No one really knows the origin of the phrase “seeing is believing.” The Oxford Dictionary traces its English language roots to 1609. Others say that it was the Ancient Greeks who first connected the act of seeing something with knowledge. Regardless, it’s largely the case that what people see is what people believe. And what they believe shapes their behavior — and the actions of those who’d like to influence it.

It’s a fitting aphorism as the financial world eagerly awaits the September CPI report, which will drop on October 12th. Consumers, on the other hand, could not care less.

Whatever the monthly percentage is and whether it is up or down from the month before isn’t relevant to them. The average American’s view of inflation and the inflation rate is shaped by their costs — what’s left in their checking account after they buy the basics, pay the mortgage or the rent and their monthly bills — not the government’s monthly inflation report card for what’s true on average.

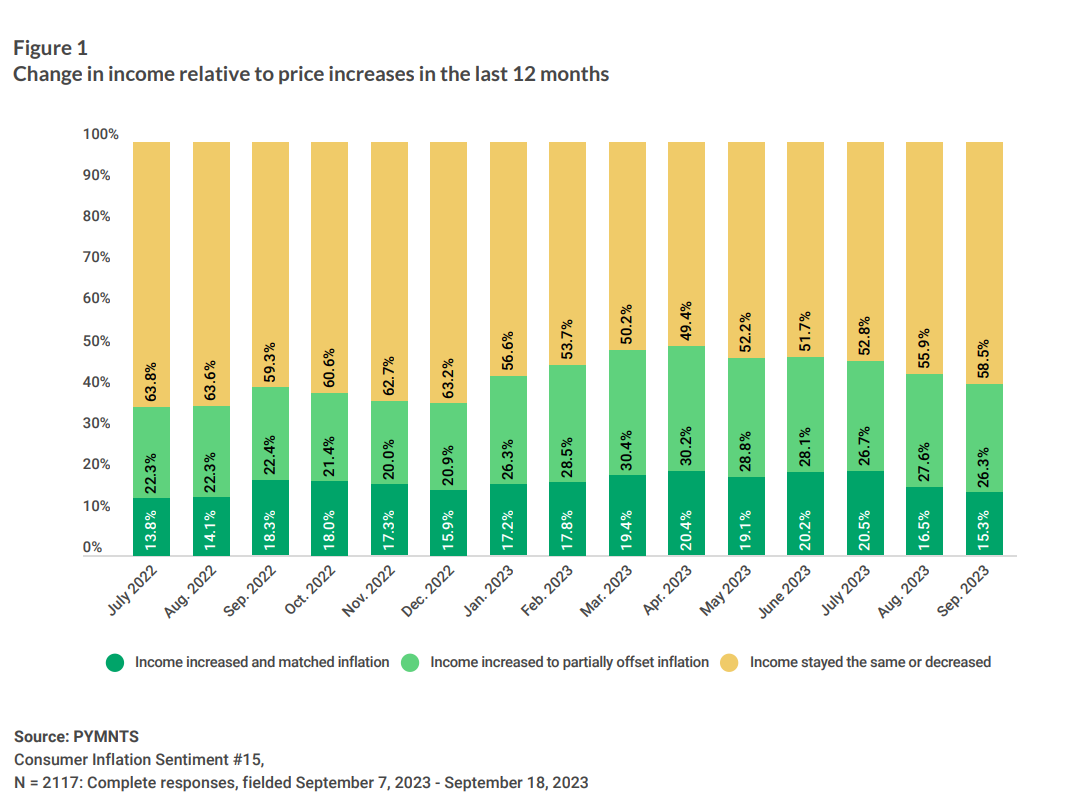

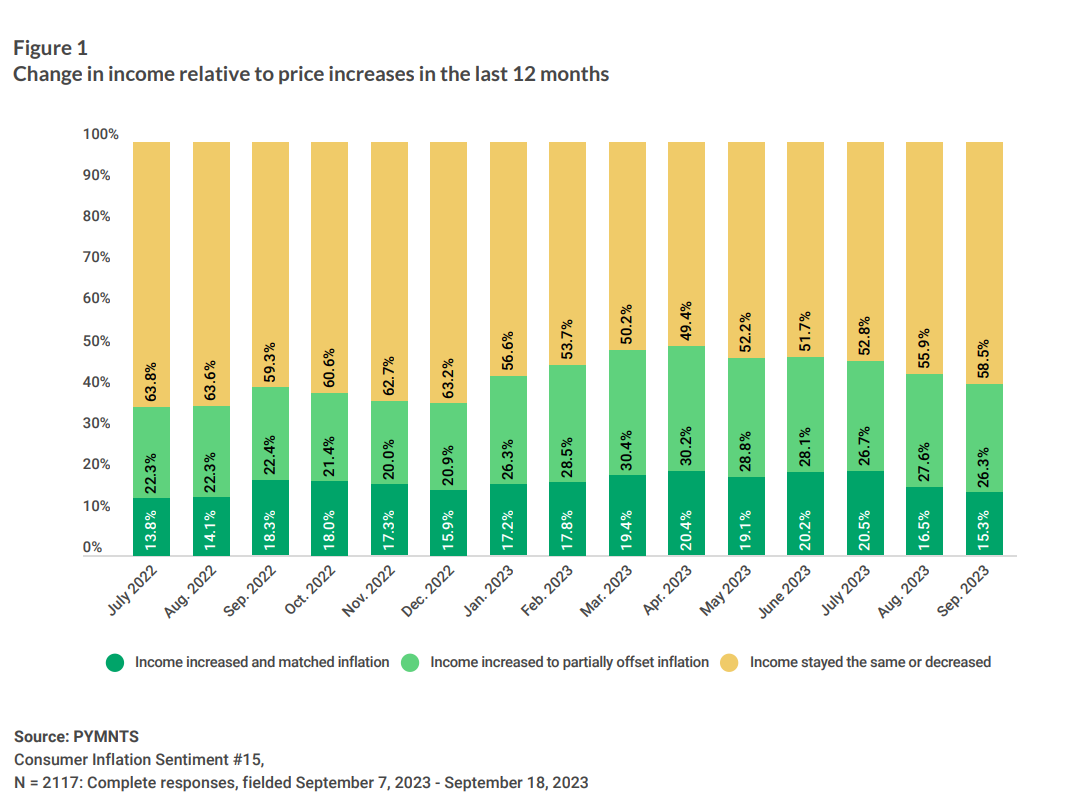

Over the last three years, most consumers have seen double-digit price increases against paychecks that haven’t kept pace with inflation. It’s that pain in the pocketbook that influences their perception of what the rate of inflation is, what a strong economy looks like and how long it might take to get there.

Most consumers say that’s another 20 months away — the Spring of 2025. As far as their perception of a strong economy is concerned, I’ll keep you in suspense for a few more sentences.

Many Americans are starting to crack under the pressure of high prices in ways that weren’t evident even a year ago. More concerning is how consumers now manage their everyday expenses, including how they prioritize and pay their monthly bills. There the relevant number is 41% — the share of U.S. consumers who now say they make partial payments to meet their monthly financial obligations who didn’t before.

Advertisement: Scroll to Continue

So, today we see a consumer whose behavior is much different than it was a year ago — and in ways that will likely impact everyone and every business for the rest of this year and into 2024.

