The Walmart/Amazon Whole Paycheck Matchup

Walmart’s Q3 earnings last week was a story of strong digital sales and 16 consecutive quarters of same-store sales growth. Consumers, executives said, continue to walk into Walmart stores and add more things to their shopping baskets.

That’s a lot of feet – belonging to some 140 million consumers globally (100 million or so in the U.S.), who each week walk into one of those physical stores, in addition to the 100 million who are said to shop one of the retailer’s online channels. Walmart’s strong digital growth, at 43 percent last quarter, has now propelled has now propelled Walmart to within spitting distance of the No. 3 post position, displacing Apple, at roughly 4 percent of retail sales.

All of those things are precisely what Sam Walton staked the Walmart brand on 56 years ago when he opened the first store in Bentonville, Arkansas. The brand was built on keeping prices low, and stocking shelves with a variety of merchandise categories that would keep consumers coming back week after week. That combination, he believed, would capture a healthy share of the consumer’s paycheck – and keep Walmart’s bottom line healthy, too.

Yet, despite these strong Q3 results, investors weren’t wowed: Walmart’s stock dropped 2 percent on news of its earnings on Thursday, and another 2 percent on Friday.

Maybe that’s because they are looking around the corner, beyond this most recent quarter, and are worried about what they see: that Walmart’s healthy share of paycheck is being challenged by another retailer whose “customer as boss” mantra and commitment to low prices and stocked shelves is just as important as it was for Sam Walton 56 years ago.

That retailer is, of course, Amazon.

