How Much Of The Consumer’s Paycheck Goes To Amazon?

In 2009, consumers first coined the term “Whole Paycheck” as a tongue-in-cheek way to describe the sticker shock many felt when looking at their receipts after a shopping trip to Whole Foods. Whole Foods is, of course, the organic grocery chain that Amazon bought for $13.7 billion in June 2017.

In 2018, the term can now be more legitimately used to define the portion of consumer spend and overall retail sales Amazon now captures given the expansion of its ecosystem.

The big difference, of course, is that Whole Foods got the moniker because of its high prices. Amazon is capturing more of a consumer’s paycheck because of its good prices, fast delivery and great service.

In other words, consumers like doing business with the company.

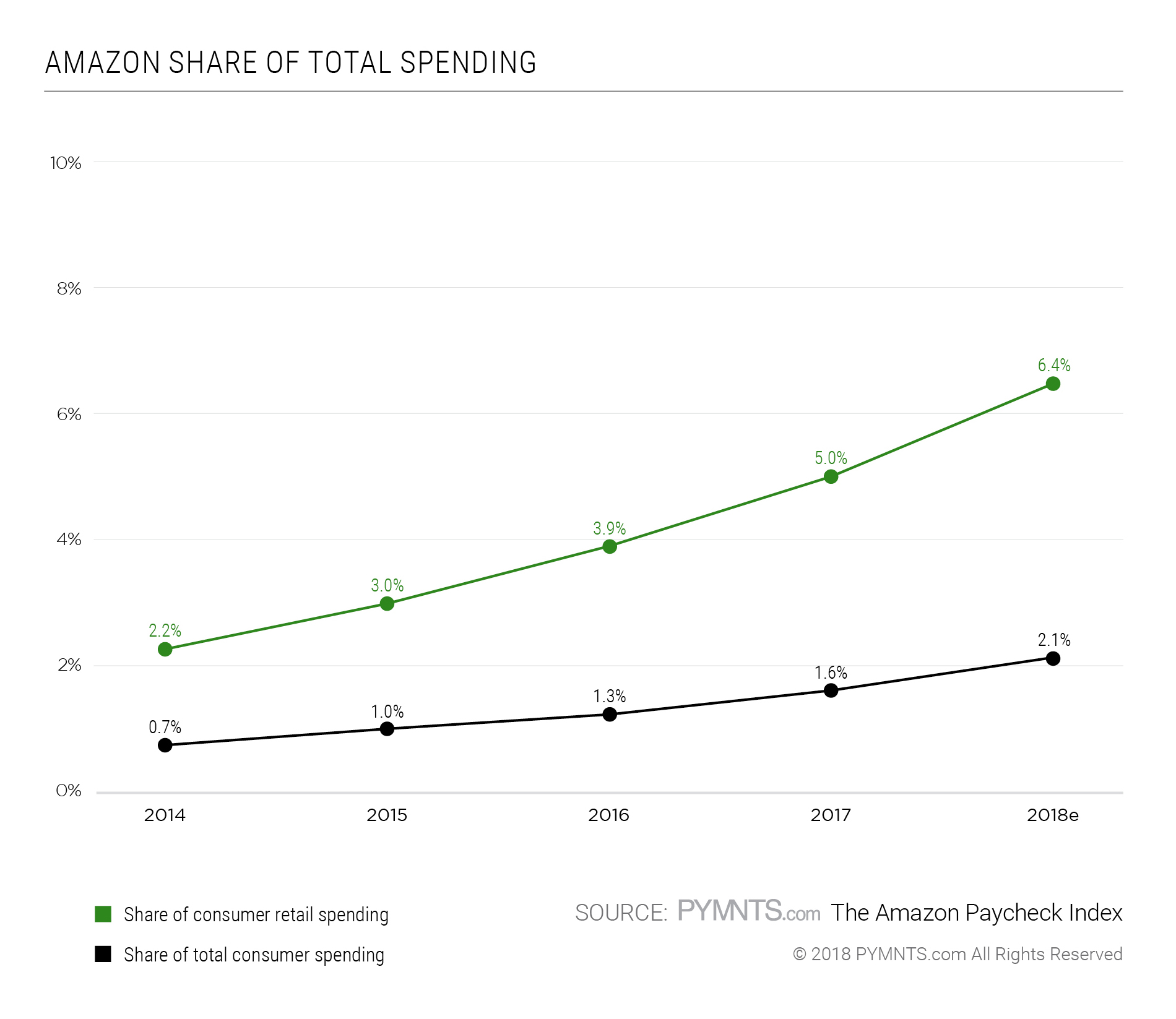

Based on detailed analysis by the PYMNTS research group, we estimated that Amazon now accounts for 2.1 percent of all consumer spend — some $1,320 of the total paycheck for a household that earns roughly $63,000 a year ($62,941, to be precise). We estimated average annual consumer spending for 2018 based on U.S. Bureau of Labor Statistics data from 2014 to 2017.

