25% of High-Income Consumers Work Side Hustles

Amid news that the U.S. job market is cooling, first-time unemployment claims are up and 64% of Americans now live paycheck to paycheck, comes this finding: One-quarter of those Americans earning more than six figures a year work side hustles to generate extra income.

But it’s not just high earners pursuing extra cash. According to PYMNTS Intelligence’s “Tracking Consumer Use of Supplemental Income Sources,” 22% of all U.S. consumers work on the side to enhance their cash flow.

And although some might assume that those living paycheck to paycheck would be the ones most likely to work side gigs, the report — which is based on surveys with more than 4,200 U.S. consumers — reveals otherwise. Twenty-three percent of paycheck-to-paycheck Americans who say keeping up with their monthly bills is a challenge currently work side jobs, which is down from 29% who reported doing so last year.

Meanwhile, 26% of workers earning more than $100,000 per year tell PYMNTS Intelligence that they worked at least one side-job in recent months — the highest percentage among the three income groups we surveyed.

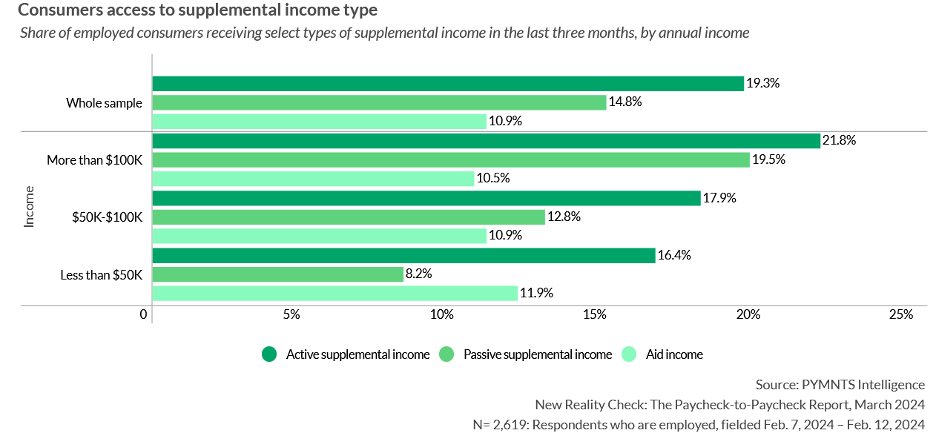

As the figure below illustrates, 22% of high-income consumers say they earned active supplemental income by working side gigs, reselling items, conducting informal tasks or peddling artisan products. Meanwhile 18% of those earning between $50,000 and $100,000 per year have found secondary sources of income in recent months, as have 16% or those earning less than $50,000 annually.

But 20% of those high-income earners also earn passive money, with profits from investments being their leading passive supplemental income source. Fourteen percent of high-income consumers told us they earned profits from investments around the time they were surveyed, while just 3.4% of low-income consumers had done so.

So how are consumers actively earning supplemental funds? Selling used goods is the most popular and accessible side hustle for consumers seeking additional cash flow. Thirty-one percent of all consumers say they have sold a used item in the last 12 months, while more than four in 10 have bought one used item this year. Age is a clearer differentiator than financial standing when it comes to reselling items, with the youngest consumers being the most involved in selling goods to make extra money.

Gen Z is the most likely to sell, as well as buy. Forty-seven percent have sold secondhand goods, and 74% have bought such items. When taking age out of the equation and looking only at paycheck-to-paycheck consumers who say they are struggling to pay bills, those shares drop to 37% selling and 49% buying such items.

As “Tracking Consumer Use of Supplemental Income Sources” concludes, although a slightly smaller percentage of U.S. consumers now live paycheck to paycheck compared to last year, more consumers are engaged with earning extra money on the side, but higher earnings alone do not preclude people from partaking in side hustles. In fact, affluent consumers appear to take some comfort in the financial cushion it offers.