Consumer Anxiety Over Debt Highest Since Pandemic

The latest data from the Federal Reserve Bank of New York reveals that consumer concerns about inflation are holding steady, but their anxieties over debt are on the rise.

The Fed’s March Survey of Consumer Expectations, which was released this week, found that for the third month running, consumers anticipate that inflation will continue hovering around 3% for the foreseeable future. However, the survey also found that “the perceived probability of missing a minimum debt payment rose to its highest level since the onset of the COVID-19 pandemic.”

This is only the latest news revealing seemingly contradictory consumer perceptions about the U.S. economy. Last week, we reported that, despite an unexpected jolt in job growth and wages, nearly half of six-figure-earning Americans say they are just getting by.

If there is a paradox around how consumers are processing economic news, it is also evident in a recent edition of PYMNTS Intelligence’s “New Reality Check” report, “High-Income Consumers Lead Surprising New Data on Side Hustles.” The report, which is based on surveys with more than 4,200 U.S. consumers as well as independent economic data, found that 6 in 10 U.S. consumers live paycheck to paycheck and that 83% say they are concerned about their near-term economic prospects.

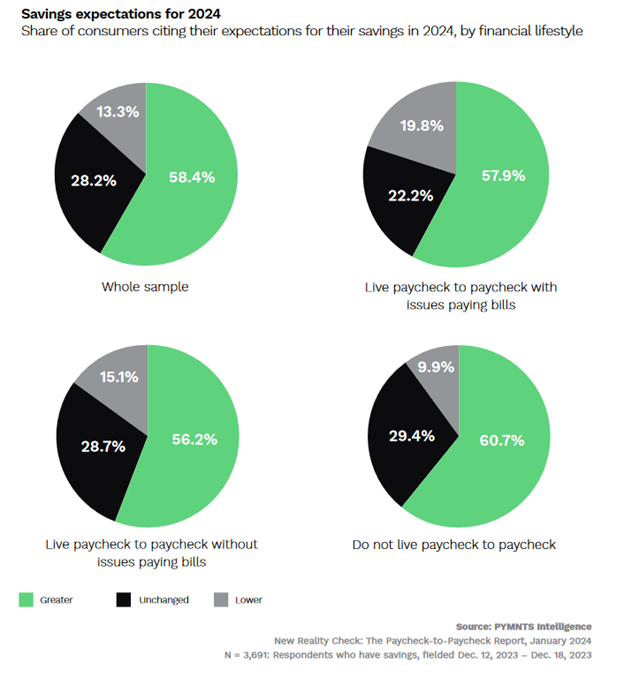

Yet, despite this seemingly grim outlook, more than half told us they anticipate ending the year in the black.

In fact, not only do most consumers expect to end 2024 with increased savings, but few believe their discretionary spending will offset their projected savings goals.

As the chart shows, 59% of respondents overall expect their savings to increase this year. One reason for this optimism might be that — according to our data — consumers ended 2023 with 13% increased saving balances over December 2022. Additionally, only 14% of consumers told us they had no readily available savings as of December 2023, a mark that could seem low but actually was down significantly from the 19% who had no savings in December 2022. This trend indicates more consumers have made saving money a priority.

Even 58% of consumers who described themselves as living paycheck to paycheck and having issues keeping up with their bills say they plan to end the year with increased savings. Meanwhile, only 56% of paycheck-to-paycheck consumers with no issues paying bills share that optimism. It remains to be seen if the Fed’s latest findings around increasing anxiety over debt will dampen this optimism.