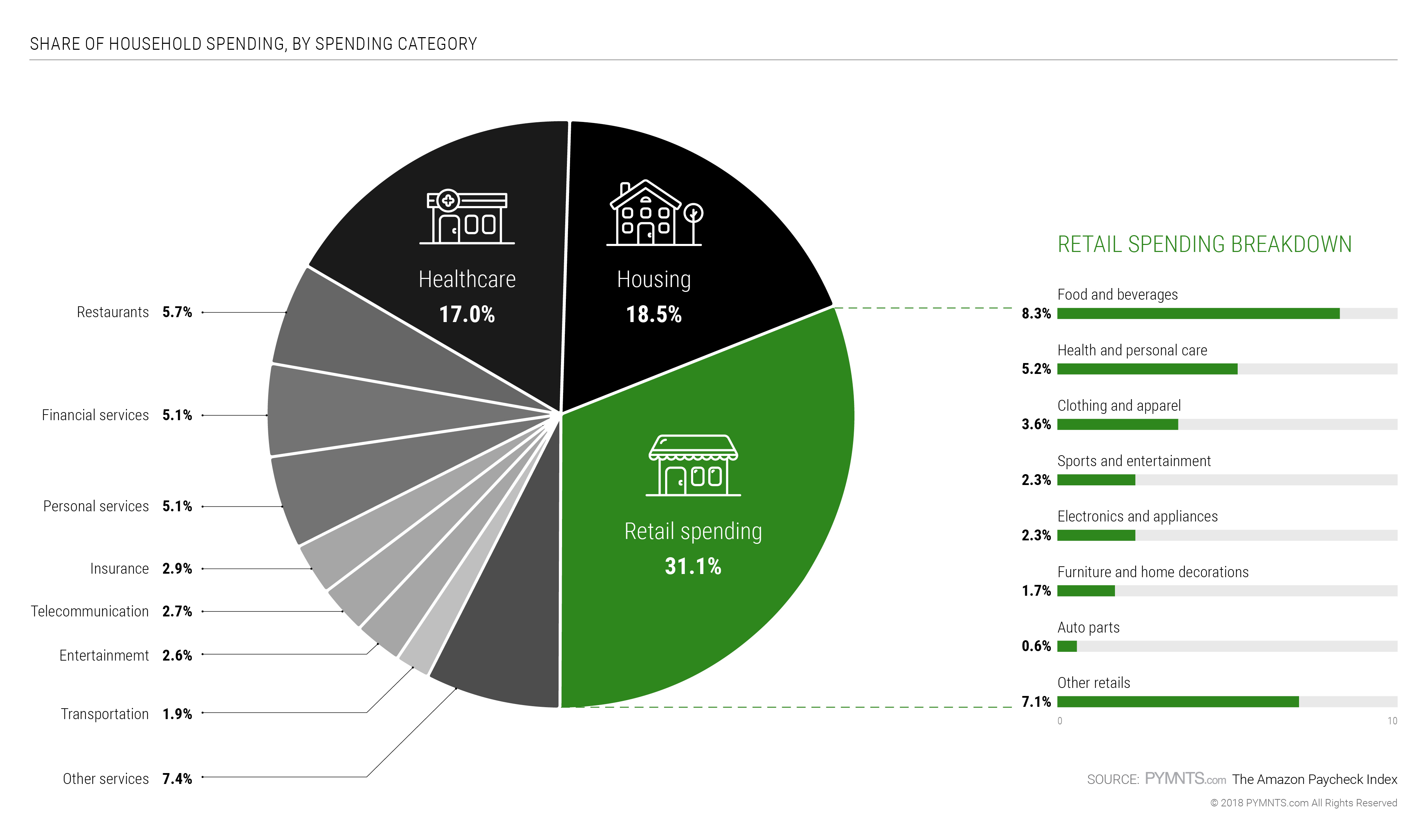

What’s driving that share of spend is the growing proportion Amazon has captured in the biggest chunk of it: retail. Retail spend captures about 31 percent of a household’s paycheck for things like food, clothing, electronics, healthcare products and furniture.

We estimated Amazon has, today, captured 6.4 percent of the $19,556 a typical household spends on those things — or some $1,243 annually.

