Household Pressures Mount as Revolving Card Debt Creeps Up

The American consumer still has some dry powder left when it comes to credit.

But the revolving balances we’re carrying — and which increased into the end of last year — will likely prove tougher for already-strapped households to handle as interest rates rise.

The Federal Reserve Bank of New York reported on Thursday (Feb. 16) that total household debt now stands at a record $16.9 trillion as of 2022’s fourth quarter, which is a nearly $400 billion gain — or 2.4% — from last year.

And with a bit more detail, the Fed’s data show that credit card balances surged by 6.6% to just under $1 trillion, as measured from the third quarter. The Fed said that, in terms of year-over-year growth, the increase in credit card balances between December of 2021 and December of 2022 was $130 billion, the largest annual growth on record.

Retail Cards and Personal Loan Balances Grow

As for retail card debt — that’s on the rise, too. Retail card debt is included in the category marked “other,” which also includes personal loans, and this metric was up $16 billion in the quarter.

The data also show that more borrowers are behind on their credit card obligations — at 18.3 million borrowers, which has outpaced the 15.8 million at the end of 2019. Total delinquencies, at 2.5% of the debt that’s out there in the field, is less than the 4.7% that had been seen before the pandemic.

But the delinquencies have been trending up, and younger borrowers in particular, the Fed said, are struggling to make payments. The stresses in retail card balances, we note, are indicated in data from the likes of Synchrony Financial. In our reporting on the company’s latest earnings, the company-wide delinquency rate was 3.7% compared to 2.6% last year, and Synchrony’s 90-plus delinquency rate was 1.69% versus 1.2% in the prior year. The fourth quarter net charge-off rate increased to 3.5% from 2.4% last year.

Elsewhere, the Fed data show that, along with the roughly $990 billion in credit card balances, the total credit card limits stand at about $4.4 trillion — so that leaves $3.4 trillion in available, as-yet-untapped credit.

The stats also give some insight into revolving debt: The revolving balance held by consumers was $340 billion in the most recent quarter, up from $320 billion in the third quarter (last year’s tally here was also $320 billion).

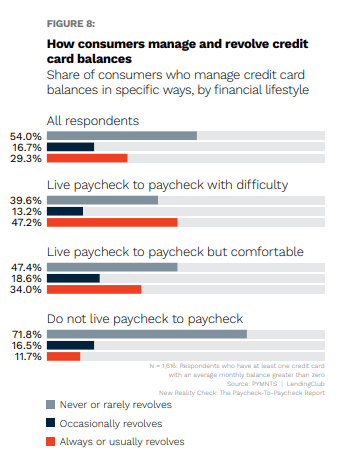

PYMNTS data show that the paycheck-to-paycheck consumers are three times as likely to revolve credit card debt and carry higher monthly balances — and as those balances become more expensive, along with higher interest rates, financial stress spreads (average rates on cards have topped 20%). Overall, the data show that 29% of credit card holders “always” or “usually” revolve their balances.

Among cardholders living paycheck to paycheck who responded to our survey, 34% of those without issues paying monthly bills and 47% of those who struggle to pay their bills “always” or “usually” have a revolving balance. The households that we’ve identified as “struggling consumers” also tend to nearly hit the average credit card spending limit of $4,700 with an average balance of $3,800 — so the dry powder as mentioned above is not as extensive as might be thought.