How consumers calculate inflation

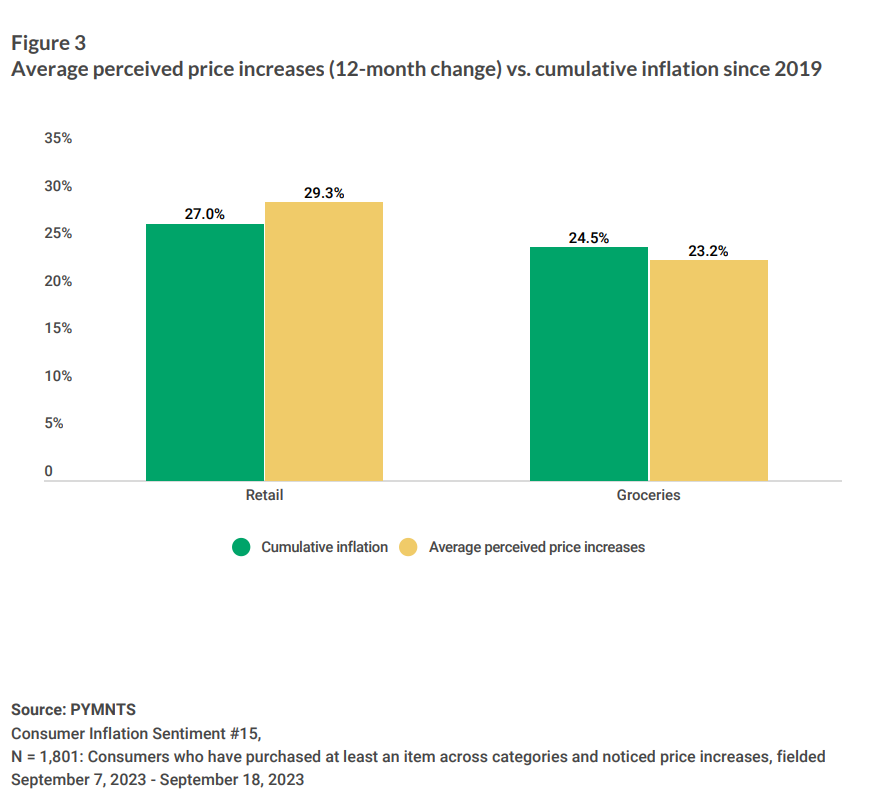

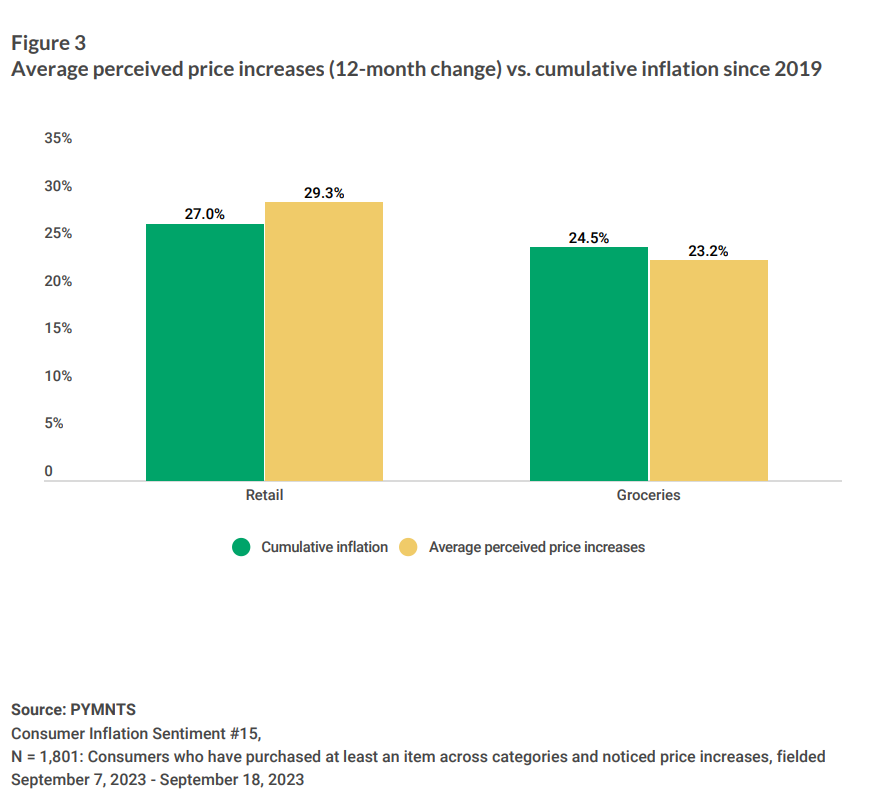

In a national study of 2,101 consumers conducted by PYMNTS Intelligence between September 7th and September 18th, consumers say they pay, on average, 29% more for retail purchases and, on average, 23% more at the grocery store than they did just a year ago.

They’re not entirely wrong.

Since 2019, prices have risen more than 24% cumulatively for both grocery and retail purchases. The result is a consumer whose perception of inflation is based entirely on how much more they spend today versus a year ago. Not the average consumer, but them.