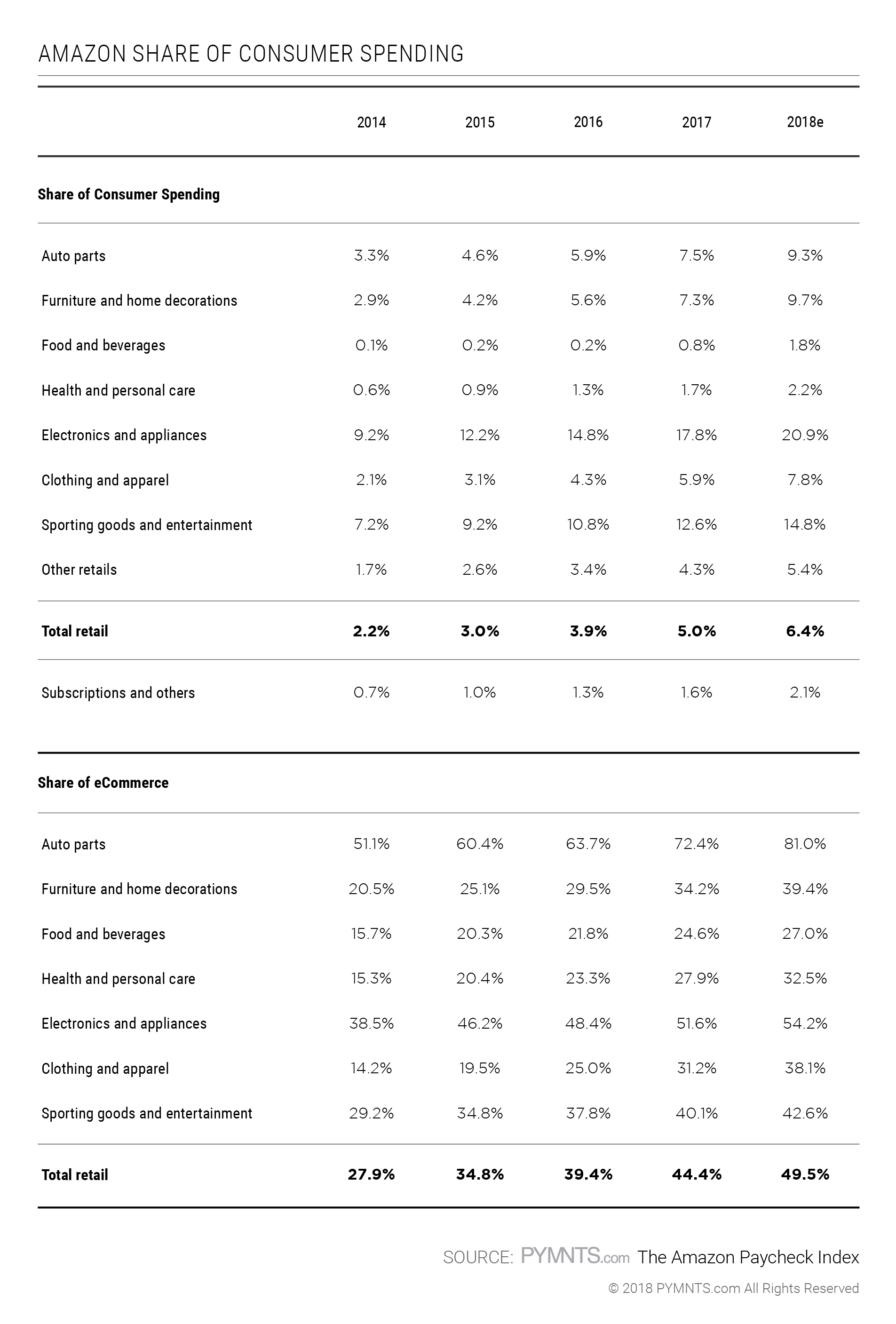

That share of overall retail spend has tripled over the last four years — growing from a 2.2 percent share in 2014 to the 6.4 percent we estimated today — a 30.7 percent CAGR over that four-year period.

Some of you reading this piece may say, “So what? Who cares? Big deal.” Amazon’s 2.1 percent of overall spend and 6.4 percent of retail spend is pretty puny.

The 2.1 percent is small as a percentage of overall spend, but the number has grown fast — remarkably fast over the last four years — accounting for an enormous chunk of eCommerce, which is humongous in certain categories as consumers shift their spend and as Amazon stays right there with them when they do.

That means Amazon has a lot of room to grow.

And lots more of the consumer’s paycheck to capture.

The Spending Nitty Gritty

Most of the time when people talk about the “Amazon Effect,” they talk in terms of the impact on traditional retail economics driven by the shift from offline to online sales and the impact of making free shipping table stakes.

However, the real Amazon Effect goes well beyond that.

I’ve always been fascinated with Jeff Bezos’ approach to methodically building a marketplace — now ecosystem — that tapped not only into what consumers might buy online, but also why they were buying those things in the first place.

Amazon started with books because it was a product everyone bought. Music followed for that same reason. Over the years, its product mix expanded as data about consumer spending behaviors on and off Amazon was examined — and actioned by the Amazon team — leveraging the assets Amazon had built and the trust consumers placed in it as a trusted commerce go-to.

That trust kept the flywheel spinning as Amazon expanded its inventory of things to buy and chipped away at essential product categories, including many household staples like diapers and batteries with its private-label brands and handmade, artisanal goods with Amazon Handmade.

Amazon’s expansion over the last four years has touched things bought or paid for online but consumed in the physical world — household and business services, food delivery with Amazon Restaurants, subscription fashion with Amazon Fashion, products for the home with Amazon Home and, more recently, even mattresses.

Given the shift that tracked with the types of things all consumers buy, I was curious to understand the “Amazon Effect” on how much of the consumer’s paycheck is now being spent with the company.

That’s what this analysis does.

The Amazon Paycheck Index is the result of many months of work by the PYMNTS research group using a variety of sources that track and report retail sales and consumer spending.

