The United States is grappling with record-high consumer credit card debt of over $1 trillion, raising concerns about credit insecurity for both consumers and providers.

As a result, a significant share of consumers rely on overdrafts to meet short-term financial needs, cover unexpected expenses and maintain their purchasing power. However, this financial flexibility has come at a steep cost not just for low-income consumers, but for the nearly 70% of high earners who spent more than they had in their accounts and were charged fees.

“The Credit Accessibility Series: How Consumers Use Overdrafts,” a PYMNTS and Sezzle collaboration in which that finding is captured, showed that overdrafts have led to further financial hardships for consumers, exacerbating financial issues against a challenging backdrop of high inflation and rising costs.

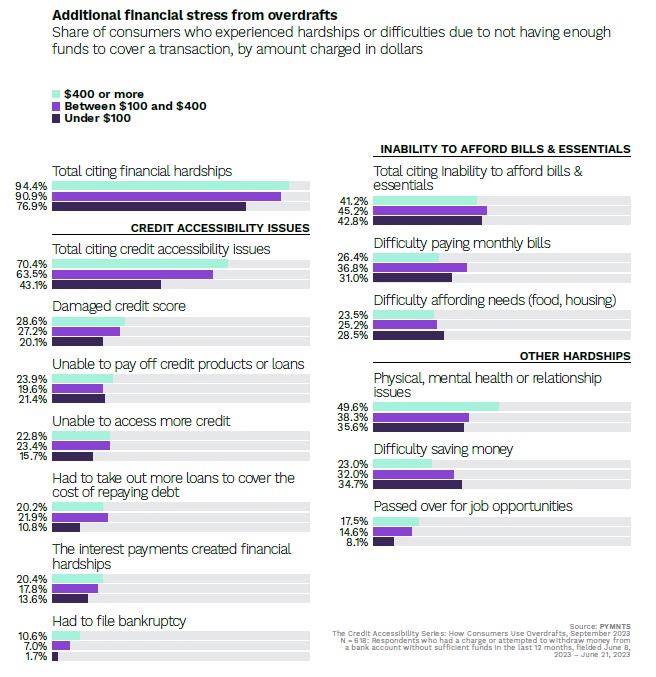

Overall, nine out of 10 survey respondents who struggle to cover charges to their accounts reported experiencing additional financial difficulties, while about 70% of overdrafts resulted in broader credit accessibility issues, per the study.

Moreover, consumers with multiple overdrafts each month faced a higher likelihood of experiencing financial hardship. For instance, 98% of consumers with multiple overdrafts reported some form of hardship, compared to 79% of those who only overspent once or twice a year.

Drilling down into the data further revealed that the dollar amount of overdrafts also played a role in the extent of financial hardships experienced by consumers. Consumers who used overdrafts to cover charges greater than $400 reported more hardships, including over 41% of consumers who cited problems paying bills and affording essentials.

Similarly, consumers who had at least $400 in charges reported facing credit accessibility issues, including damaged credit scores, challenges with interest payments and having to resort to more loans to cover the cost of repaying debt.

Additionally, some consumers reported having to file bankruptcy due to a lack of money to cover overdraft fees, further highlighting the financial burden consumers face from relying on overdrafts.

This finding aligns with data released by the Administrative Office of the U.S. Courts in July, which showed that bankruptcy filings in the country rose 10% in the year ending in June, compared with the previous year. This represented total annual bankruptcy filings of 418,724 during the period, compared with 380,634 cases the year prior. Of this number, non-business bankruptcy filings rose 9.5% to 403,000, compared to about 368,000 in the previous year.

The double-digit spike is worth highlighting given that filings “over any 12-month period have increased only rarely since filings peaked in 2010,” with bankruptcies falling “sharply after the pandemic began in early 2020,” per the data.