That turns out to be $100 for the basket of groceries and retail products that cost them $89.21 last year. The “good news” that monthly CPI levels are moderating isn’t what they see day to day, so many just tune it out.

A consumer who measures the annual rate of inflation by her perception of how much more things cost uses that as a benchmark for how she measures a healthy economy. This casts an interesting light on just how high or low an acceptable rate of inflation is.

Been there done that, got the high inflation T-shirt

Experience, as they say, is the best teacher.

The grizzled, battle-hardened Gen Xers and boomers who’ve been there, done that and gotten a few high inflation/bad economy T-shirts to prove it aren’t unduly influenced by what’s happened over the last several years, but rather their experiences over decades of ups and down. Although they don’t believe the economy has to be at a 2% inflation level to be strong, they agree that a rate in the high-three or low-four percent range is both acceptable and even realistic. We understand that Chairman Powell would disagree.

Gen Z and millennials whose strong economy lens is a decade of low inflation and interest rates have a very different perspective. More than half of millennials and Gen Z say their paychecks have either not kept pace with inflation or decreased over the last twelve months. More of their discretionary income is paying for the higher cost of food and rent. For this cohort of consumers, whose perception of inflation is in the mid to high 20s annually, an inflation rate of seven, eight or even 10 percent may feel like a win — and even a path to a stronger economy.

The bill payment pressure cooker

Unsurprisingly, this same PYMNTS Intelligence report finds that 85% of consumers say that inflation has had a negative impact on their financial health.

Sixty two percent of the middle class — those earning between $50,000 and $100,000 — say their income has either decreased or stayed the same over the last 12 months. Nearly 70% of those earning less than $50,000 say they are in the same boat. This is the same group of consumers who’ve seen their personal cash cushion plummet by a third over the last twelve months. Women, who often play the role of household CFOs, are more worried than men about the impact of inflation on their financial well-being and that of their households.

Sixty-two percent of consumers now live paycheck to paycheck, a number that has spiked a bit since last month, but largely stayed consistent for the last six. Consumers have learned to manage within the constraints of their paychecks and their increasingly expensive monthly financial obligations.

But these same consumers are now dealing with a different paycheck reality. In addition to higher prices, consumers are facing an increase in mortgage, auto and rent payments, adding a couple of hundred dollars or more each month to service their debt. Credit card interest rates are spiking, raising the monthly minimums and the overall cost of their purchases.

According to PYMNTS Intelligence, nearly half (49%) of consumers say that they have trouble paying their bills the way they once did. That’s an increase of 7% since this time last year.

And the way they once did was to prioritize certain bills above all others and pay them, in full, at the end of the month.

Today, consumers are adapting by making partial payments, something that 41% now say they do. Three in ten consumers make partial payments on their credit card bills, the highest level since the start of the year.

Consumers have also reprioritized the order in which they pay their bills.

After paying their rent or their mortgages, consumers rack and stack their payments based on how essential the service is to them: power/water, mobile phone, internet, and insurance in the event of a catastrophic loss rounded out the top five a year ago. Credit cards came next, and digital media and memberships (think fitness, weight loss) are dead last.

Where the rubber meets the road in 2023 and beyond is what consumers say they will do if money gets really tight. This is where more consumers say they’d make partial payments instead of prioritizing the payment in full of one bill over another. We see the biggest shift in how consumers say they will make credit card payments: a third fewer consumers say they’d prioritize making their credit card payments over another bill. Somewhat surprisingly, the same is true for mobile phones and home internet services. Retail subscriptions look remarkably durable, even as streaming services, digital media and membership services all look like they are ready for the chopping block.

Consumers would opt to do the minimum to keep their accounts in good standing for the services or products they view as essential until the economy or their financial circumstances improve.

It’s all that many may be able to do.

Why payments should care

Anyone who has lent or is lending money to consumers, like many do in the payments and financial services sector, needs to pay attention to how consumers are feeling the pinch of rising prices. It is far more multifaceted and variable than anything you can glean from the CPI reports.

And the Fed, and other policymakers who want to change consumer behavior to help steer the economy to a good place, should not overfocus on the mythical average consumer for whom the CPI, and other measures of inflation rates, apply. Instead, they must consider the masses of consumers who do not fit the average. For them, seeing should be believing, too.