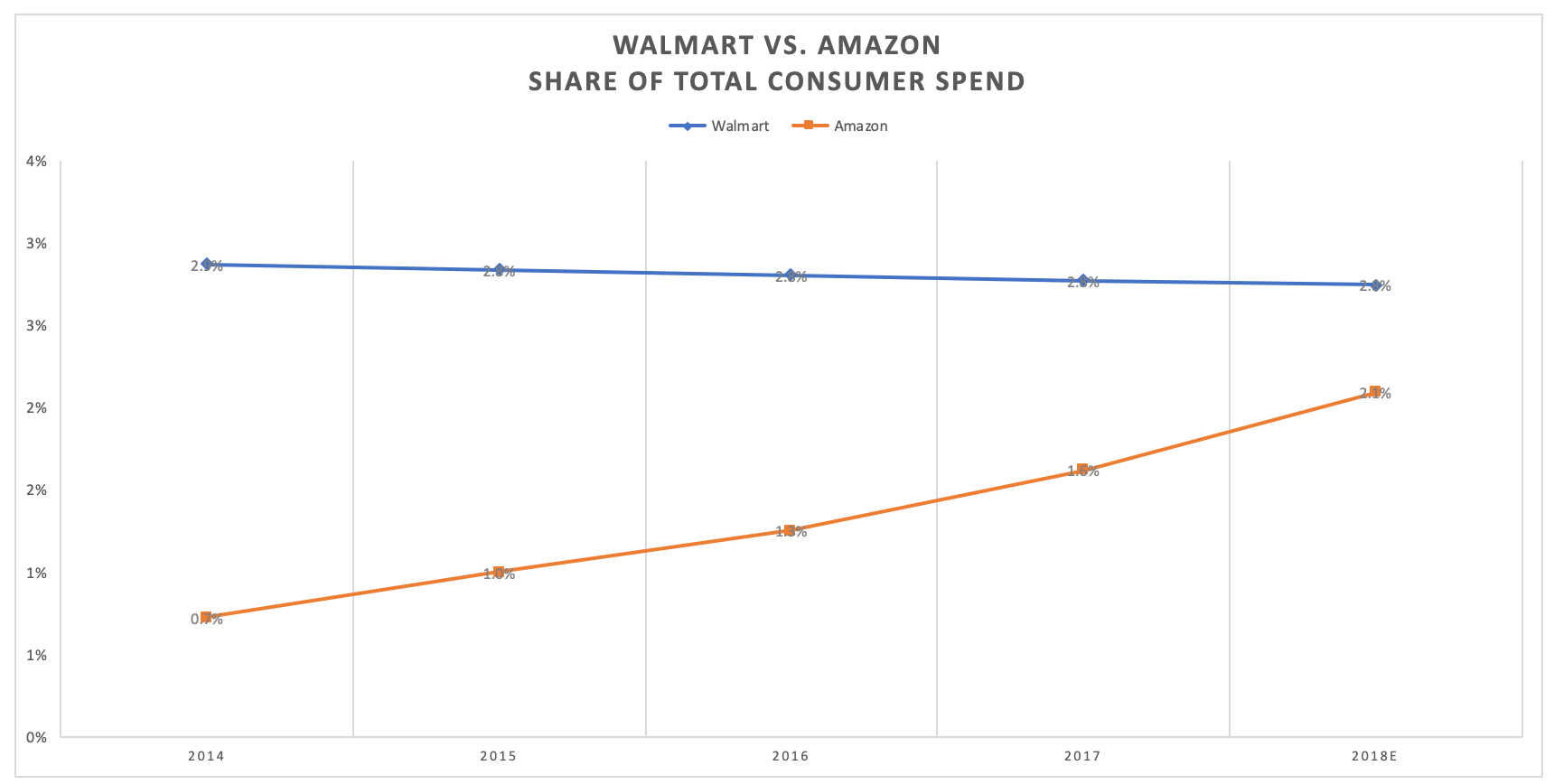

Today, based on brand-new PYMNTS proprietary analysis, Walmart accounts for roughly 8.9 percent of consumer retail spending in the U.S. and 2.8 percent of all consumer spending in the U.S.

That probably sounds pretty good.

Until you look at this chart.

At 6.4 percent and 2.1 percent, respectively, Amazon is nipping at the heels of Walmart’s share of consumer spending. Perhaps more troubling for Walmart, however, is that Amazon’s share of spend, overall and within retail, has grown rapidly over the last four years.

Walmart’s has remained relatively flat.

Source: PYMNTS.com

Source: PYMNTS.com

Based on our analysis, that spending share gap will close even more rapidly, given Walmart’s increasing loss of share to Amazon in many of the key categories that drive big chunks of consumer retail spending today.

And the investments that Amazon is making in other areas outside of retail account for large chunks of the consumer’s paycheck overall, and will continue to do so in the years to come.

The Battle for the Consumer’s Whole Paycheck

PYMNTS first published the Amazon Whole Paycheck Index a month or so ago – driven, in part, by my curiosity over the degree to which consumer spend was being redirected toward Amazon and its growing consumer and retail footprint, and away from more traditional retail channels.

That curiosity was piqued by my walks to the office when I am in town (I live in Beacon Hill in Boston) and my mental counts of the number of Amazon boxes I see out on trash day. Last holiday season, by my own informal and non-statistically relevant methodology, I estimated that seven out of every 10 households on Beacon Hill shopped Amazon for the holidays.

In an effort to be much more scientific and reliable, our data teams built a sophisticated statistical model to measure what we coined the Amazon Whole Paycheck phenomenon.

We started with census data to estimate how much households in the U.S. spent, overall, in 2018 across all spending categories.

That’s $62,941.

We then drilled into how that spend is allocated across different spend categories. The lion’s share of that $62,941 – 31 percent – is spent on retail purchases (food, electronics, clothing, etc.). Housing (18.5 percent) and healthcare (17.0 percent) round out the top three.

Source: PYMNTS.com

We then created a proprietary data model, using a variety of data sources and statistical techniques to calculate the “paycheck index” for both Amazon and Walmart.

The story of the Amazon Whole Paycheck Index is here, which I’ll come back to in a minute, so let’s instead focus on Walmart Whole Paycheck numbers.

Here’s Walmart’s share of consumer spend by retail product category.

Source: PYMNTS.com

You might be thinking, hey, this looks pretty strong – incredibly strong, in fact – in the segments that drive a big chunk of consumer spend, like food, auto parts, furniture/home furnishings, clothing and even health/personal products.

You would be right.

Food and healthcare account for about 44 percent of all retail spend. And adding electronics, auto parts, clothing and home furnishings into the mix, the percent of all retail spend attributed to those categories climbs to about two-thirds.