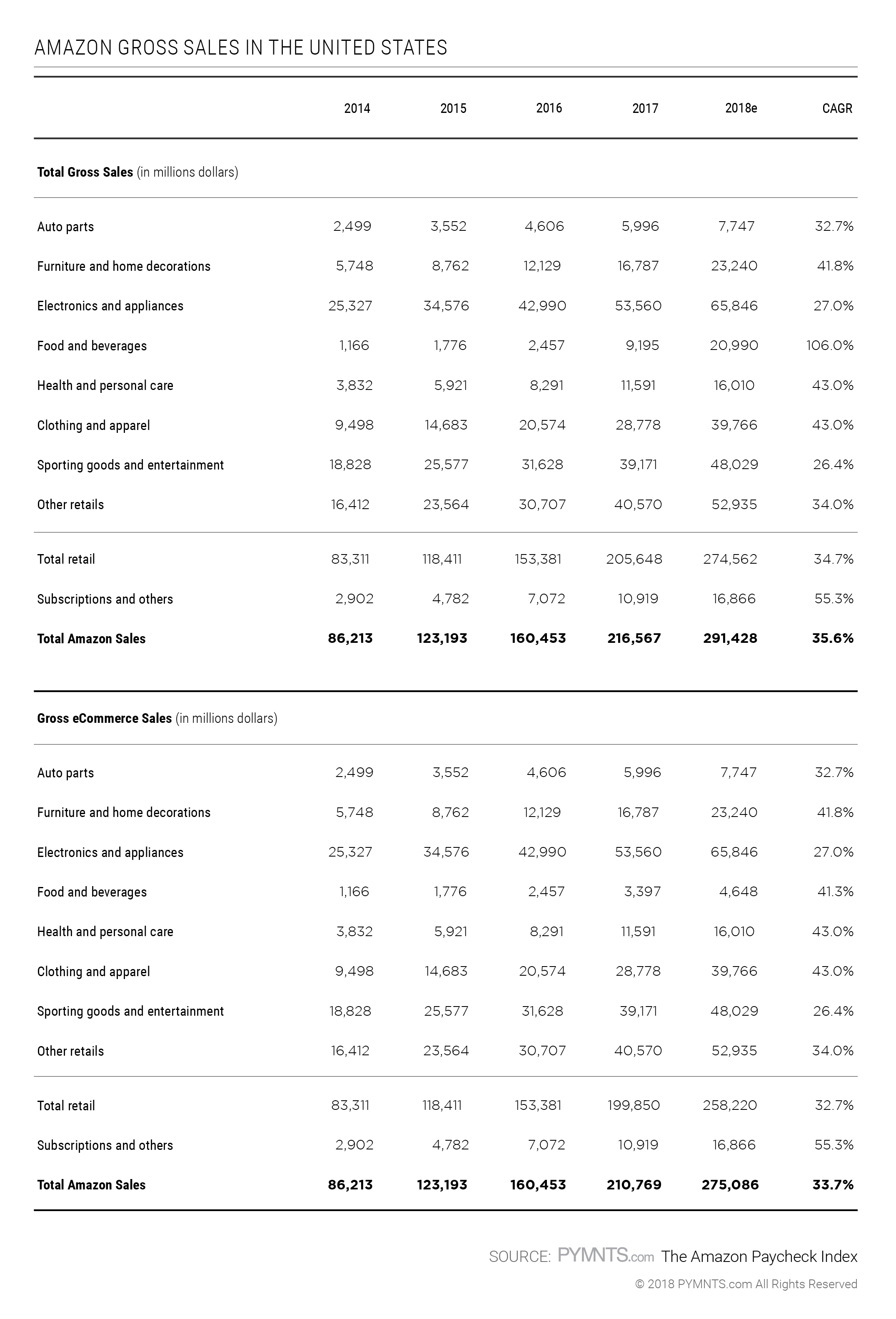

We used data from the U.S. Bureau of Labor Statistics for information on consumer household spending and Census data for information on sales across all categories of consumer spending, including retail sales. We used eMarketer data to estimate total retail sales by product category. We used Amazon’s 10-K for specific information related to Amazon sales and growth by category, taking care to represent sales of items sold by third-party sellers as the commissions Amazon receives, instead of the GMV of those products sold.

We then built a data model and used statistical techniques to refine the model and project 2018 numbers using conservative assumptions. We’ve tested and refined the model and believe it presents a very solid picture of how much consumers are spending with Amazon — because they want to.

Amazon’s Whole Paycheck

The 2.1 percent of all consumer spend that is now Amazon’s shouldn’t be all that hard to believe.

