Brazilian Shoppers Surpass US, UK Counterparts in P2P Payments

Despite outsized growth in Click-and-Mortar™ shopping opportunities in Brazil during the last three years, retailers there still don’t offer 39% of the digital features consumers want.

This is just one finding from PYMNTS Intelligence’s “2024 Global Digital Shopping Index: Brazil Edition,” which was commissioned by Visa Acceptance Solutions and drew on insights from 2,200 consumers and 622 merchants to help merchants in Brazil better understand their customers.

Click-and-Mortar™ shopping refers to the methodology consumers use to buy: first checking in on digital sites to browse then showing up in-person in stores to buy, often all in one day.

PYMNTS Intelligence found that there is still a preference for physical, in-store shopping in Brazil. Just 22% of Brazilian consumers complete their purchases entirely online, despite the fact that in-store shopping there has evolved a great deal since 2020 to capitalize on the integration of digital features there. These Click-and-Mortar™ shopping experiences have gone up by 49% in Brazil since 2020, indicating consumers there are utilizing digital features to supplement their brick-and-mortar shopping experiences at a considerable clip.

Yet, PYMNTS Intelligence determined, despite this obvious hunger consumers have for digital features, merchants in the region are still operating in a digital-feature deficit. Thirty-nine percent of the features Brazil’s consumers are clamoring for, merchants simply do not provide.

To illustrate just how open Brazilians are to the technology, consider the following exclusive PYMNTS Intelligence data that wasn’t included in the original edition of our “2024 Global Digital Shopping Index” report.

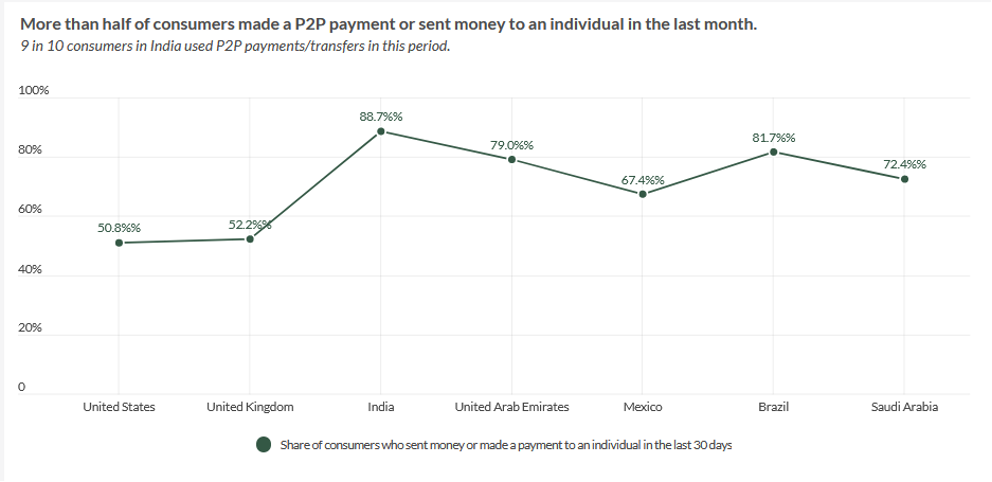

As the chart below shows, when it comes to embracing peer-to-peer (P2P) payments — where consumers send money directly to others via apps — Brazil is ahead of the curve.

Nearly 82% of consumers in Brazil send money using P2P functionality. Only India, where nine in 10 consumers use P2P technology, surpasses Brazil. (Meanwhile 51% of U.S. consumers use P2P payments and 52% of U.K. residents do the same.)

And what are Brazilians using P2P payments for? Fifty-one percent of them use P2P technology to pay for purchases from individuals, while 24% use the technology to send money to others, and 23% deploy it for gifting purposes. Meanwhile, 20% of U.S. consumers, 17% of U.K. shoppers and 24% of buyers in the United Arab Emirates pay individuals with P2P apps.

The lesson here for Brazilian merchants is to ramp up the technology they offer to ensure they are delivering on the demands of what is clearly a highly sophisticated consumer segment.