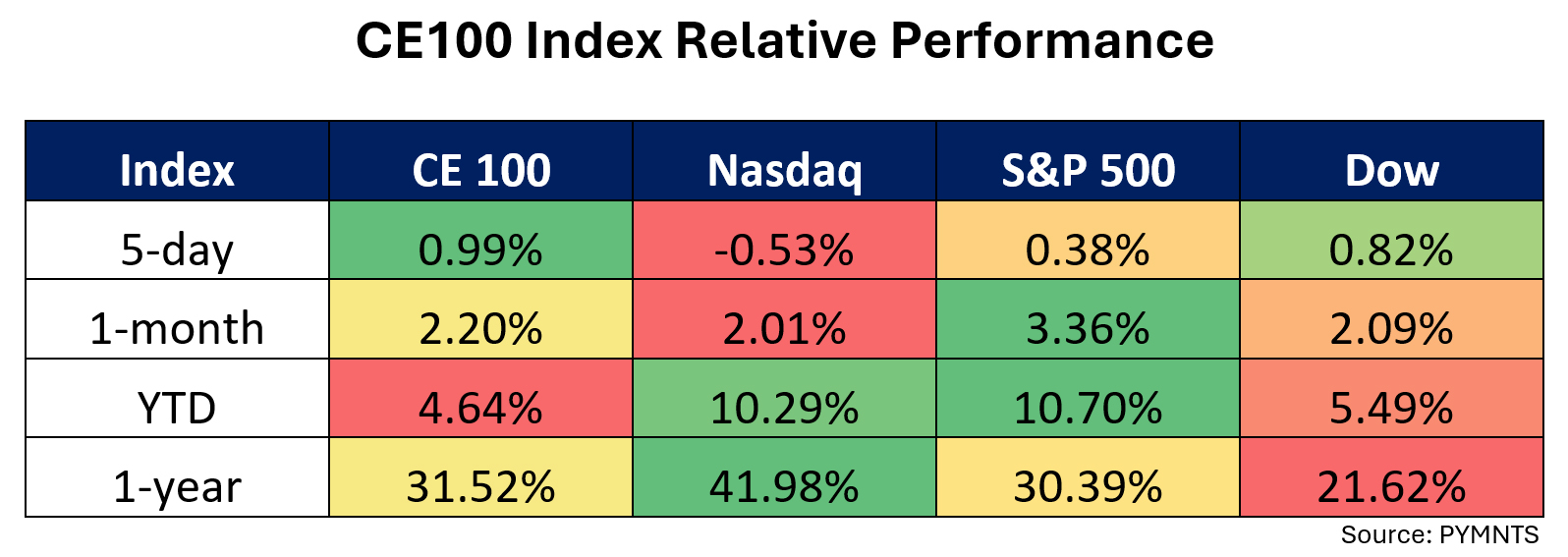

The CE 100 Index was 1% higher on the week, as a majority of pillars finished in the black.

Porch Group soared 14%, powering the “Live” pillar 1.7% higher and continuing a post-earnings rally that has seen the stock appreciate by roughly 40% in less than a month.

As we noted during earnings season, the company’s fourth-quarter revenue surged to $114.6 million, a 79% increase from the previous year. Adjusted EBITDA (a rough measure of cash flow) also spiked, reaching $11.7 million, a $25 million enhancement from the previous year.

At the time of the report, we noted that operational achievements such as a lower gross and combined loss ratio, the approval in 13 states to use Porch’s unique property data in insurance pricing, and the launch of new products underscore the company’s strategic focus on innovation and market expansion.

Shares of Domino’s gathered 8.4%, leading the “Eat” segment higher by 3.5%. According to news reports this past week, Domino’s Pizza Group will invest £11 million in DP Poland (DPP) to support growth opportunities in the region, where it operates more than 100 stores in Poland and Croatia.

PDD Holdings Loses Ground

PDD Holdings shares were 5.5% lower, as the “Shop” segment was down 0.8%.

PDD reported earnings that showed that total revenues in the fourth quarter of 2023 were $12.5 billion, up 123% from the same quarter a year earlier. PDD Holdings’ fourth-quarter revenues included $6.9 billion from online marketing services and $5.7 billion from transaction services, according to the company’s earnings press release. Those totals were up 57% and 357%, respectively, from the same quarter in 2022.

The company’s strategy has included broadening the selection of good quality products sold on its platforms and focusing its promotional efforts on premium consumer goods, Jiazhen Zhao, executive director and co-CEO of PDD Holdings, said during the company’s quarterly earnings call. Those goods include trending national brands, imported goods and high-quality products.

Meta and Nvidia Blunt Enabler Gains

The Enablers segment rose a muted 0.3%, blunted by losses as Meta shares slipped 4.7%. The European Union has initiated investigations into three tech giants — Google, Meta, and Apple — as part of its first probes under the Digital Markets Act, introduced in 2022.

Elsewhere, we reported that Meta will close Facebook News in the United States and Australia in April.

According to company updates, the number of people using Facebook News, a dedicated tab for news content, dropped by 80% over the last year in Australia and the U.S. In addition, news makes up less than 3% of the content people around the world see in their Facebook feed.

The company’s existing Facebook News agreements with publishers in Australia, France and Germany will continue until they expire, per the update. Agreements with publishers in the U.K. and the U.S. have already expired.

Nvidia’s slide followed on Meta’s heels, as the company’s stock gave up 4.2%,

We reported here that Nvidia rolled out a new series of artificial intelligence (AI) products at its annual developer conference in California earlier in March, as it strives to strengthen its reputation as the top choice for companies specializing in AI technologies.

Nvidia has also announced it is bringing its technology to Apple’s Vision Pro AR/VR headset. This move aims to allow developers to leverage Nvidia’s Omniverse tools within an AR/VR framework through the Vision Pro.