Walmart looks well-positioned in mostly all of them.

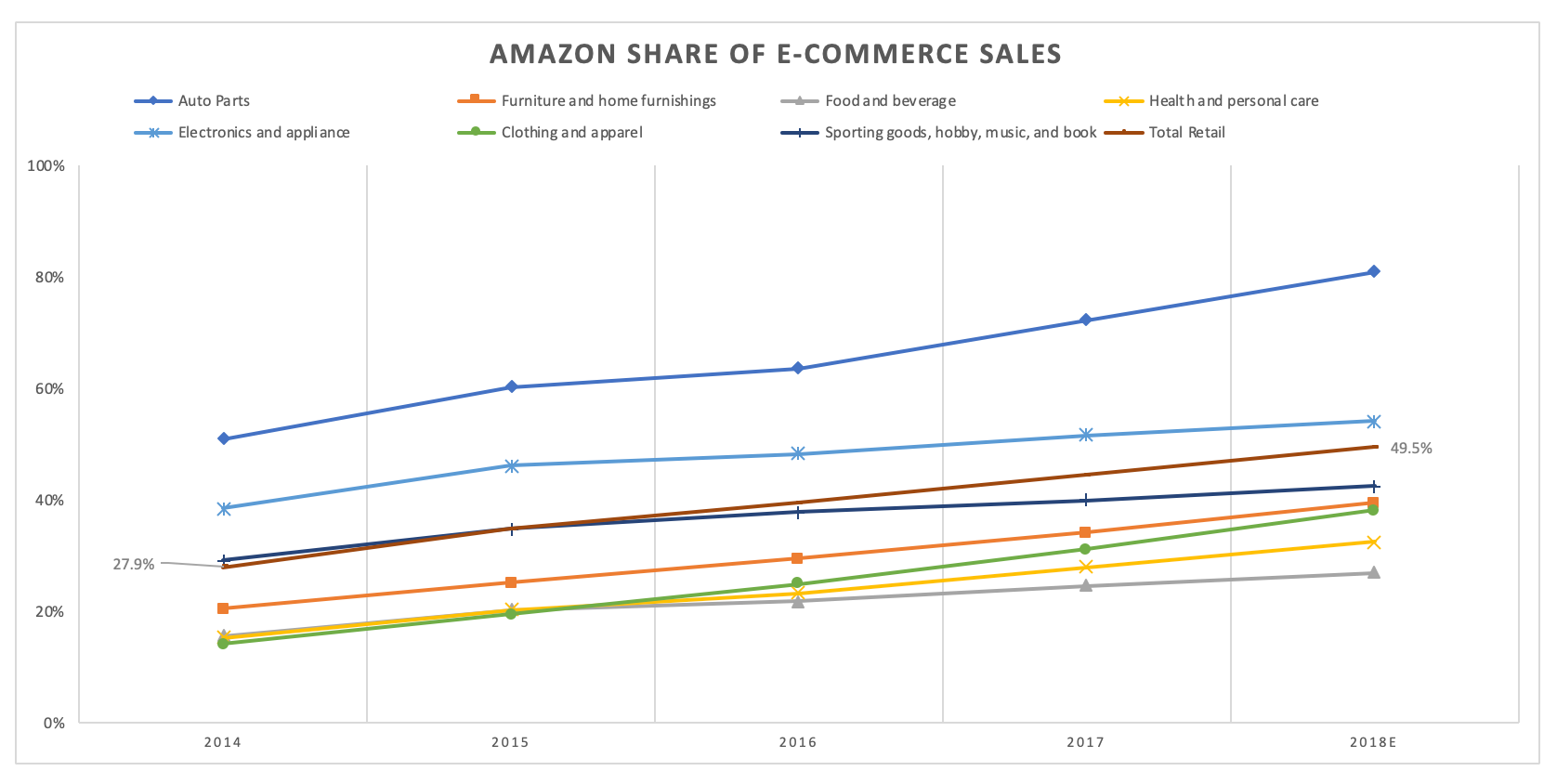

Until you look at this chart.