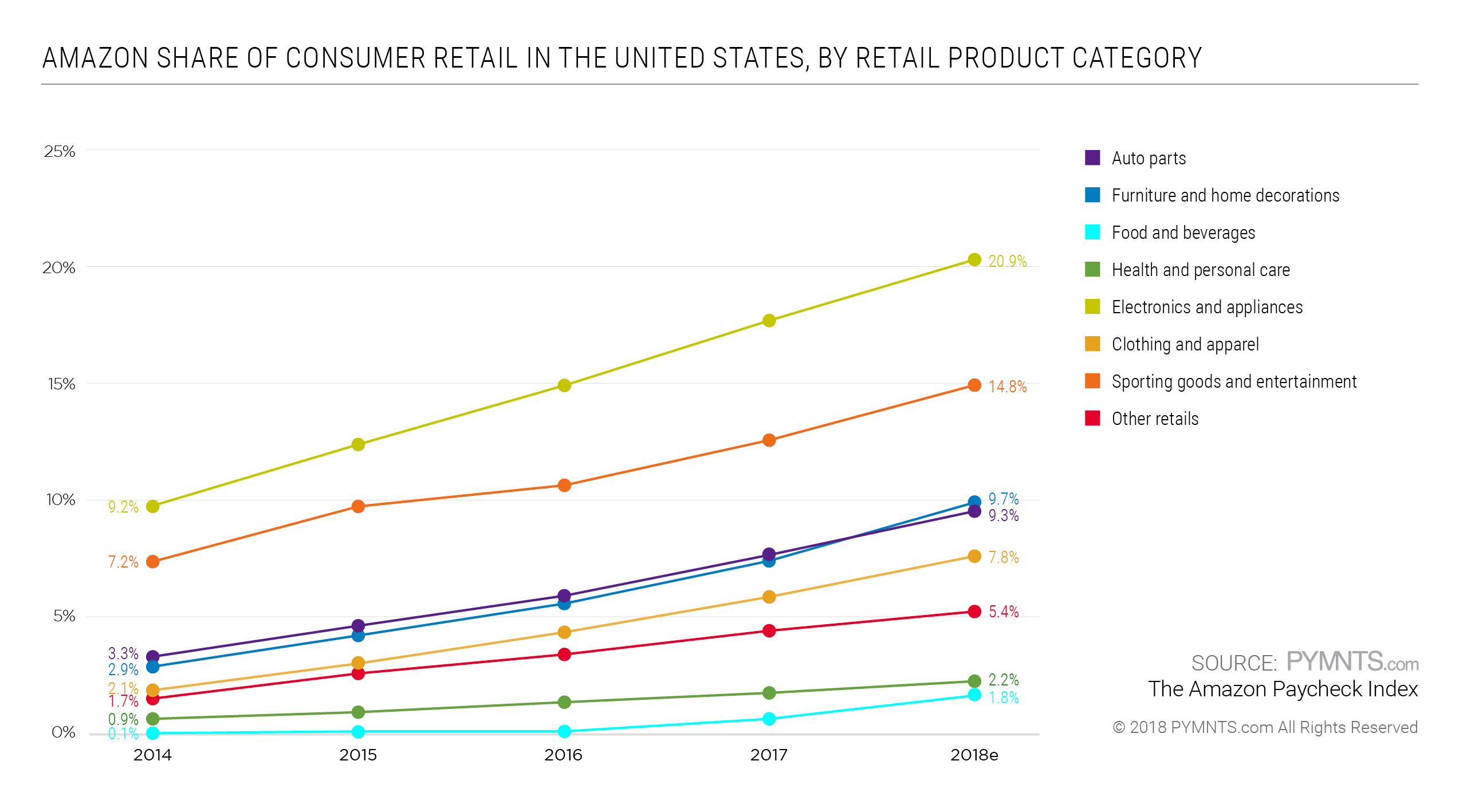

Over the last four years, retail sales have shifted to Amazon in key categories that were once the domain of the physical store.

Amazon now accounts for 20 percent of all electronics, 9.7 percent of home furnishings, 9.3 percent of auto parts, 7.8 percent of apparel and 5.4 percent of sporting goods (which includes books, music and hobbies) sales.

