Snap’s 30% Surge Leads Positive CE 100 Index’s Momentum

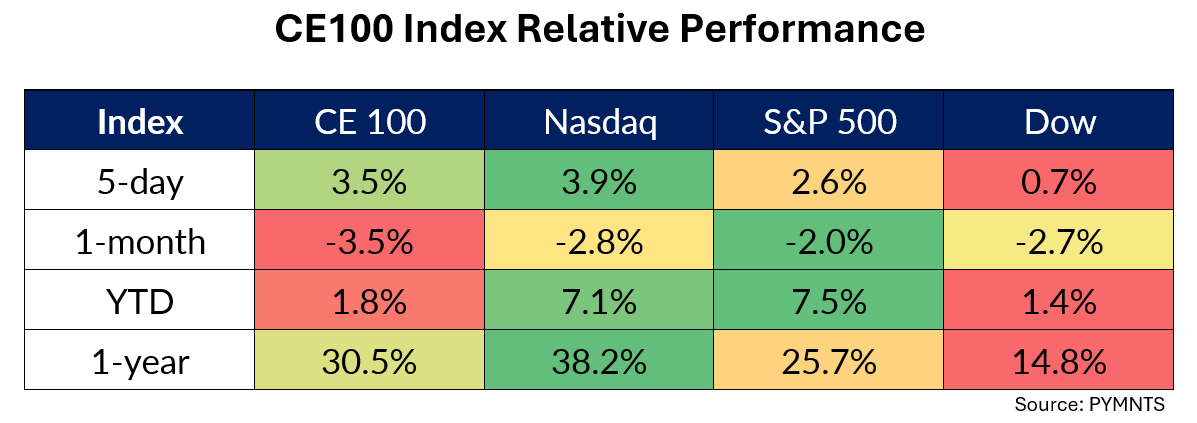

All pillars in the CE 100 Index posted gains for the week, as earnings spurred broad-based rallies.

Snap was up 30.1%, helping drive the Communications pillar up by 12.5%.

Snap Leads the Pack

As reported last week, Evan Spiegel, CEO, said that augmented reality (AR) will be “one of the most meaningful advancements in computing that the world has ever seen.” The remarks were made during the company’s earnings call, and management noted that, per presentation materials, 70% of the people who download Snapchat engage with AR during their first day using the app. Revenues were 21% higher during the most recent period to $1.1 billion. Daily active users (DAUs) were 422 million in the March quarter, up 10%, year over year.

Stride gained 18.6%, as the Live pillar added 5.3%. The company reported earnings that detailed a consolidated top line of $520.8 million, a 10.7% increase year over year. Revenues from its General Education segment were 14% higher, to nearly $329 million. Average enrollment was 9% higher. The company guided to 10% revenue growth for the year.

MongoDB surged 17.2%, as the Enablers segment was 5.1% higher. India’s Economic Times reported that, in the words of its CEO Dev Ittycheria, the company sees India as one of the “big growth engines … India is a great opportunity for us.” The opportunity is driven by generative AI, said the executive, who added that banks and commercial airlines, among others, are launching AI business models.

Some Double-Digit Decliners

Adyen dropped 15.3% on the week, holding the Pay and Be Paid segment’s gains to 2.8%.

“We think that we offer a premium proposition, and we price for that,” Ethan Tandowsky, chief financial officer at Adyen, said Thursday during the company’s quarterly earnings call. “I think it is really a strong proof point that these customers are willing to expand wallet share with us and bring more of their business onto the Adyen platform.”

Adyen’s unified commerce processed volume grew 30% year over year in the first quarter. The company’s platforms processed volume jumped 55% year over year. Adyen expects its annual net revenue growth up to an including 2026 to be between the low 20es and high 20s percentage points, according to the business update.

Xerox shares slipped nearly 15%, as the Work vertical was 1.5% higher. The company posted its most recent results, which indicated, as John Bruno, Xerox president and COO, said in remarks, “We experienced disruption across our organization this quarter.” Revenues were down more than 12% to about $1.5 billion. The company’s earnings release noted a 12.6% slide in the Print segment, while earnings materials detailed that “growth in services signings remains strong, particularly for our growing portfolio of Digital Services, as clients seek both digital and physical solutions to address their most important document workflow needs.”

Meta shares gave up 7.9%. As detailed last week, AI remains a critical component of the company’s strategic roadmap. CEO Mark Zuckerberg said during the call, “We’re building a number of different AI [artificial intelligence] services, from our AI assistant to augmented reality apps and glasses, to APIs [application programming interfaces] that help creators engage their communities and that fans can interact with, to business APIs that we think every business eventually on our platform will use.

“AI will help customers buy things and get customer support, it will write internal coding and development APIs for hardware, and a lot more,” he added.

Family daily active people (DAP) averaged 3.2 billion, marking a 7% increase compared to the previous year. Total revenue for the period amounted to $36.5 billion. Ad impressions within Meta’s Family of Apps experienced a significant uptick, rising by 20% year over year.