Source: PYMNTS.com

You don’t have to be a math whiz kid to note that the slope of the lines on this chart and those on Walmart’s look remarkably different.

Walmart’s are largely flat, and Amazon’s are rising – in every category.

For Amazon, the slope of those lines is moving up and to the right, rapidly, in the categories that are helping them close the total spending and total retail spending paycheck gap with Walmart.

That makes the story of the Amazon Whole Paycheck Index not so much about the percentage of spend – since one could argue whether 2.1 percent of total spend or 6.4 percent of all retail spend is too high or too low or maybe just about right.

But the remarkable annual growth rate (CAGR) that Amazon has achieved over the last four years has been in segments that represent the big chunks of that spend: grocery (at 106 percent), auto parts (at 32.7 percent), furniture/home furnishings (at 41.8 percent), clothing (at 43 percent), electronics (at 27 percent) and health and personal care (at 43.0 percent).

Minding the Whole Paycheck Gap

The consumer spending share gap between Walmart, the biggest retailer by market cap, and the world’s largest digital retailer is being narrowed by three things.

First, the rapid growth in online sales, of which Amazon has a 50 percent share.

When it’s easier to do so, consumers now buy things online – and with Amazon about half of the time. That’s either by shopping on the Amazon marketplace, via one of the brands that it now owns – Zappos or Shopbop, for example – or via one of the 80 or so private-label brands that it now operates.

For Walmart, landing the spot of No. 3 largest etailer in the world sounds great, until you realize that the gap between it and the No. 1 player – Amazon – is bigger than the Grand Canyon today, despite Walmart’s own impressive growth story of late.

Source: PYMNTS.com

It’s a growth story, though, that’s tempered by Amazon’s acquisitions in segments that drive large chunks of consumer spend, and also drive feet into Walmart stores: grocery with Whole Foods, and healthcare/prescriptions with its $1 billion acquisition of PillPack in June of 2018.

Then there’s the pervasiveness of Alexa and the consumer’s growing adoption of voice as a commerce enabler. PYMNTS’ latest How We Will Pay study, done in collaboration with Visa, highlights the universal appeal of voice – 28 percent of all consumers own a voice-activated device, and 27 percent of those use it to make purchases. That is a remarkable adoption curve in just four years, and a use case that will increasingly serve as a commerce tailwind for Amazon the more places that Alexa turns up. Walmart’s voice story is entirely dependent on the adoption curve of Google and Google Assistant, and the ecosystem beyond Walmart that will give consumers a reason to opt into Google and not Alexa.

If you’re Walmart, these charts – and those facts – are downright scary.

According to our analysis, Walmart has already ceded ground to Amazon in the clothing and electronics categories – sporting, books and music, too. Home furnishings is literally neck and neck (Walmart at 10.5 percent and Amazon at 9.7 percent), given Amazon’s rapid growth over the last four years, and the recent launch of its own private-label furniture line.

All of this makes the Walmart/Amazon rivalry over who will be the biggest, baddest retailer of them all about one and only one thing: who will be the biggest, baddest player in grocery and health-related services, where 44 percent of all retail spend in physical stores still holds sway – at least for now.

Where the Whole Paycheck Battle Will Be Fought

Grocery has always been Walmart’s bread and butter – pun intended. But over the last four years, its share of that consumer spend has remained largely flat at 18.5 percent.

But largely flat is all relative, since grocery represents more than half – 56 percent – of all Walmart’s sales. That makes that 18.5 percent an enormous number. It’s a number that also includes 18 percent of all SNAP food stamp redemptions, with Walmart reportedly as the largest individual recipient of that program.

Walmart is keenly aware that grocery and competitive grocery prices are what get consumers into the Walmart stores, and are driving sales and investments in innovations to keep consumers coming back.

For instance, curbside pickup is now, or soon will be, available in 40 percent of all Walmart stores in the U.S., and the acquisition of Jet.com has helped Walmart bolster its online grocery sales. Plus, their investments in services and partnerships have helped to solve for last-mile delivery logistics.

Source: PYMNTS.com

It’s no surprise, then, in looking at this chart, why Walmart has made grocery its focal point.