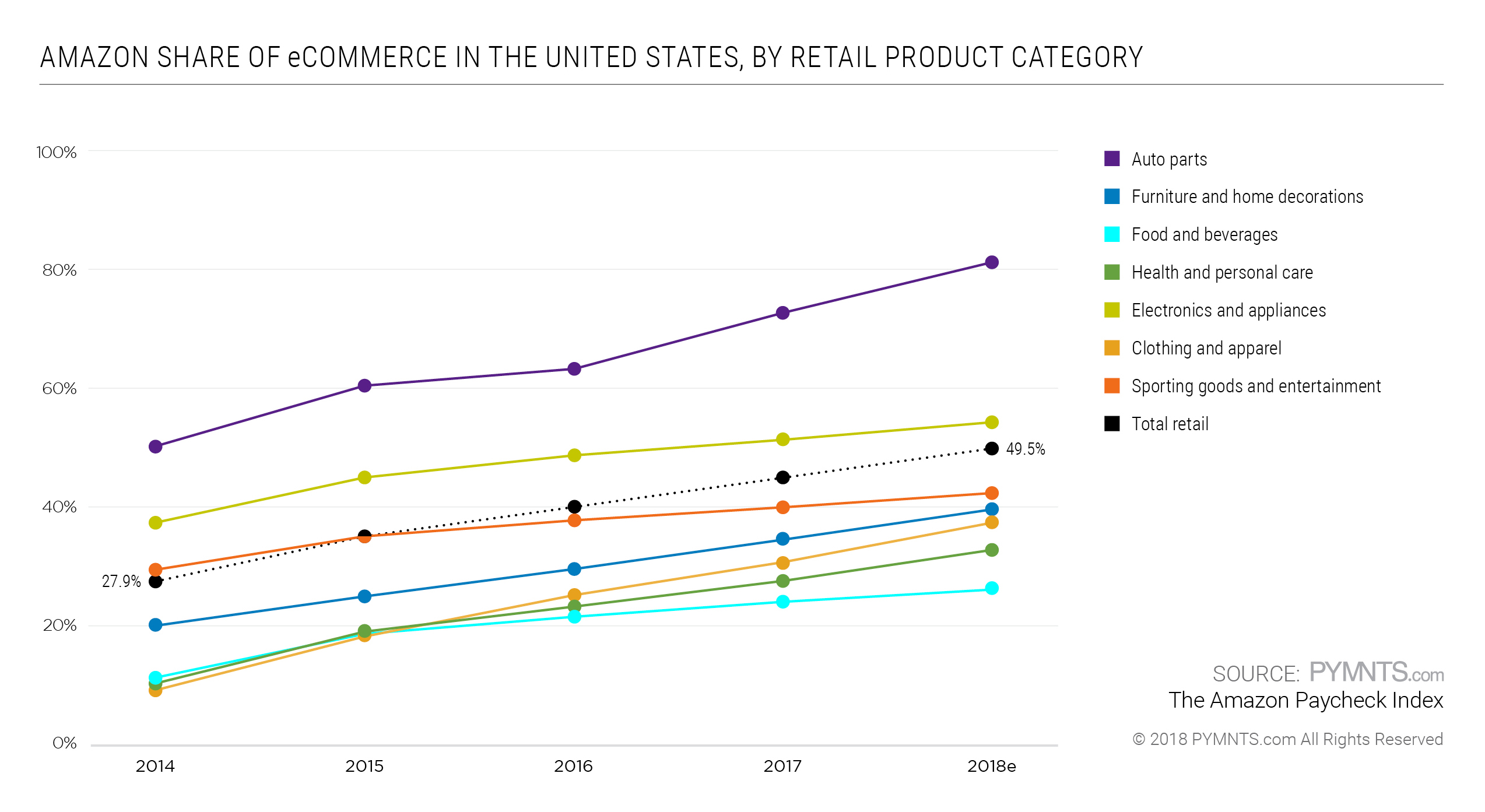

Looking at eCommerce share only, the picture is even more staggering, with Amazon taking a 54.2 percent share of electronics, 39.4 percent of home furnishings, 81 percent of auto parts and 38.1 percent of apparel accordingly, and 14.8 percent of sporting goods/books/music and hobbies sales.

By the end of 2018, Amazon, we estimated, will account for roughly 49.5 percent of all eCommerce sales.

Amazon Share of Retail Sales (Percent of Total Sales) by Retail Segment

Those numbers and that growth isn’t because consumers don’t have other places to shop or feel they’re trapped somehow into shopping at or with Amazon.

Or because Amazon is necessarily the cheapest place for them to buy things.

It’s because consumers say Amazon is the most convenient place for them to shop and buy things. Amazon has become the default for how consumers start their search for what to buy or where to buy the things they might see on the web.

Convenience that Drives Spend and Amazon Share

When I looked at this analysis, what left my jaw dropping was the sheer growth in Amazon’s sales across just about every retail category — and in just the last four years:

Clothing and apparel and health and personal care sales both grew at 43 percent annually, furniture and home furnishings sales at nearly 42 percent.

