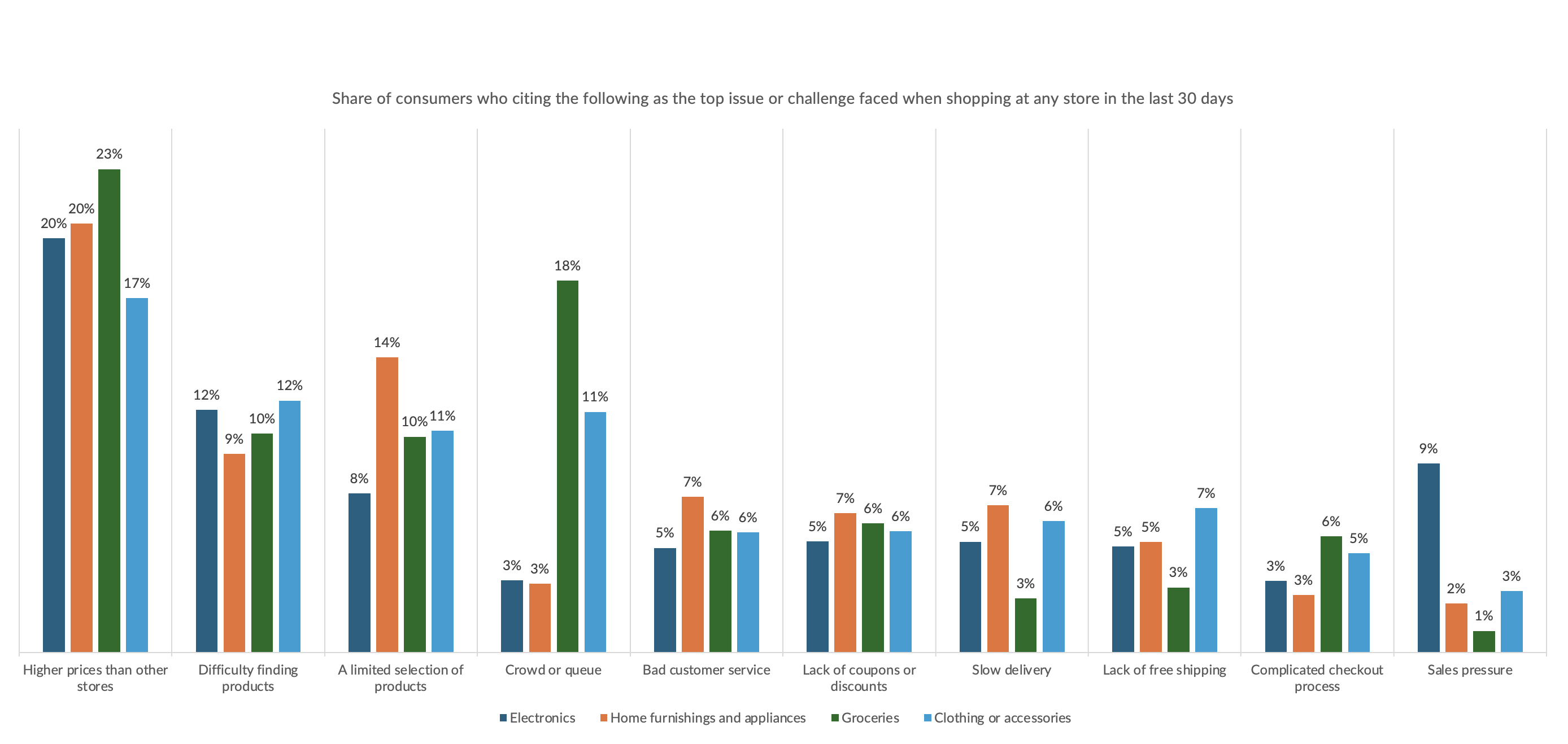

23% of Grocery Shoppers Alienated by High Prices

As grocery shoppers look to find the merchant best suited to their needs, a significant share of customers find themselves put off by higher-than-expected prices, threatening their loyalty.

By the Numbers

The PYMNTS Intelligence report “The Online Features Driving Consumers to Shop With Brands, Retailers or Marketplaces,” created in collaboration with Adobe, drew from an October survey of more than 3,500 U.S. consumers to better understand their actions, choices and behaviors when they shop online.

The study found that, among consumers who had purchased groceries in the previous month, 23% said that facing higher prices than other merchants was the top issue or challenge faced in the process. This share is greater than those who said the same in any other industry and greater than those who said the same of any other difficulty purchasing groceries.

Meanwhile, another 18% cited the crowds or lines as the top challenge they faced, 10% cited difficulties finding the products they wanted, and an additional 10% cited the limited selection of products.

The Data in Context

Noting the tendency of high prices to alienate consumers and conversely the power of bargains in attracting them, retail giants Walmart and Amazon are competing to offer the lowest grocery prices.

“We have almost 7,000 (price) rollbacks. That’s really helping. In our food categories, we see an even larger spread between eating at home, preparing meals at home, and eating out, which we think can help Walmart over the remainder of the year,” Walmart CEO Doug McMillon told analysts on the company’s most recent earnings call in May.

Meanwhile, also in the spring, Amazon Fresh, the eCommerce behemoth’s mass-market grocery division, began rolling out discounts of up to 30% on 4,000 items. The PYMNTS Intelligence report “Whole Paycheck Report: New Consumer Spend Data Finds Amazon Way Ahead of Walmart” found that by the end of last year, Walmart captured 18.9% of food and beverage consumer spending, while Amazon increased its share to 2.9% from 2.6% in the previous quarter.