And why Amazon acquired Whole Foods.

For Amazon to make a dent in the roughly 8 percent of consumer spend that is food and beverage, the retailer needed a physical store footprint to meet the consumer where she buys groceries today – and where distribution centers for grocery delivery could be easily accessible.

The grocery gap between the two, for now, is enormous.

But all food dollars may not be created equally right now, and the share of consumers who are buying groceries online across all age groups in growing by double digits. And today, when consumers think about what to eat for dinner, they aren’t always looking for what’s in the fridge from the last grocery run to cook. Prepared foods, meal kits and delivery services are all now very much in the mix, requiring both Amazon and Walmart to adapt their offerings through their grocery store beachheads to accommodate those changing preferences.

Source: PYMNTS.com

Then there’s spend on health and personal care, which today captures 5.2 percent of consumer spend, and growing. It’s an area where Walmart leads Amazon in terms of share of consumer retail spend, but where the gap appears to be narrowing – and where Amazon is also growing quickly.

Today, Walmart is the fourth largest pharmacy operator in the U.S., driving more than $20 billion annually in pharmacy sales. Filling and refilling prescriptions is not only an important revenue driver, but also a big contributor to store foot traffic and those larger basket sizes.

Health and personal care is also where Walmart is making investments to remove friction and create stickier consumer relationships. The retailer has made the Walmart app more Rx friendly, and opened express lanes in stores to reduce the amount of time people spend waiting in lines for refills. Walmart now operates 19 clinics inside its stores to attend to routine, non-emergency health-related matters.

Over the years, Walmart has launched programs with incentives for consumers to eat healthier and visit the doctor, combining pharmacy refills and doctor’s visits with a chance to drive more spend across all of Walmart. For example, women on Medicaid who maintain a regular schedule of prenatal doctor’s visits get incentives to buy specific items at Walmart to keep themselves and their babies healthy. Others with chronic health conditions, such as diabetes or hypertension, are given similar incentives. And as the largest employer in the U.S., Walmart is working with insurance companies to reduce the cost of healthcare – and premium costs – for its 2.2 million employees by creating programs with similar incentives.

At about $100 million in annual revenue, Amazon’s PillPack acquisition has a long road to hoe to best Walmart’s hold on the share of the consumer’s paycheck dedicated to prescription refills. But there’s a reason that when the news was announced, the shares of major drug distributors took a market cap hit of $13 billion, just as the market cap of the major grocery chains took a $22 billion hit when Amazon announced it was buying Whole Foods in June of 2017.

Once the PillPack acquisition is cleared this year, Amazon will be set up to fill online prescriptions for consumers in 49 of the 50 states. That threatens existing distribution outlets like traditional drug stores – including Walmart, who was said to be a PillPack suitor but rebuffed.

The market’s reaction to the PillPack news reflects its expectation for Amazon to become a force by making prescription refills as easy as shopping online, and to make next-day or same-day delivery a competitive advantage.

Of course, Amazon, too, is investing in other aspects of healthcare and health-related products, ranging from the online sales of medical equipment to a joint healthcare venture with JPMorgan Chase and Berkshire Hathaway that will reinvent healthcare delivery for first their collective workforces, and then for who knows who else once the model is in place.

To the Consumer Go the Spending and Paycheck Spoils

Looking at the share of consumer spend overall, and by retail category, is a new and interesting way to see how Walmart and Amazon are each playing to their strengths and placing their bets on how to keep and grow that share.

What seems clear is that both Walmart and Amazon recognize that consumer choice will never just be about one channel versus the other, but about who can deliver what they want with the least amount of friction.

And that’s increasingly in categories where inspecting things in the physical store no longer seems to be all that important. One needs only to look at Amazon’s share of clothing and accessories or home furnishings to see how real that consumer reality has become.

That’s why we’ll keep our eyes peeled on the two big sectors that will decide how this retail rivalry plays out – food/grocery and health/personal services – and how each will make investments to better their score, and the role that logistics will have in deciding how all of this ends up.

As both Sam Walton and Jeff Bezos know well, the consumer is the boss. And it’s the consumer who will decide how it all shakes out.