At a 32.7 annual growth rate over the last four years, Amazon is now the largest online seller of auto parts in the U.S.

Over the last four years, Amazon has expanded the inventory of products it carries via third-party sellers, added more perks for Prime Members and expanded the number of places off Amazon where consumers can use Amazon Pay to check out.

The Amazon Prime perk that started with free shipping has now expanded to include lots of other goodies that make being a Prime Member valuable and sticky: streaming services, discounts on other services and even a co-branded Chase/Visa card that gives consumers a 5 percent cash back incentive.

Clearly, what’s driving that spend and growth in share is the convenience consumers find when buying from Amazon online.

But it’s not just online anymore.

Over the last four years, Amazon has seen its sales of food and beverage products grow 106 percent — with most of that growth happening in the aftermath of the Whole Foods acquisition in 2017. Spending on groceries is the largest single driver of consumer spend in the retail segment, and Amazon doubled its food and beverage sales from 2017 to 2018 after quadrupling them the year prior. Food is a category we believe has the potential to capture more of the consumer’s spend over the next several years.

Amazon has opened Amazon Go stores in several cities to capture the food sales now going to convenience stores. Reports say that 3,000 more will open over the next several years.

Amazon also opened a store in SoHo that carries trending products sold online as well as those that receive the best ratings.

These physical storefronts offer special perks and goodies for consumers who are also Prime Members — and are used to acquiring and converting non-Prime consumers.

Over those four years, Amazon has also done something else: It has ignited voice commerce via Alexa. Alexa was first introduced via the Echo in November 2014. Since then, Alexa has made her way into a slew of voice-activated devices — both Amazon- and third-party-branded devices.

Alexa and her pervasiveness as a virtual assistant inside the consumer’s home, inside the car and, increasingly, wherever the consumer wants to take her has contributed to that shift in share of spend and only underscored the importance of voice as an enabler for commerce.

And Amazon’s importance as the consumer’s go-to ecosystem for commerce.

And Amazon Pay’s importance as the payment intermediary through which all these payments flow.

The Road to Whole Paycheck

The share of consumer spend that is now Amazon’s is even more remarkable when one considers that roughly 45 percent of a household’s paycheck today — some $29,000 — goes toward things Amazon doesn’t touch (yet).

Roughly 36 percent of a consumer’s paycheck in the U.S. is spent on housing (18.5 percent) and healthcare (17.0), with another 12.6 percent on insurance (2.9 percent), financial services (5.1 percent), telecom (2.7 percent) and transportation (1.9 percent).

Roughly 36 percent of a consumer’s paycheck in the U.S. is spent on housing (18.5 percent) and healthcare (17.0), with another 12.6 percent on insurance (2.9 percent), financial services (5.1 percent), telecom (2.7 percent) and transportation (1.9 percent).

Yet, however, is the operative word. Amazon has made investments in or created partnerships with key players to expand the scope of its services — and in areas that consume big chunks of essential consumer spend: healthcare through a joint venture with JPMorgan Chase and Berkshire Hathaway; housing through an investment in a pre-fab home builder and insurance via opening a digital insurance storefront with Travelers Companies just last week.

Yet, however, is the operative word. Amazon has made investments in or created partnerships with key players to expand the scope of its services — and in areas that consume big chunks of essential consumer spend: healthcare through a joint venture with JPMorgan Chase and Berkshire Hathaway; housing through an investment in a pre-fab home builder and insurance via opening a digital insurance storefront with Travelers Companies just last week.

The trust and convenience of buying from Amazon, coupled with giving consumers an easy and convenient way to pay, the perks of being part of the Amazon club and having access to a personal assistant that can now help sort out insurance coverage or (at some point) healthcare options or pay claims or book appointments could give Amazon a decided advantage in capturing more of what consumers spend on the things all consumers have to buy.

And in those segments where there are many options, and where consumers want a trusted intermediary to make it easy for them to decide and then buy: Amazon, Amazon Pay and Alexa.

That also might mean that we don’t really need Amazon to tell us what it plans to do next.

Instead, all we might need to do is to follow the money — money in the form of how the consumer is spending her paycheck — to get a sense of where Amazon — and the consumer’s paycheck — is headed next.